VIRTUAL price prediction – Is a correction already underway?

- Data reveals that VIRTUAL’s Open Interest has dropped by 18% in the past 24 hours.

- Exchanges have witnessed an outflow of $4.80 million worth of VIRTUAL.

Virtual Protocol [VIRTUAL] has been making waves amidst the ongoing market uncertainty due to its impressive performance.

However, on the 30th of December, VIRTUAL, along with Bitcoin [BTC], Ethereum [ETH], and XRP, seems to be struggling to gain momentum, raising concerns about a potential price correction.

Looking at the current market outlook, it appears that long-term holders are booking their profits after a notable 42% upside momentum in the past week, during which the price surged from $2.44 to $3.47.

It is crucial for investors to determine whether the price will stabilize at this level or if a potential decline may occur in the coming days.

VIRTUAL price prediction

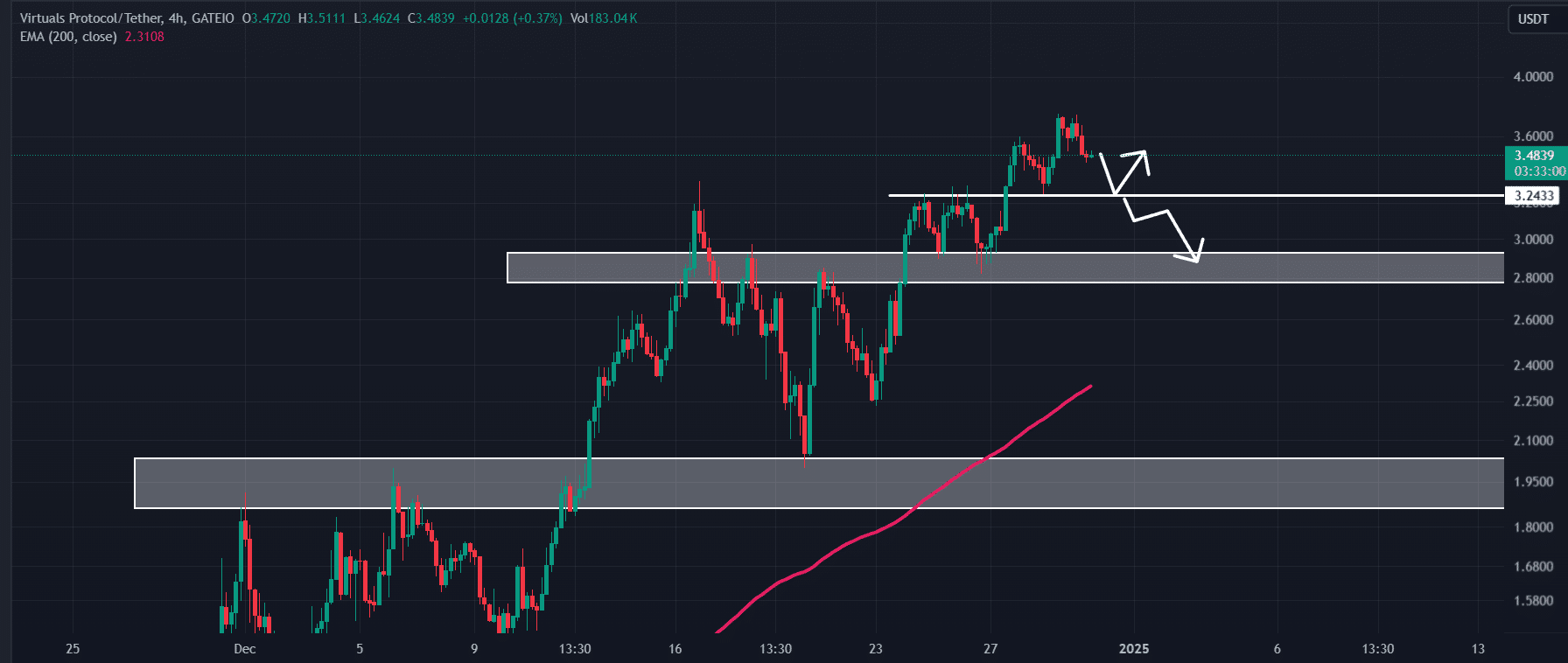

According to AMBCrypto’s technical analysis, VIRTUAL has recently broken out of a small four-hour consolidation zone, which it formed near the $3.70 mark.

Following this breakdown, the asset has lost one of its strong liquidation areas, which could support bears in driving the asset’s price down by another 7%, reaching the next support level at the $3.24 mark.

If VIRTUAL holds that level, a potential price rebound may occur. Otherwise, traders and investors could witness a further price decline to the $2.90 level in the future.

Mixed sentiments, on-chain

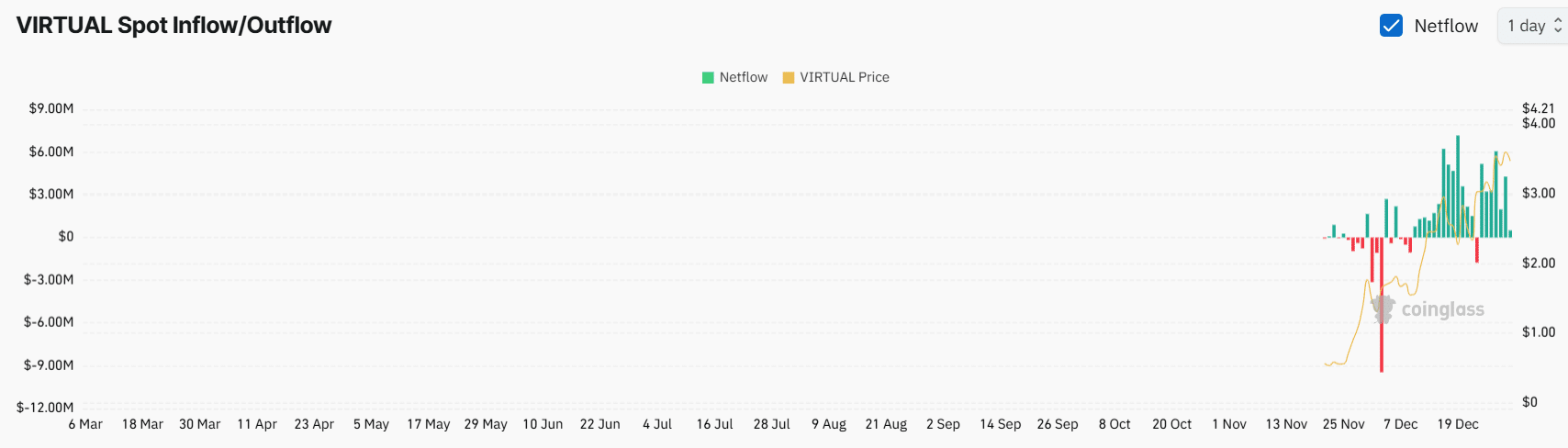

With this potential price decline and recent price drop, traders seemed hesitant to build new positions, as reported by the on-chain analytics firm Coinglass.

Data showed that VIRTUAL’s Open Interest has dropped by 18% in the past 24 hours.

Meanwhile, long-term holders were accumulating the asset, reflecting their confidence and interest.

Data from VIRTUAL’s spot inflow/outflow revealed that exchanges witnessed a modest outflow of $4.80 million worth of VIRTUAL during the same period.

In cryptocurrency, “outflow” refers to the movement of assets from exchanges to long-term holders’ wallets, indicating potential accumulation and increased buying pressure.

When combining all these on-chain metrics with the technical analysis, it appears that the asset is bearish on the shorter time frame, and a potential price correction may occur.

However, on the longer time frame, investors remain bullish on the asset, which could drive the price higher in the future after a successful price correction.

Read Virtuals Protocol’s [VIRTUAL] Price Prediction 2025–2026

At press time, VIRTUAL was trading near $3.46, after a price decline of over 6.45% in the past 24 hours.

During the same period, its trading volume increased by 3.5%, indicating rising participation from traders and investors compared to the previous day.