USDC loses more ground in the stablecoin dominance race

- USDC’s market cap has declined by almost half compared to a year ago.

- USDT has gained more dominance with the USDC loss.

The Circle USDC has remained one of the leading stablecoins for several years. Nevertheless, recent analyses indicate a gradual decrease in the market capitalization of this prominent stablecoin.

The unstable market cap of USDC

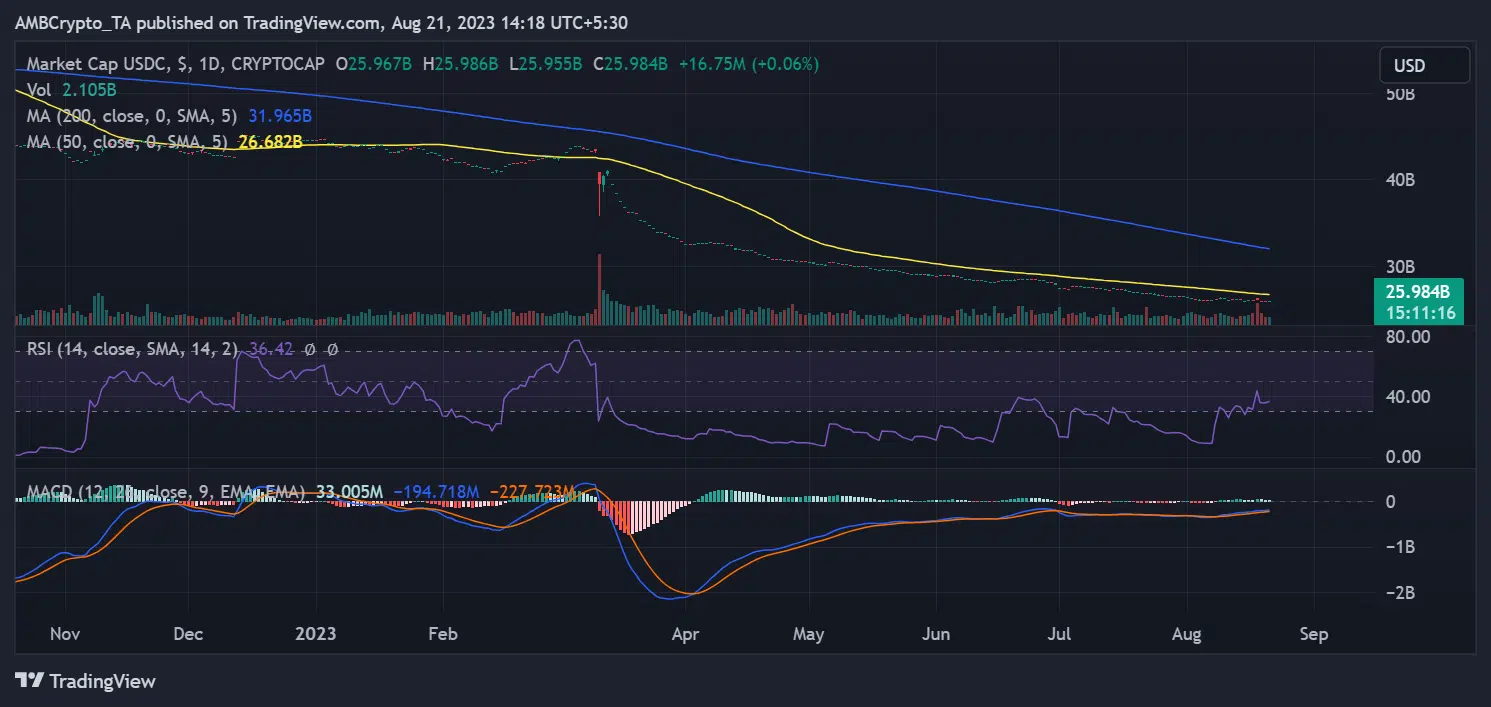

One year ago, the market capitalization of USDC surpassed $50 billion. However, this value has experienced a substantial decrease, as indicated by a Trading View chart. As of this writing, the market capitalization was approximately $25.9 billion.

The current trading volume highlighted that half of its market capitalization was lost compared to its position in August 2022. While the decline has been ongoing, the chart illustrated a significant plummet in value around 11 March. During that time, there was a decline of more than 8%, marking the highest drop in quite a while, and a subsequent recovery has not occurred since then.

How the Silicon Valley Bank’s fall impacted USDC

USDC is a stablecoin tied to the US dollar and is issued by Circle, a cryptocurrency payments company. The assets supporting this stablecoin are securely stored under the custody of BlackRock, BNY Mellon, and other financial institutions.

In the latter half of July 2022, USDC’s market capitalization peaked at around $55 billion.

Subsequently, this value diminished to roughly $44 billion by the beginning of March in the current year, as observed from the chart. The decline was further accelerated due to the insolvency of Silicon Valley Bank, where Circle had initially placed $3.3 billion of its reserves. However, Circle regained control over those funds following a federal bailout provided to SVB.

Tether’s USDT pulls further away

While USDC has grappled with its market capitalization, Tether (USDT) has made strides. According to the observed Trading View chart, Tether’s market capitalization has surged by nearly $20 billion from January to the present date.

The market capitalization was approximately $66.5 billion at the year’s commencement. However, as of this writing, the market capitalization has surpassed $83 billion.

Despite the challenges faced by USDC in terms of its declining market cap, it still retained its position as the second-largest stablecoin by market capitalization. Data from CoinMarketCap indicated that it maintained a lead of over $20 billion compared to the nearest stablecoin, DAI, as of this writing.