Virtuals Protocol [VIRTUAL] – Can altcoin hit $6 despite whale profit-taking?

![Virtuals Protocol [VIRTUAL] - Can altcoin hit $6 despite whale profit-taking?](https://ambcrypto.com/wp-content/uploads/2024/12/VIRTUALS-1200x675.webp)

- VIRTUAL rose by over 10% over a single 24-hour period

- VIRTUAL risking liquidation of heavy leveraged orders at $3.10.

Virtuals Protocol (VIRTUAL) registered a hike in price recently, with the altcoin climbing from around $2.95 and peaking at $3.22. This movement represented a 10.57% hike within just one day, with its market cap hitting $3.22 billion too. .

Despite a 5.78% drop in daily trading volume to $290.57 million, the volume-to-market cap ratio remained healthy at 9.05% – A sign of robust trading activity.

The altcoin’s recent performance is.a sign of investor optimism. This pointed to a strong market position for VIRTUAL, potentially impacting its future price trajectories.

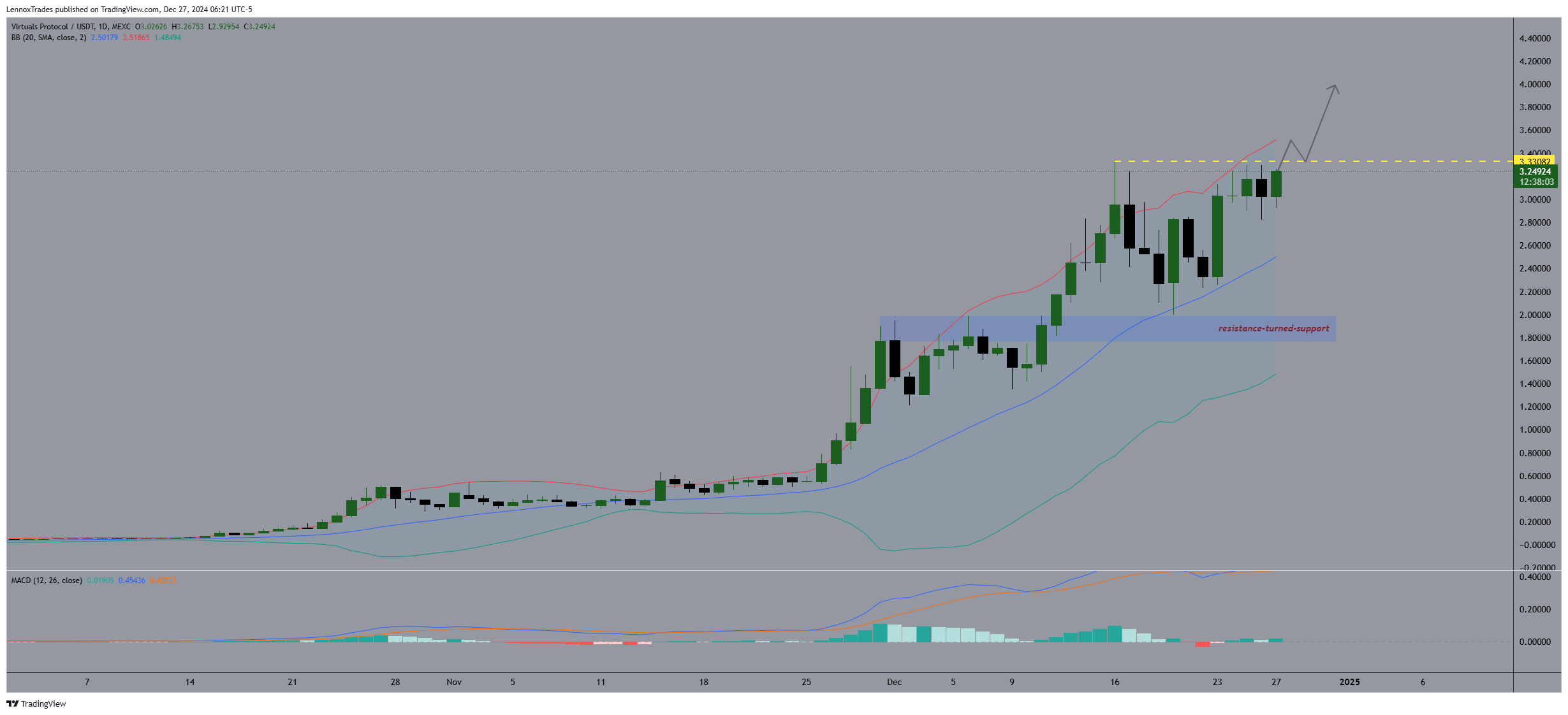

VIRTUAL price action and prediction

Looking into the chart, VIRTUAL showed a compelling test of its ATH with attempts to surpass its resistance level. The price first peaked at $2 with a breakthrough at that level, setting the stage for further rallies with VIRTUAL hitting an ATH of $3.33.

The subsequent retreat from these highs, however, saw the price stabilize near $2, hinting at resistance-turned-support dynamics. This supported a bullish outlook, with VIRTUAL’s price action suggesting it could hit the $6-mark.

Conversely, a dip below the consolidation zone could prompt a retest of the Bollinger Bands’ mid-line or even its lower boundary, offering critical support.

If the price breaches this lower band, it could trigger a short-term bearish trend within the overarching uptrend.

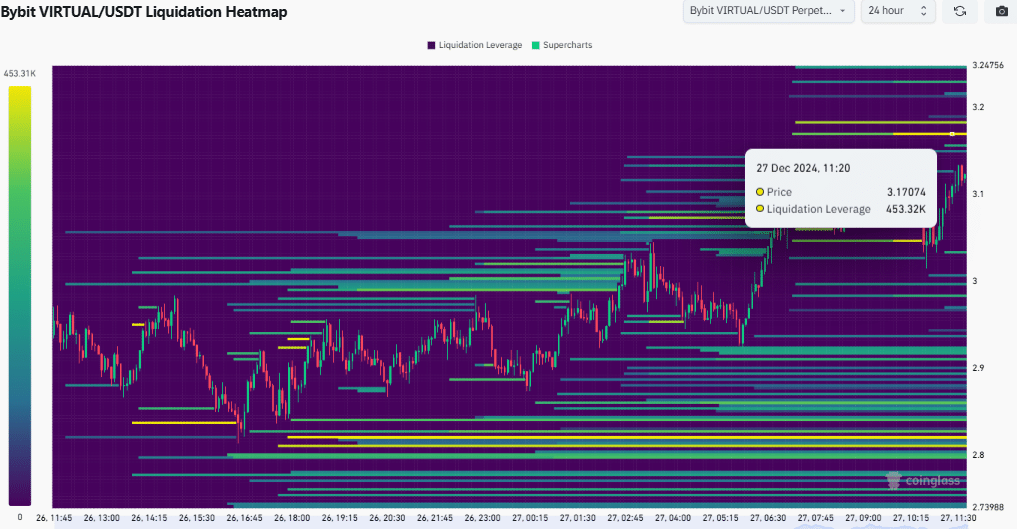

Liquidation heatmap and whale activity

The Liquidation Heatmap indicated concentrated liquidation levels at specific price points where price movements were prevalent.

Notably, the heatmap showed heavy liquidation leverage at $3.1074, where 453.32k in leverage were at risk of liquidations if the price hits that level.

This level represents a critical zone where the price has gravitated to, suggesting heightened trading activity and potential pivot points for future movements.

Past trends also revealed that the price often approached these dense liquidation zones, possibly driven by traders aiming to capitalize on shifts in market sentiment.

If VIRTUAL’s price is to continue interacting with these zones, it could trigger further price fluctuations around these liquidation levels. This denoted the dynamics of supply and demand at key technical levels within the market.

Finally, a Virtuals Protocol whale swapped 9.9 cbBTC for 1.913 million VIRTUAL, valued at around $896,000 at that time.

This strategic move was followed by a significant sale, where the whale offloaded 1.026 million VIRTUAL for $2.7 million, realizing a profit of approximately $1.8 million.

The whale retains 887,000 VIRTUAL now, worth about $2.75 million – A sign that the whale is anticipating more uptrend while systematically taking profits.

The whale’s trading activity over this period culminated in a total profit of $4.56 million, yielding an impressive return on an investment of 5.1x the initial stake.