VeChain’s market could weaken, but short traders can gain from these levels

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- VET’s market could weaken and extend its downtrend.

- Development activity and open interest rates dipped.

VeChain’s [VET] uptrend momentum eased as it approached the weekend (mid-January). It reached a high of $0.02163 before bears pushed it into a short-term range.

At the time of publication, VET was trading at $0.02058 after retesting the immediate support secured by the bulls at $0.02010.

However, VET’s overbought condition could set it for another retest of the above support or a breach below it. Such a downward move could see short traders benefit from short-selling opportunities at these levels.

Read VeChain [VET] Price Prediction 2023-24

The $0.02010 support: Is a retest likely?

VET’s recent rally offered investors about 40% gains as it rose from $0.01543 to $0.02168. The rally saw VET reach the overbought zone, as evidenced by the Relative Strength Index (RSI) hovering above 70. The overbought condition makes a trend reversal highly likely.

In addition, the On Balance Volume (OBV) peaked and exhibited a downtick, showing trading volumes peaked and declined slightly. Therefore, VET could drop and retest the $0.02010 support or breach it and be held by $0.01950.

These two levels can offer short-selling opportunities for short traders if VET weakens.

How much is 1,10,100 VETs worth today?

However, VET is still bullish and could attempt a break above $0.02082. If VET bulls overcome the hurdle, especially with a bullish BTC, they can focus on the overhead resistance at $0.02229. But such an upswing will invalidate the bearish bias described above.

VET’s development activity and open interest rates declined

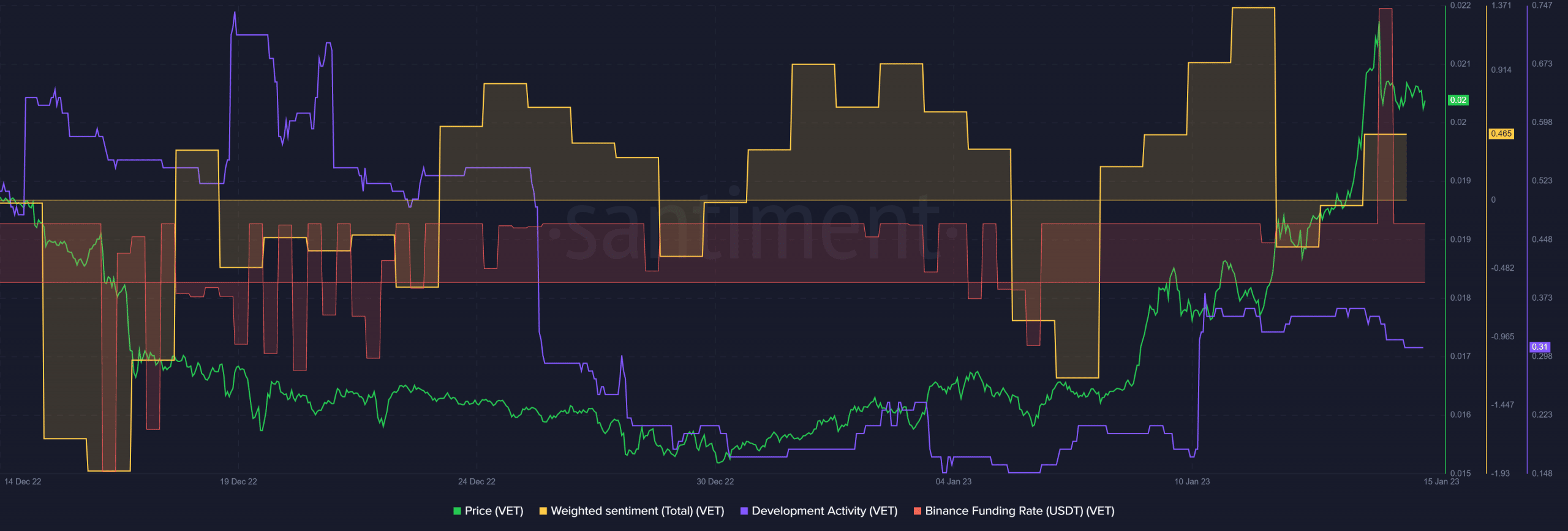

VET recorded a rise in development activity since the start of the year. However, the development activity flattened and declined slightly at the time of writing. But, investors’ outlook on the asset remained bullish, as exhibited by positive weighted sentiment.

Nevertheless, the Binance Funding Rate for the VET/USDT pair reduced sharply, indicating demand for VET reduced at the time of publication. The drop in demand could influence a bearish outlook on the asset if it continues in a few hours/days.

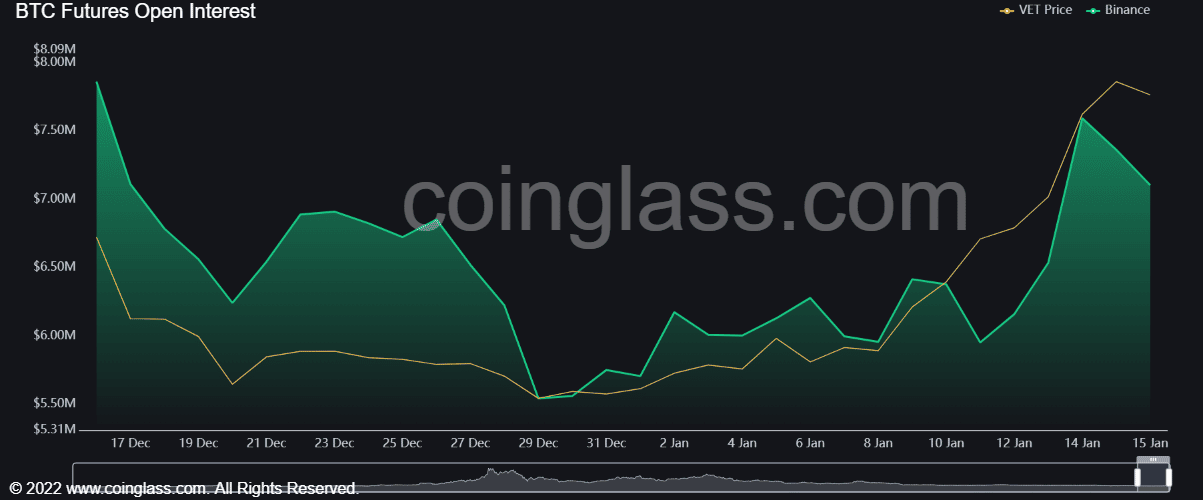

Finally, VET had a hidden price/open interest (OI) divergence at press time, as VET made higher lows from 14 January, but open interest dropped sharply in the same period. It shows that uptrend momentum could slow and make a U-turn as more money flows out of the VET’s futures market.

However, VET’s OI and volume could increase if BTC is bullish; thus, investors should track the King’s coin’s performance.