Voyager [VGX]: Creditors oppose the immunity plan, details inside

Following the confirmation of FTX as the winner of the auction for the assets of bankrupt crypto brokerage Voyager Digital Ltd, its creditors have challenged the proposed plans to offer the company’s officers and directors immunity from any lawsuits related to the collapse of the crypto brokerage firm, court papers filed on 12 October revealed.

According to the court filings, the creditors, while not opposing the proposed sale to FTX as same, are necessary to “maximize recoveries to the Debtors’ unsecured creditors in the most timely, efficient, and effective manner,” they believe that the sale appears to be conditioned on “broad releases for Voyager’s directors and officers.”

Voyager creditors alleged further that they investigated the circumstances that led to the crypto brokerage’s bankruptcy. While not disclosing their findings, the creditors claimed that “the findings are sobering.”

Per court filings, the state of things foisted upon the creditors a “Hobson’s choice” to “either support consummation of the Sale Transaction and the Second Amended Plan, together with effectively full and complete releases of the Debtors’ directors and officers, or risk these Chapter 11 Cases devolving into a morass of litigation, to the sole detriment of unsecured creditors, whose assets will continue to remain frozen for a far longer period of time.”

Bon voyage to everyone buying

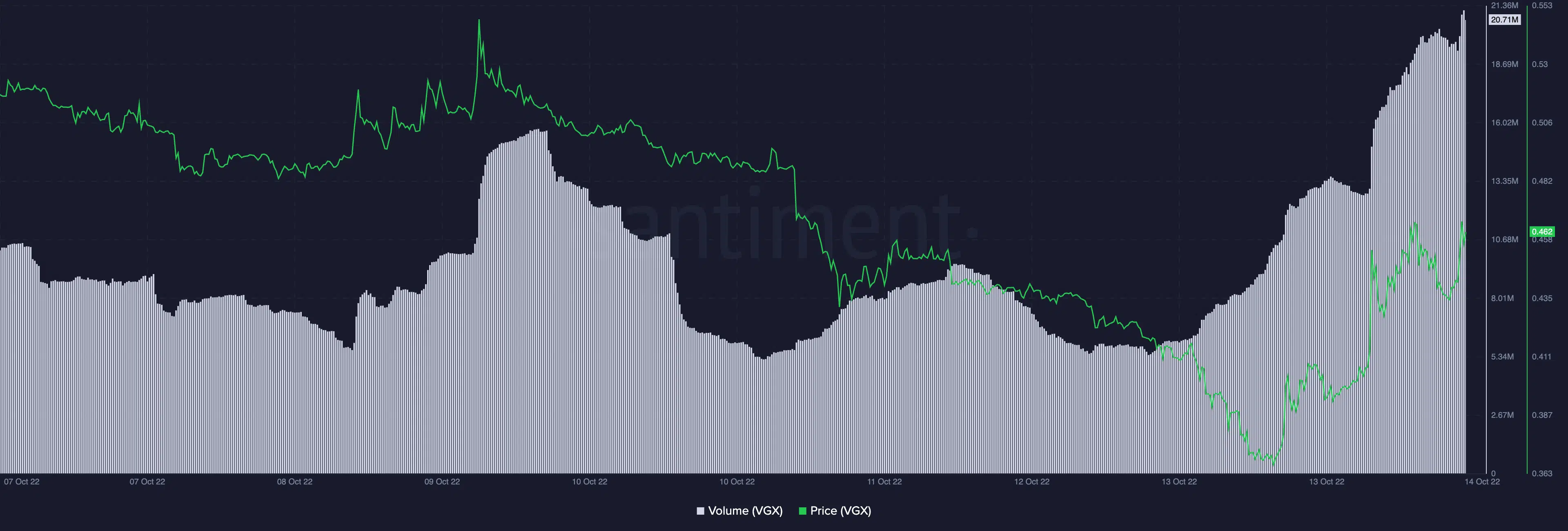

As of this writing, VGX exchanged hands at $0.4608. Per data from CoinMarketCap, the price of the asset rallied by 24% in the last 24 hours.

Furthermore, VGX’s trading volume was up by 121% at press time. Per data from Santiment, as of this writing, VGX’s trading volume skirted around the $20 million mark.

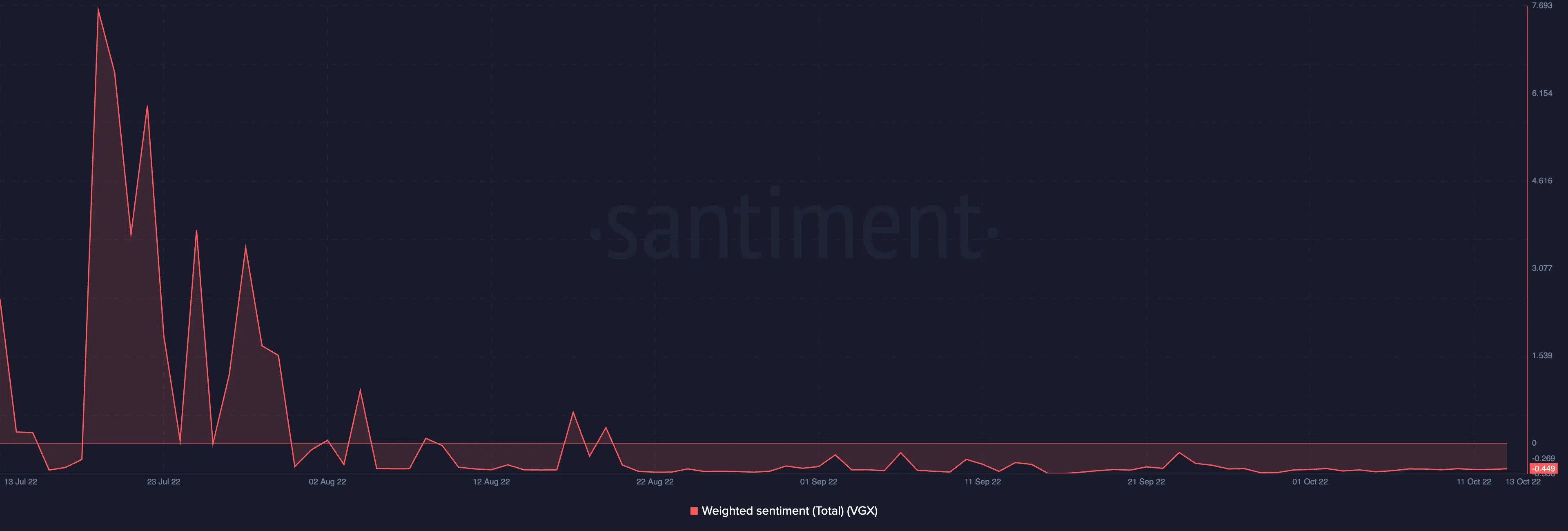

Coupled with an unknown future for the crypto brokerage firm, the holders of its VGX token have been plunged into losses since 21 September, data from Santiment showed.

A look at the asset’s market-value-to-realized-value (MVRV) on a 30-day moving average revealed that the metric had posted negative values since 21 September. At press time, VGX’s MVRV was -28.83%, indicating a sizeable number of VGX holders held at a loss.

Interestingly, despite the rally in the asset’s price in the past 24 hours, VGX continued to see negative bias from its holders. Weighted sentiment against the token has been negative since the middle of August. At press time, this was a -0.449.