This USDC metric is hot off the press and here’s what it’s telling you

Circle [USDC] announced that it was adding a series of chains to its network. In an official statement released during the Converge 2022 event, the financial technology company announced that it was onboarding five blockchains to the USDC ecosystem.

Interestingly, these new chains consisted of both Layer-one (L1), and mostly Layer-two (L2) protocols. The multi-chain expansion included Near Protocol [NEAR], Cosmos [ATOM], Optimism [OP], Polkadot [DOT], and Arbitirum.

However, the questions on the lips of the crypto community will be if this expansion could be vital in rescuing the current challenges faced by the stablecoin.

Too early to conclude?

Following the update, there was no clear sign that USDC could reignite its pursuit of overthrowing Tether [USDT]. Considering the market cap, USDC was still far below USDT with a $19 million difference.

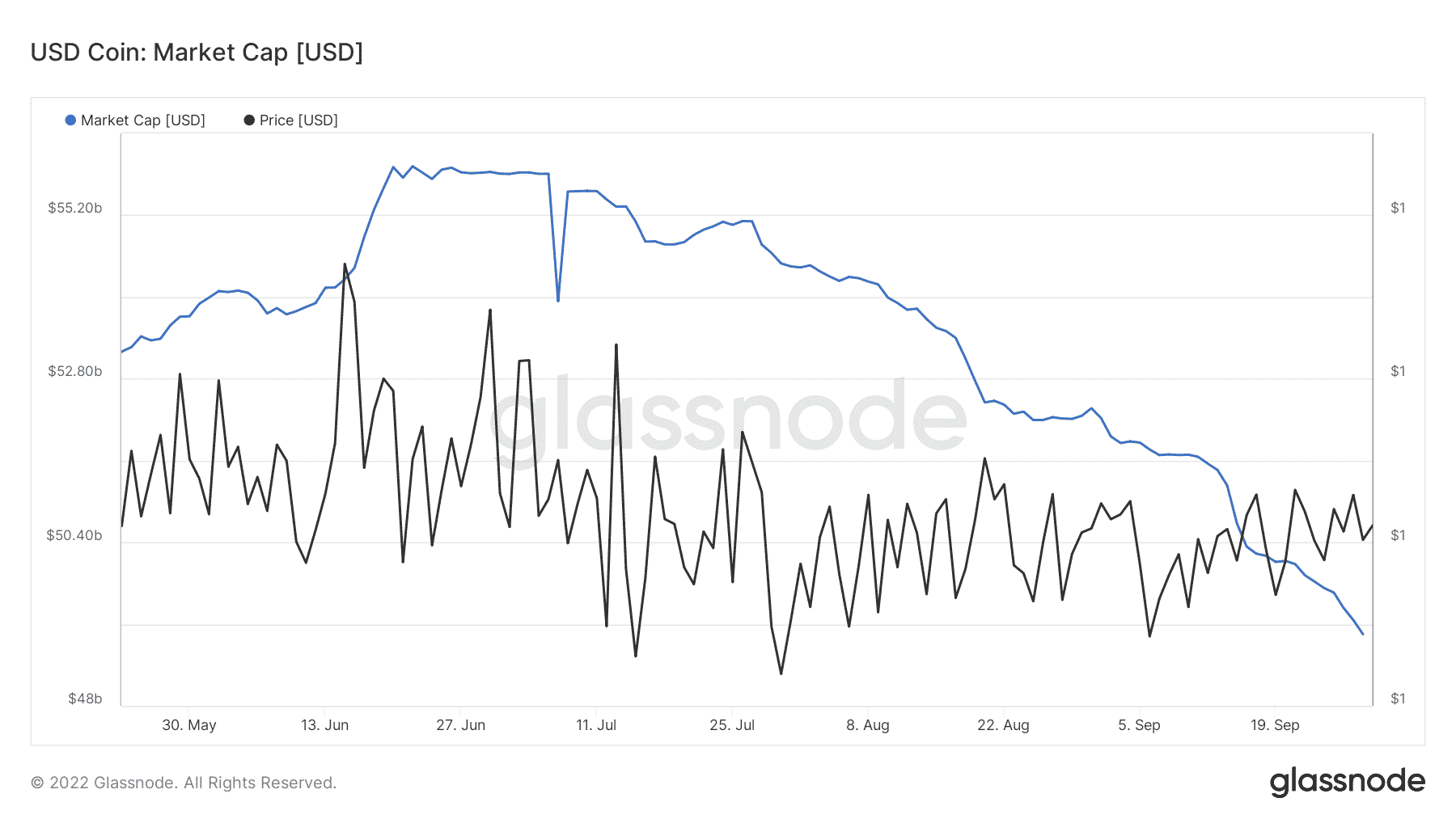

At press time, Glassnode data showed that USDC’s market cap was still on a downward trend at $48.04 billion.

A look at the USDC price further showed that it was holding steady at $0.9999, according to CoinMarketCap. At its current price, it could mean that it had overcome its earlier difficulties. However, it may seem too soon to assume that the integrations have had no effect.

For USDC, every one of the chains will have its roles to play. Arbitrum, for one, would help with cheaper and faster transactions, while Cosmos would help it with better security.

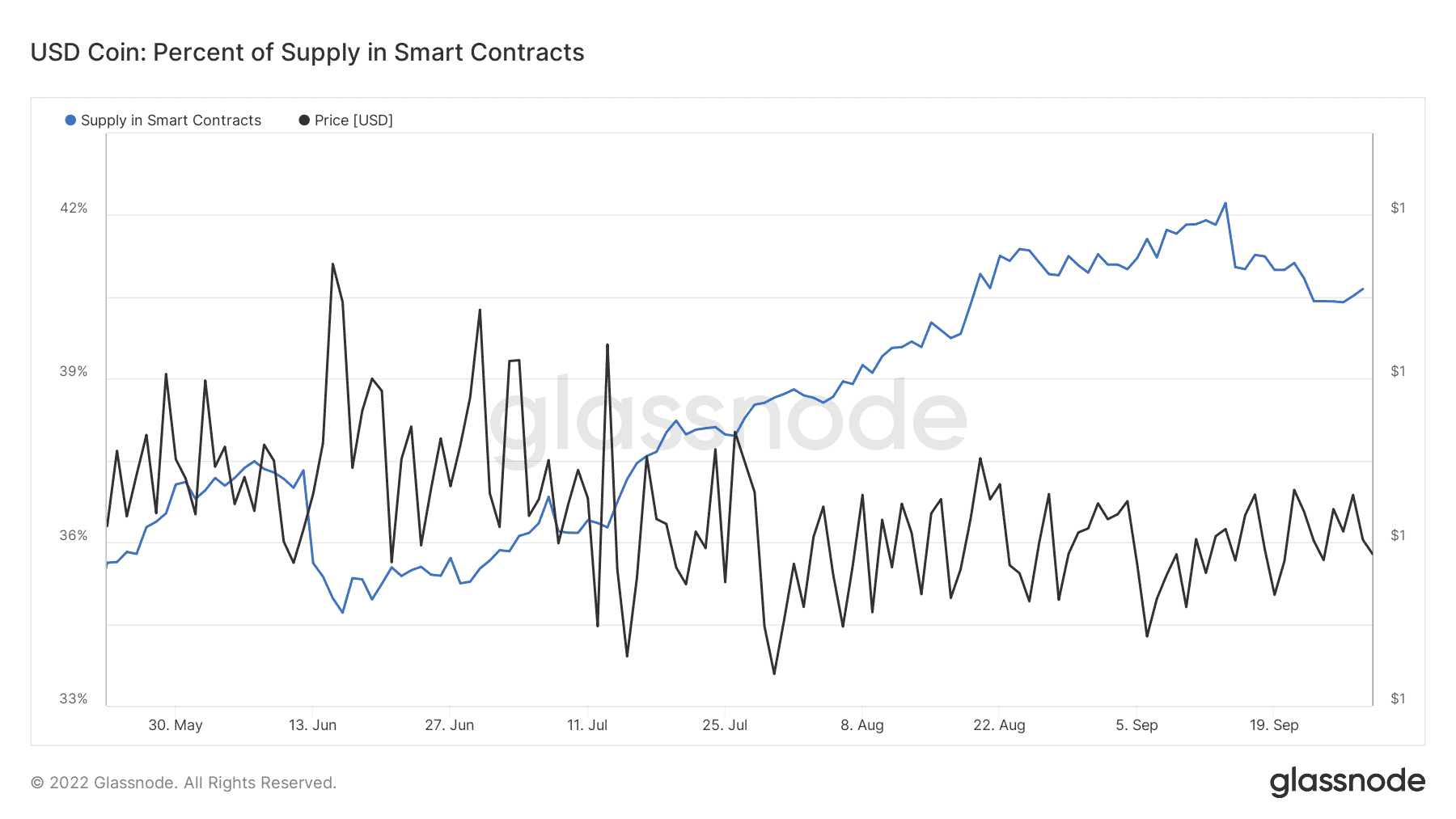

With some of the chains involved in deploying smart contracts, USDC’s performance in that aspect did not seem to have fallen significantly.

In fact, it was a slight increase in the last 24 hours. Based on Glassnode data, the USDC smart contract supply percentage increased from 40.41% to 40.64%.

Hopes uprising

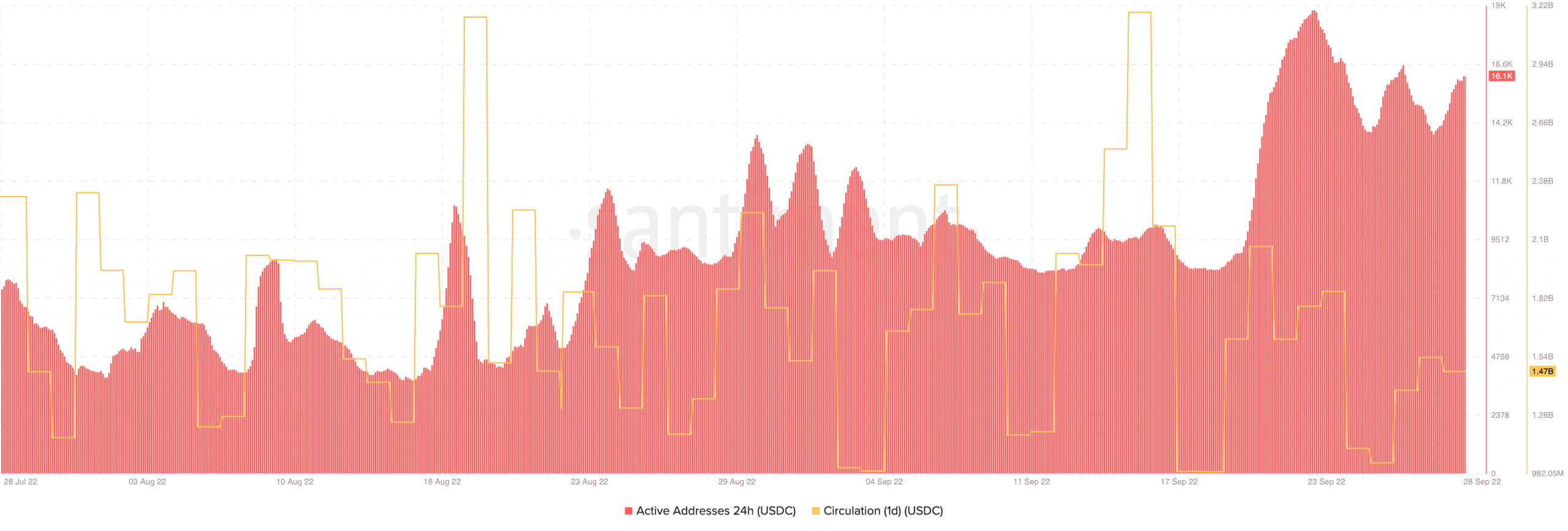

Additionally, it would seem that it would be disastrous to write off USDC in the stablecoin battle. This is because the 24-hour active addresses on the USDC ecosystem had improved significantly since a decline on 27 September.

Furthermore, at the time of press, active addresses went up to 16,100 from 13,900 on the date mentioned above.

It was also an almost similar situation to the one-day circulation. According to the analytic firm Santiment, the one-day USDC circulation was 1.47 billion. While there was a slight decrease, it was hardly a vivid one.

Despite that, USDC holdings on the exchange had decreased as it seemed like investors preferred to hold the alternatives. At press time, the USDC exchange inflow was 7.82 million while the outflow was three times more at 25.24 million.