USDT-USD peg breaks as Binance halts withdrawals, here are the impacts

- Ceasing Bitcoin’s withdrawals acted as a catalyst for USDT’s uneventful volume and circulation truancy.

- The exchange explained that its large BTC movement was simply a change in address.

Binance’s resolution to temporarily stop Bitcoin [BTC] withdrawals may have created unforeseen consequences for Tether [USDT]. As per Twitter user Parrot Capital, USDT’s value on the exchange swung between $1.03 on low volume and $.130 on high volume during the period.

?BINANCE WARNING?

The #BinanceUS #Tether $USDT to $USD peg has broken ?, spiking to nearly $1.30 on high volume then returning down to $1.03 on low volume.

This comes as #Binance international has locked users out ? from withdrawing #Bitcoin multiple times today.

Not good. pic.twitter.com/wttMeSuFoJ

— Parrot Capital ?(Follow me & read the pinned ?) (@ParrotCapital) May 8, 2023

Read Binance Coin’s [BNB] Price Prediction 2023-2024

Although Binance cited congestion in the Bitcoin network as its reason to cease BTC exchange or withdrawals, it is noteworthy to mention that it was the only major exchange that took action.

Dealing with the inability to…

However, when Binance halted withdrawals, it created a disruption in the supply and demand dynamics of USDT, leading to cracks in the USDT-dollar peg.

This triggered a surge in demand for USDT as traders sought to move their assets to a more stable form. The increased demand for USDT put pressure on the available supply. This, in turn, led to Binance’s inability to fill a significant part of the orders, the blockchain transparency watchdog revealed.

There's massive buy and sell $USDT orders on the books, but the actual executed orders are tiny in comparison. pic.twitter.com/VuZMvE5bfP

— Parrot Capital ?(Follow me & read the pinned ?) (@ParrotCapital) May 8, 2023

As a result, the value of USDT briefly deviated from its intended 1:1 peg with the US dollar, experiencing fluctuations and potentially undermining its stability. This implied that there was no real depth in the trading volume. In fact, some have suggested that this could be a case of market manipulation, with Binance being the prime suspect.

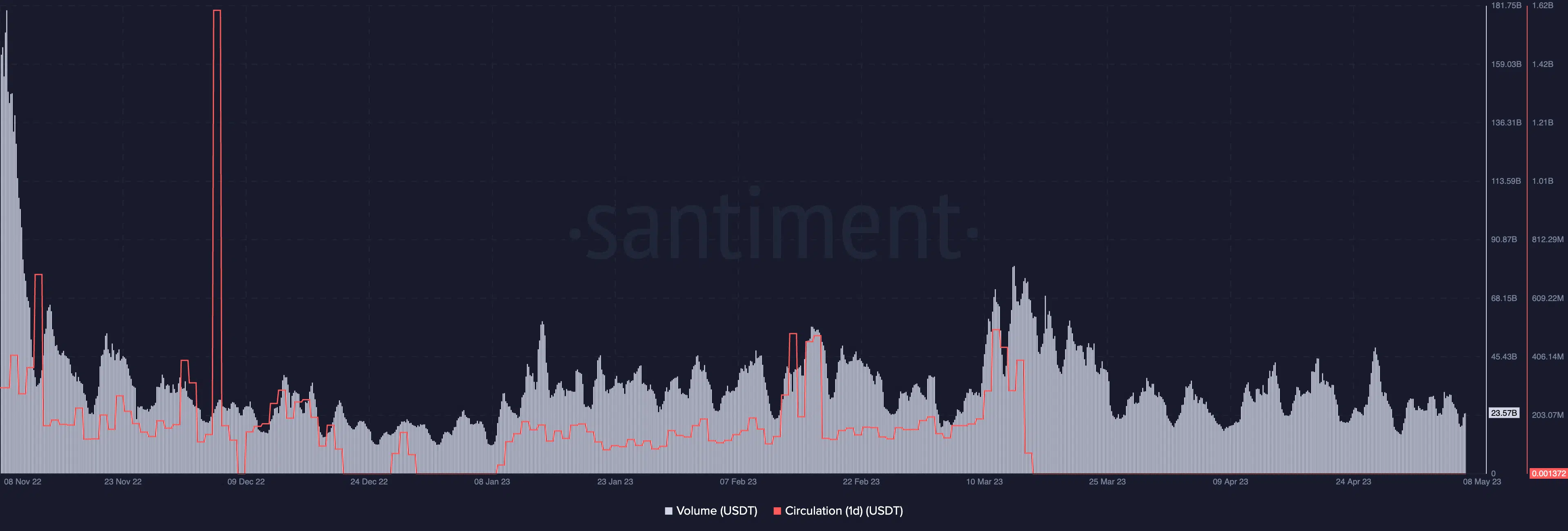

Looking at on-chain data, Santiment showed that the USDT volume slightly increased to 23.55 billion. However, the stablecoin’s circulation over the last 24 hours was at the lowest point in over four months.

Circulation, in crypto, reflects the number of unique coins or tokens used in transactions within a set period. Since Binance boasts the highest trading volume across all exchanges, the inability to trade influenced USDT’s absence of circulation.

CZ: Is the man culpable or not?

Some comments from Parrot Capital’s revelation implied that Binance, led by Chanpeng Zhao (CZ), was not honest in their dealings. For others, this was a sign to take assets off exchanges.

Is your portfolio green? Check the Binance Coin Profit Calculator

Meanwhile, the exchange resumed BTC withdrawals by modifying its fees. However, it did not directly respond to the allegations. But it cleared the air on its 162,000 BTC outflow as a simple “address adjustment” between its hot and cold wallets.

We’re aware that some data are showing a large volume of outflows from #Binance.

This ‘outflow’ are actually movements between Binance hot and cold wallets due to the BTC address adjustments.

— Binance (@binance) May 8, 2023

In the interim, the incident has prompted discussions and debates within the crypto community if service providers should be held as per their credibility in the space. Additionally, Parrot Capital was not convinced by Binance’s explanation, noting that:

“Binance answer doesn’t make sense, as other exchanges didn’t need to stop withdrawals, nor does it explain the massive USDT depeg. Once again, CZ isn’t providing answers to the real questions as he continues to be on the run.”