Uniswap’s trading volume gives alarming signal; should you short UNI

- Uniswap’s trading volume falls as revenue collected by the DEX declines.

- Traders go short against UNI as on-chain metrics suggest a negative outlook.

According to recent data provided by the token terminal, the trading volume of UNI declined considerably over the past few days. The decreasing interest in the Uniswap DEX could be one of the reasons behind the same.

Is your portfolio green? Check out the Uniswap Profit Calculator

Troubling times ahead?

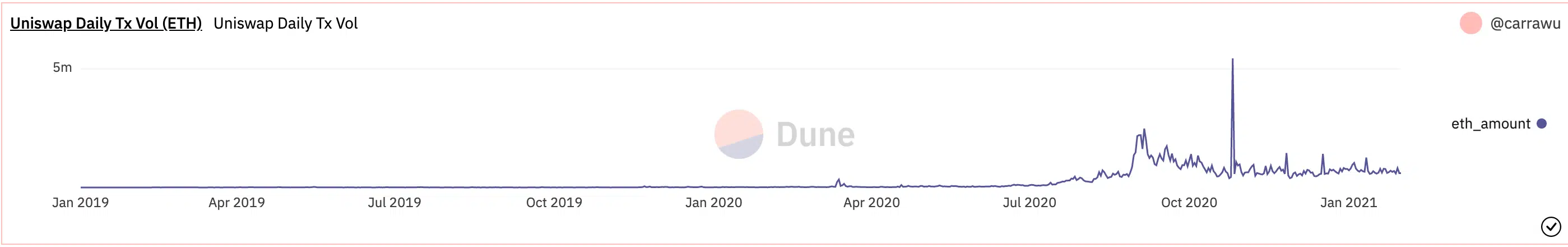

Based on Dune Analytics’ data, it was observed that the number of daily transactions on the DEX declined significantly. One of the reasons for the same could be the decreasing number of unique users on the Uniswap network.

As per Messari, the number of unique users on the Uniswap DEX declined by 0.12% in the last 24 hours,

Furthermore, the fees collected by the protocol also fell by 4.1% over the last week. This impacted the revenue as well.

Based on Messari’s information, the revenue generated by Uniswap decreased by 0.47% in the last 24 hours.

Selling ensues

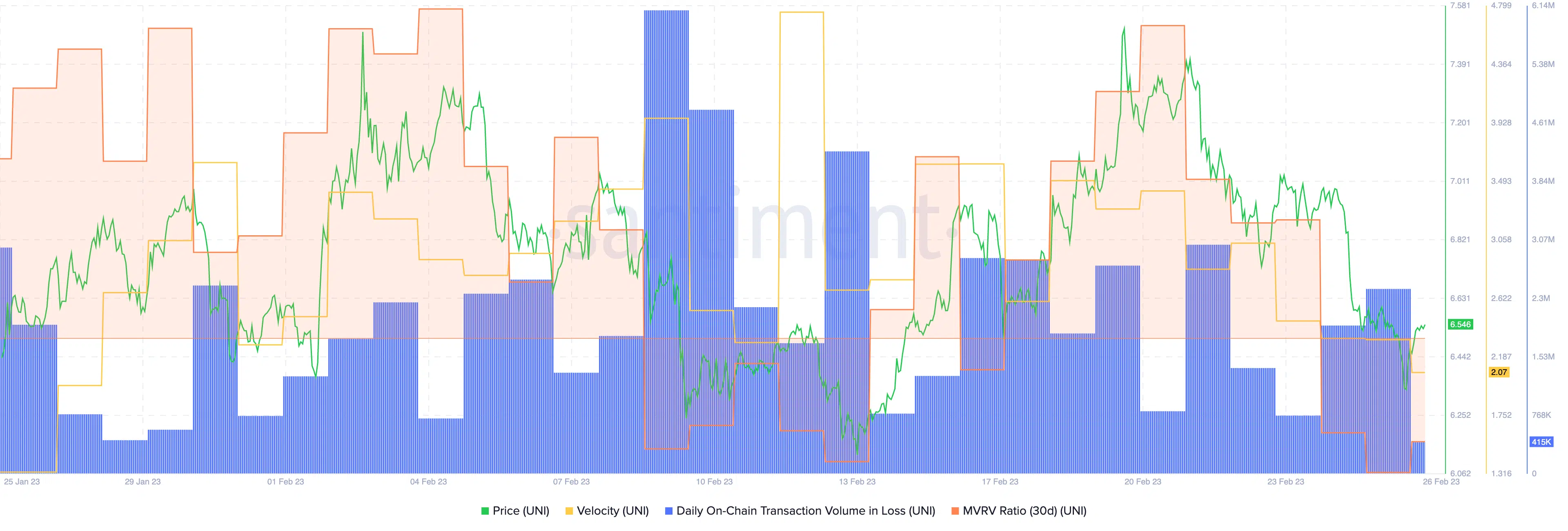

Furthermore, as per Santiment, UNI’s velocity increased materially over the last week. This implied that the frequency with which UNI was being traded had gone up. However, a large part of these transactions was UNI being sold at loss.

Read UNI’s Price Prediction 2023-2024

This was indicated by the spike in transaction volume at a loss. As the MVRV ratio continued to decline, the addresses saw massive losses.

The spike in ‘transactions in loss’ suggested that addresses were not ready to hold their tokens and were more than willing to sell even if it comes at the cost of losing money.

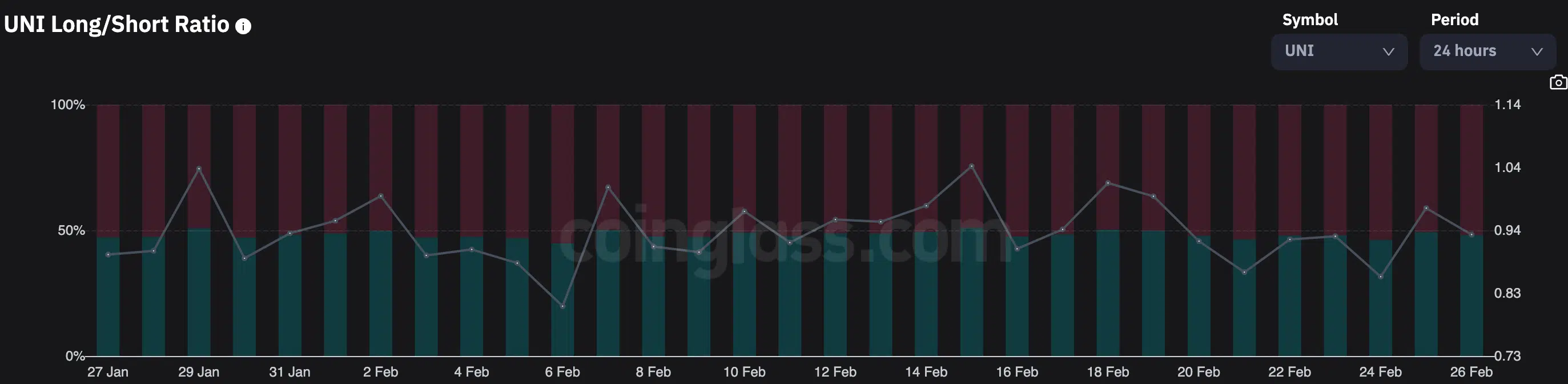

This spike in the sale of UNI drove the price of the token down. Consequently, traders turned pessimistic toward the UNI token. According to coinglass’ data, the number of short positions taken against UNI increased in the last few days.

However, despite all these factors, Uniswap continued to be the dominant force in the DEX marketplace. At press time, it occupied 75% of all the market share in the DEX space.

It is yet to be determined whether these challenges will actually end up affecting Uniswap’s dominance or it would just cause a momentary hiccup.