Uniswap’s new deployment on StarkNet: Is it a game-changer for the DEX giant?

- Uniswap deploys on StarkNet’s mainnet to reduce gas costs and expand offerings.

- Uniswap dominates in terms of active users, however, its revenue declined.

In a recent proposal, Uniswap stated that it would be deploying onto StarkNet’s mainnet. StarkNet is a permissionless ZK-rollup that inherits security from the Ethereum mainnet. This move by Uniswap could potentially bring a host of benefits to the platform and its users.

Read Uniswap’s Price Prediction 2023-2024

New deployments

One of the key benefits of deploying Uniswap on StarkNet is the reduced gas costs on Uniswap transactions. By deploying Uniswap on a zk-rollup with a thriving and growing ecosystem, Uniswap could potentially reduce the costs associated with using the platform.

This could make it more accessible and attractive to users, particularly those who are looking to make small transactions.

Another benefit of deploying Uniswap on StarkNet would be StarkNet’s growing ecosystem. StarkNet has an expanding ecosystem of developers and projects, and Uniswap could potentially tap into this ecosystem to expand its offerings and services.

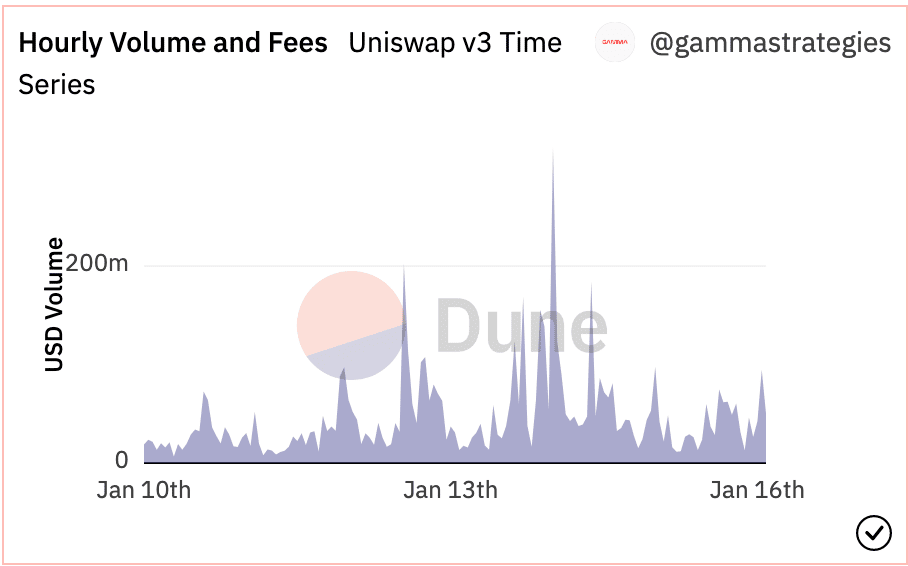

Despite these potential benefits, Uniswap’s revenue has been declining in recent months. According to data provided by Dune Analytics, Uniswap’s volume went from $155.8 million to $50.65 million, and the fees collected by Uniswap were also impacted.

This decline in volume and fees has had a direct impact on Uniswap’s revenue, which according to Messari, has declined by 50.66% over the last month.

Despite this decline in revenue, Uniswap still managed to dominate the DEX market in terms of the number of active users. Based on Dune Analytics data, the number of active users on Uniswap contributed to 62.0% of the overall DEX users in the space.

HODLers continue to wait

Even though Uniswap had the most active users, its token holders continued to lose money. According to Santiment’s data, Uniswap’s MVRV ratio was extremely negative over the last month, suggesting that most holders would not make any money if they sold their positions.

Is your portfolio green? Check out the Uniswap Profit Calculator

Despite these negative metrics, Uniswap’s MVRV ratio did continue to increase along with the token’s trading volume. This could suggest that if things continue to go in a positive direction, holders would benefit in the long run.

Additionally, the deployment on StarkNet’s mainnet could potentially bring new users and increased volume to the platform. Thus, improving its revenue and potentially increasing the value of the UNI token.