USTC gives Terra-fic fight of 309.80% but what of LUNC lunatics

While the rest of the cryptocurrency market posted losses in the last seven days, collapsed coins USTC and Terra’s LUNC led with significant gains. According to data from CoinMarketCap, Terra’s USTC recorded the most gains with a 309.80% uptick in price.

Similarly, trading at $0.000126 during press time, the price of LUNC registered a 66% growth in the last seven days.

So what else do we know about the performance of these coins?

To the moon, maybe

Seven days ago, the price per USTC coin stood at $0.023. With over 300% growth in price, it exchanged hands at $0.06484 at press time.

Further, within this period, the coin’s market capitalization increased from $233 million to $633 million.

In the same time period, the price of the collapsed LUNC also rallied by 66%. Trading at $0.000076 seven days ago, the coin exchanged hands at $0.0001257 at the time of writing.

In the last 24 hours, while other crypto assets suffered in the hands of bears, the price of the USTC and the LUNC rose by 10% and 0.07%, respectively.

In addition, buying pressure for the USTC coin increased gradually at press time. Its Relative Strength Index (RSI) marked its position at 55.59. The Money Flow Index (MFI) was also at 65.78 during press time.

Interestingly, for LUNC, significant distribution was underway at the time of press. The RSI was spotted at 9.09.

Is price uptick a hoax?

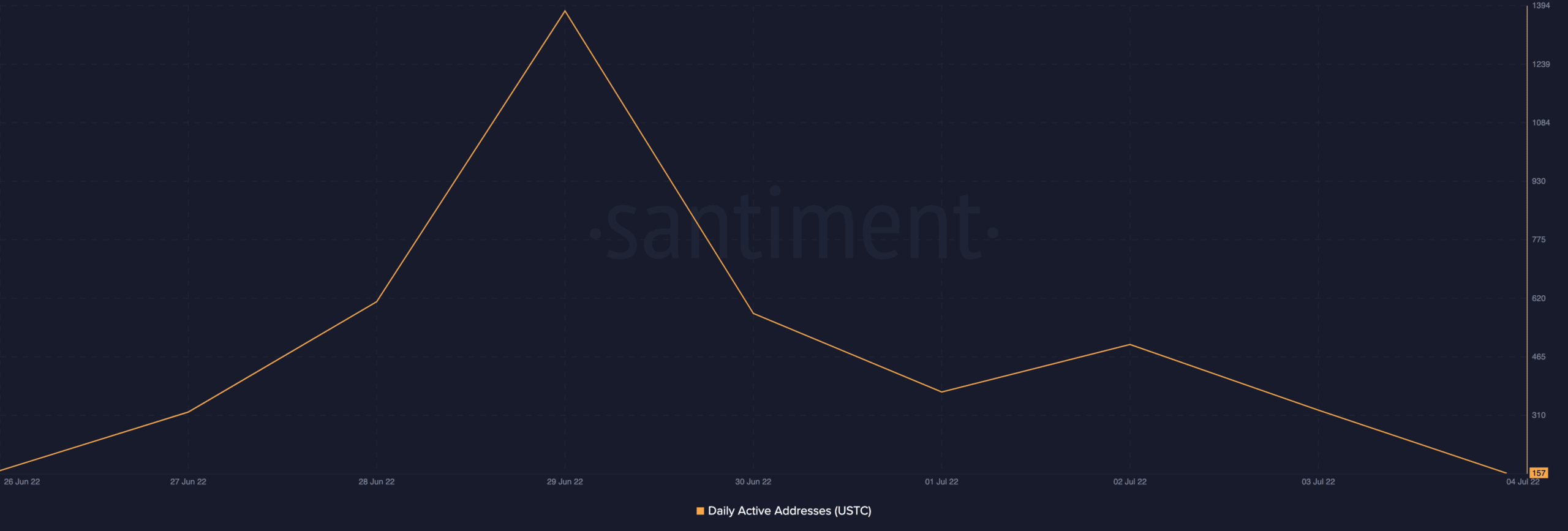

While both coins grew tremendously in the last seven days, the on-chain analysis revealed something different. Interestingly, as the price of the USTC coin continued to soar, data from Santiment showed a steady decline in the count of daily active addresses that transacted the coin in the last seven days. After registering a high of 1381 on 29 June, this declined by 59% by press time.

On a social front, USTC has declined since 30 June. At 0.247%, social dominance fell by 130% in the last five days. The coin’s social volume also declined by 91% within the same period.

For the LUNC, its social dominance registered a 46% decline since 29 June. And, its social volume also dropped by 90% in that period.

While these crypto projects are abandoned mainly, the uptick in price is attributable to investors trying to squeeze shot gains as their prices remain unstable.

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-400x240.png)