USDC, a sudden ETH whale interest, and what it means for the stablecoin

- ETH whales regain interest in USDC as stablecoin wars start to heat up

- USDC purchases in the last 24 hours increased in the last 24 hours

Circle’s USDC stablecoin made it to the list of most purchased tokens by the top 5,000 ETH whales according to WhaleStats. But what are the potential implications of this observations and why is it important at this point in time?

Read Ethereum’s [ETH] price prediction 2023-2024

USDC has had its fair share of ups and downs in the recent past. It also lagged behind its counterpart USDT in terms of adoption. This is part of the reason why the observed increased demand especially from ETH whales stands of key interest.

? Top 1 purchased tokens by 5000 biggest #ETH whales today

? $USDC

Whale leaderboard ?https://t.co/kOhHps8XBB pic.twitter.com/eOqTwTHqcK

— WhaleStats (tracking crypto whales) (@WhaleStats) December 11, 2022

According to the WhaleStats observation, the demand for USDC among ETH whales outperformed demand for other stablecoins. This includes USDT which secured the second position for the post purchased token among ETH whales.

One of the potential reasons for the renewed whale interest could be the support that USDC is receiving from Coinbase. The latter was one of the largest regulated crypto exchanges in the U.S. Its push for USDC might be favoring the demand for the stablecoin.

#USDC repeated failures at adoption, being delisted on #Binance and @Circle failing to go public meant that @coinbase had to come to the rescue.

You can now swap #USDT to #USDC for free!

But there is an issue: You can't swap USDC to USDT for free.

Stablecoins war returns! pic.twitter.com/vCmesUz9Oz

— Duo Nine | discord.gg/ycc (@DU09BTC) December 9, 2022

Whales are loading up on USDC

Regardless of its woes, the demand for USDC increased in the last few days. This was likely due to the ongoing market conditions underpinned by less demand for riskier assets.

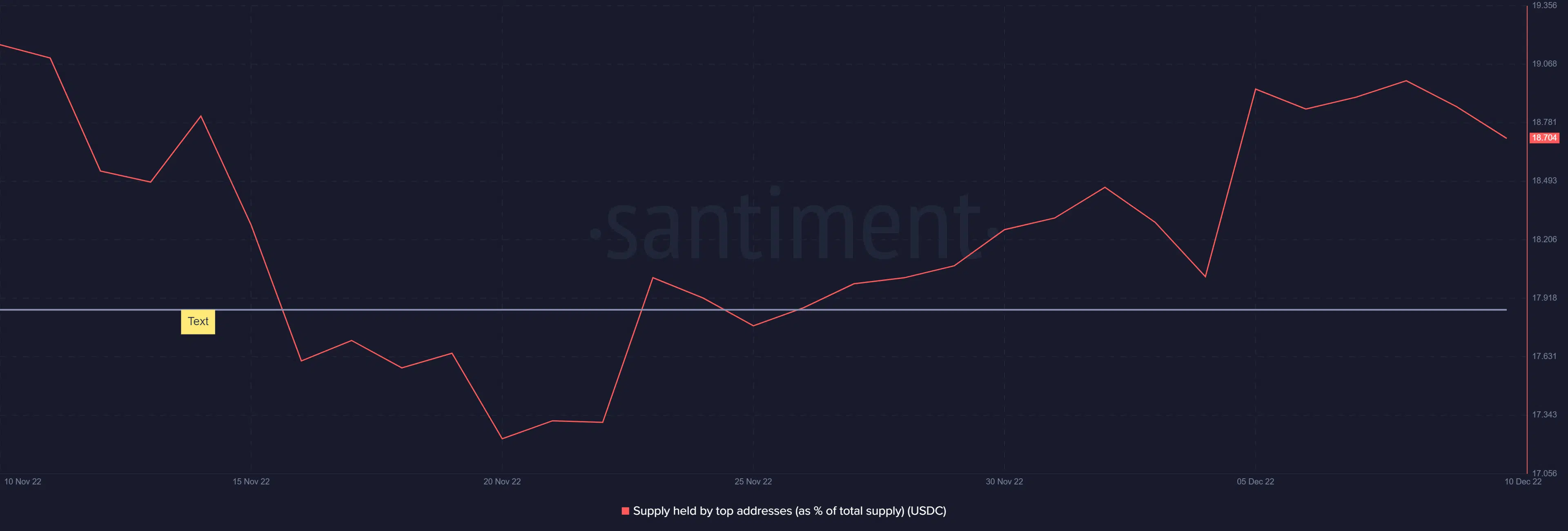

Many traders have thus shifted to a preference for stablecoins to avoid potential losses. Whales have been accumulating USDC judging by the increase in the supply held by top addresses as a percentage of supply.

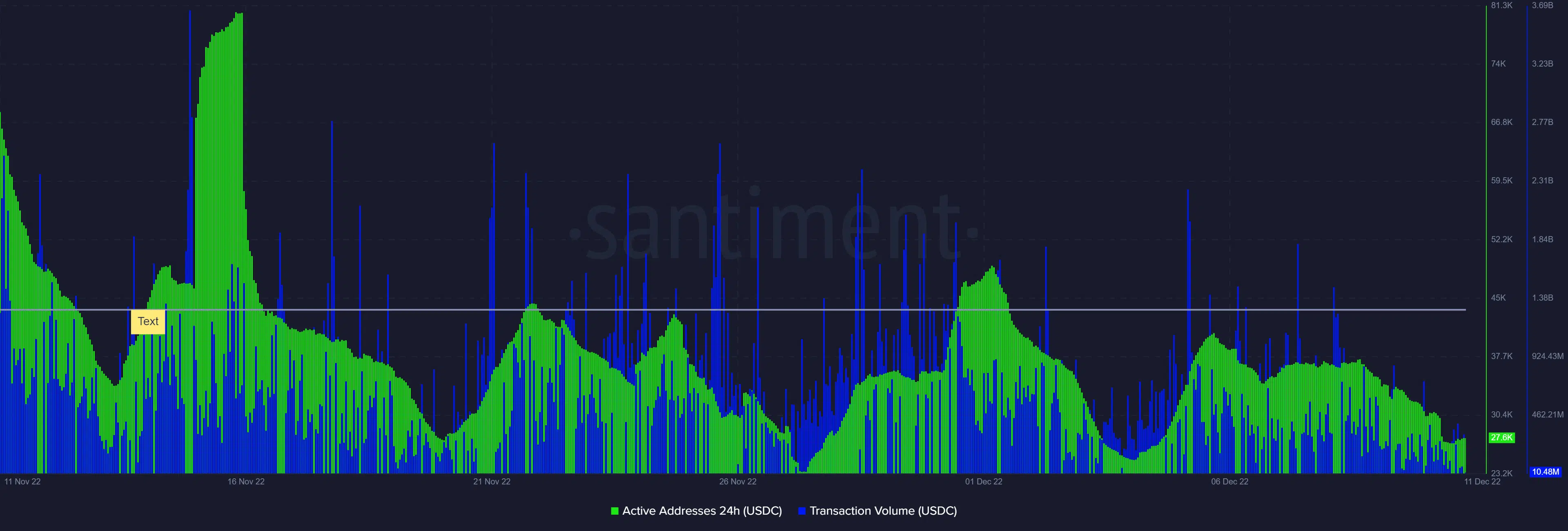

The USDC purchases in the last 24 hour only registered as a slight increase in both volume and active addresses. This meant there was low participation in the market especially from the retail segment. Whale demand was thus responsible for USDC’s favorable ranking.

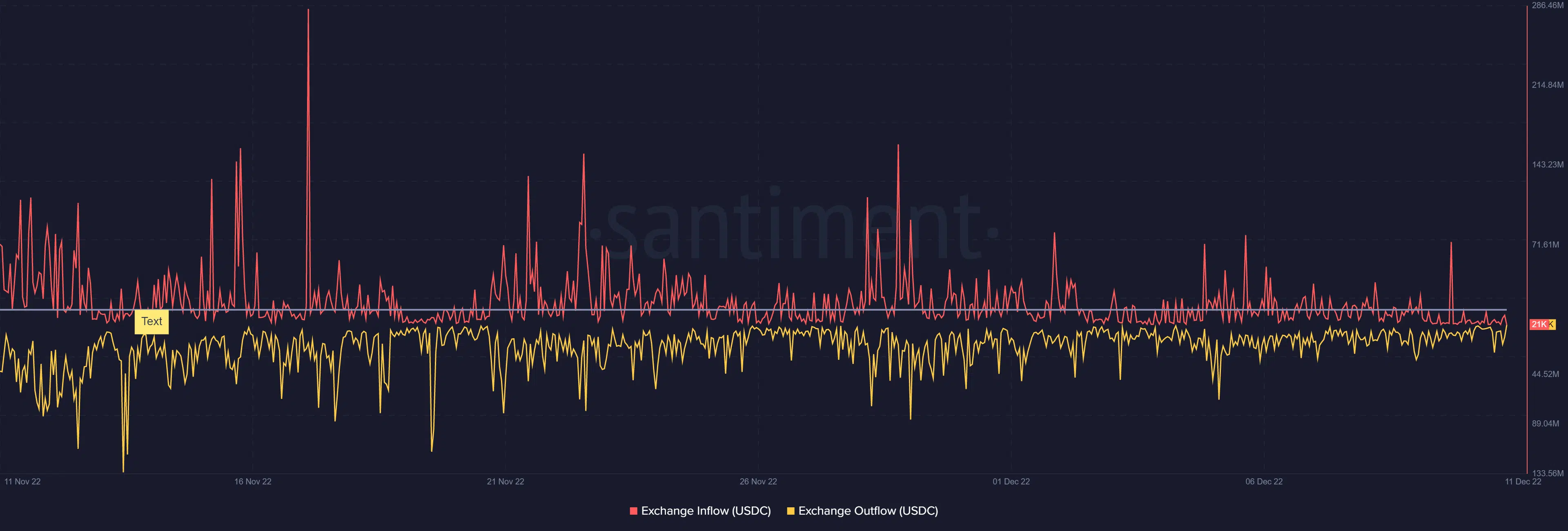

Overall, USDC’s volume was down significantly in the last 30 days. The same was the case for the number of active addresses. A similar theme was observed upon evaluating the overall USDC exchange flows. Its exchange flows at press time, stood lower than they were at around the same time in November.

A look at USDC’s exchange flows in the last two days revealed that higher exchange outflows dominated against exchange inflows in the last two days. This might be a healthy indicator that whales have been selling off their cryptocurrencies during the weekend.

Where to next?

The above metrics highlighted the fact that the market was going through a low-volatility phase. Meanwhile, the surge in demand for USDC among ETH whales may be a sign that investors were loading up their guns as far purchasing power was concerned.

However, it remains unclear whether Coinbase incentivizing the use of USDC might have triggered this demand.