Warning: Litecoin can jump to $74, but you might lose money

Litecoin, over the years, has become one of the fastest-growing crypto payment methods in the world. The credit for which goes to its investors. Well, the same group of investors is leading the supply of LTC now. As it were, giving crypto the space to recover its losses of the last year.

Litecoin and its heavy guns

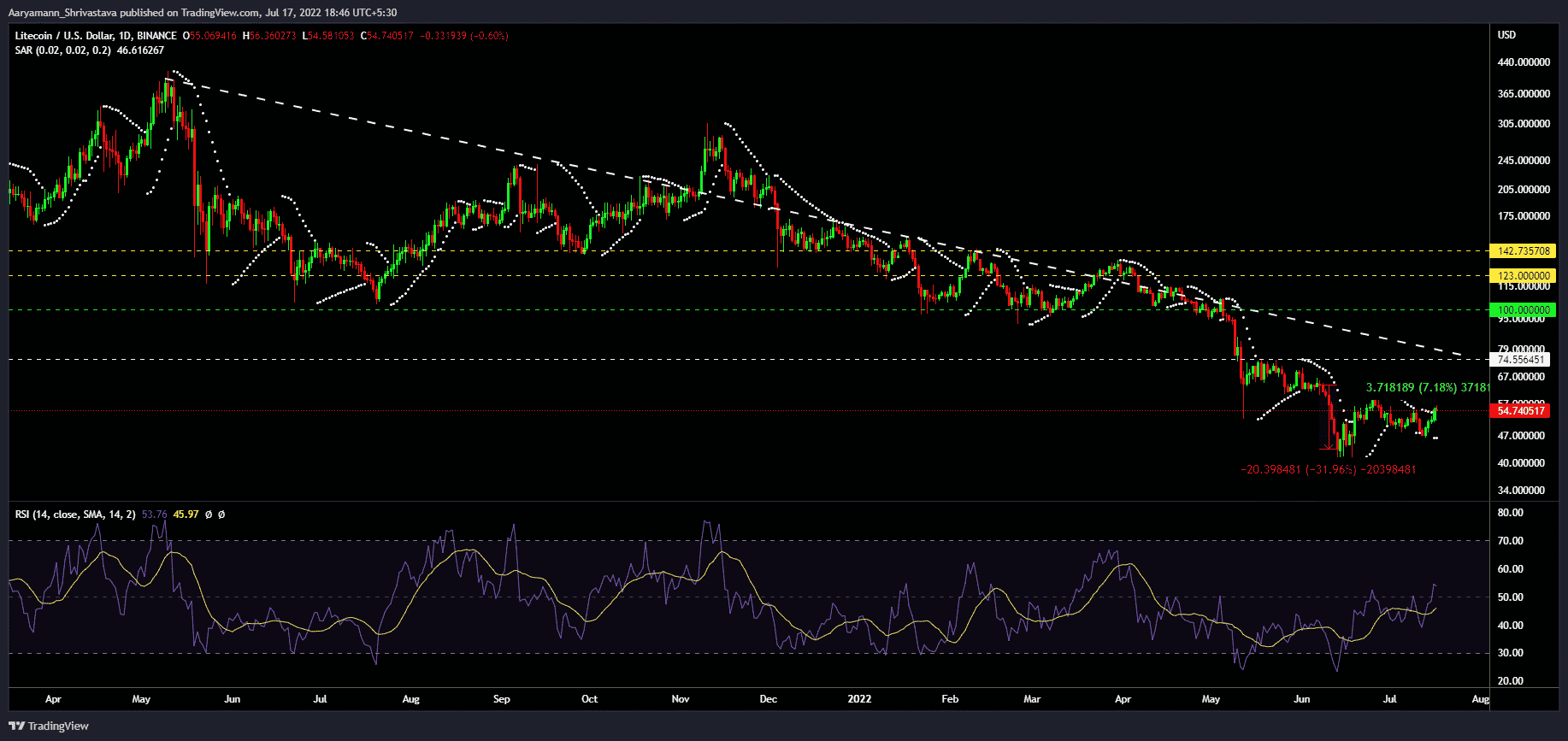

Over the past 14 months, LTC has been stuck in a downtrend that could not be invalidated even during the months of October to December 2021- a time period when most of the cryptocurrencies marked their new all-time highs.

Since May 2021, LTC failed seven times in its attempt of breaching the downtrend line.

However, the recovering market of late has imbued a new sense of hope among investors. And, LTC now has a chance to achieve what it hasn’t been able to in a long time.

Notably, on 17 July, LTC was trading at $55.3. There was a sign of positive movement in price as the Relative Strength Index (RSI) entered the bullish zone for the first time in more than three months.

Iterating the same was the Parabolic SAR which shifted gears into an active uptrend.

Litecoin price action | Source: TradingView – AMBCrypto

Given the current market condition, the next major resistance for Litecoin is at $74.55. And, coinciding with the same is the downtrend line. If by the end of July LTC flips that resistance into support, it will be able to breach through the downtrend.

However, in order to sustain that rise, the investors will have to abstain from taking profits to keep the selling pressure low.

Well, this is quite possible. Over the last 14 months, Litecoin’s 2.29 million addresses have been consistently accumulating LTC regardless of all the ups and downs.

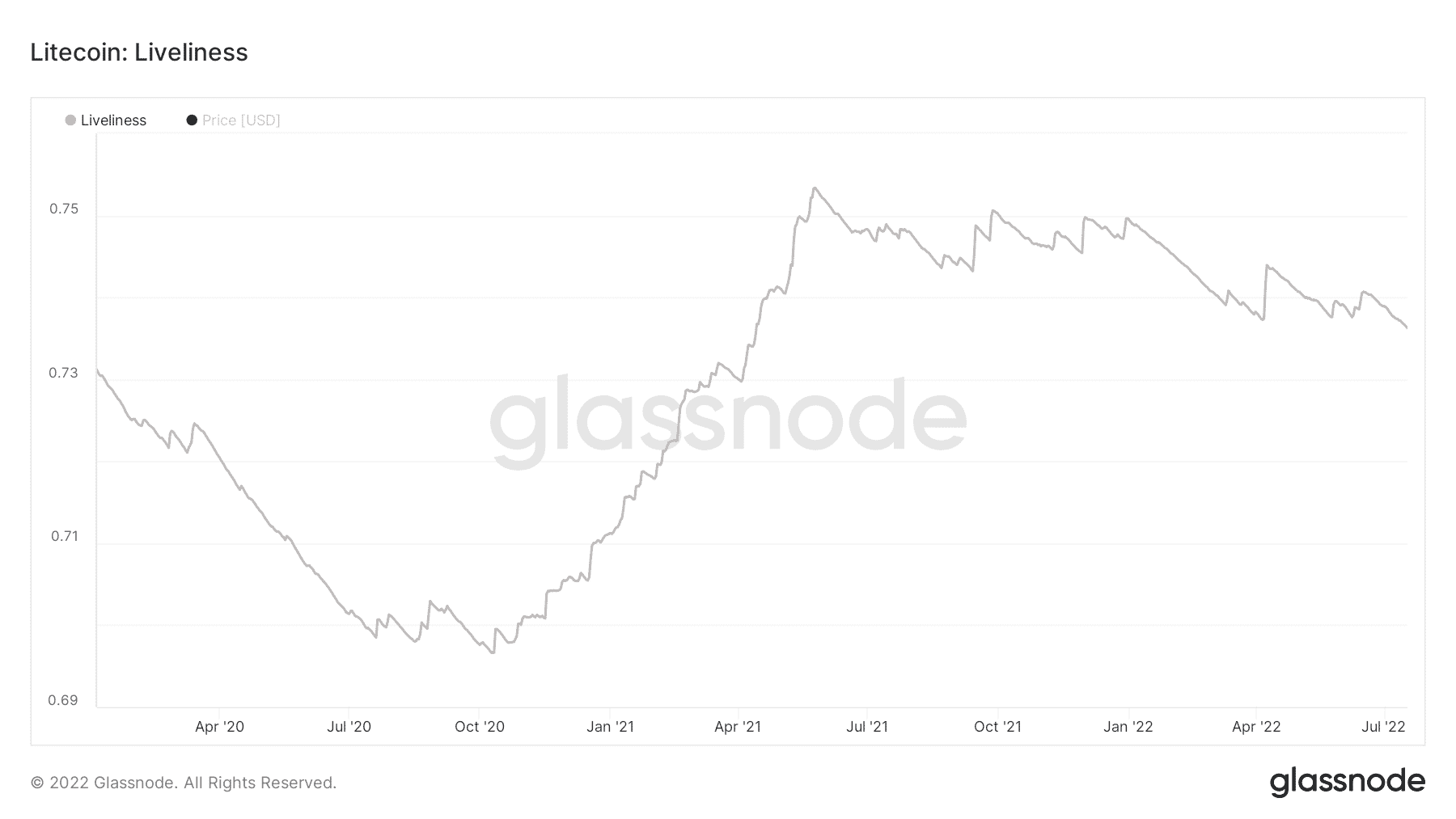

Litecoin Liveliness | Source: Glassnode – AMBCrypto

The Liveliness indicator, which observed significant liquidation between July 2020 and May 2021, switched to accumulation and hasn’t changed since.

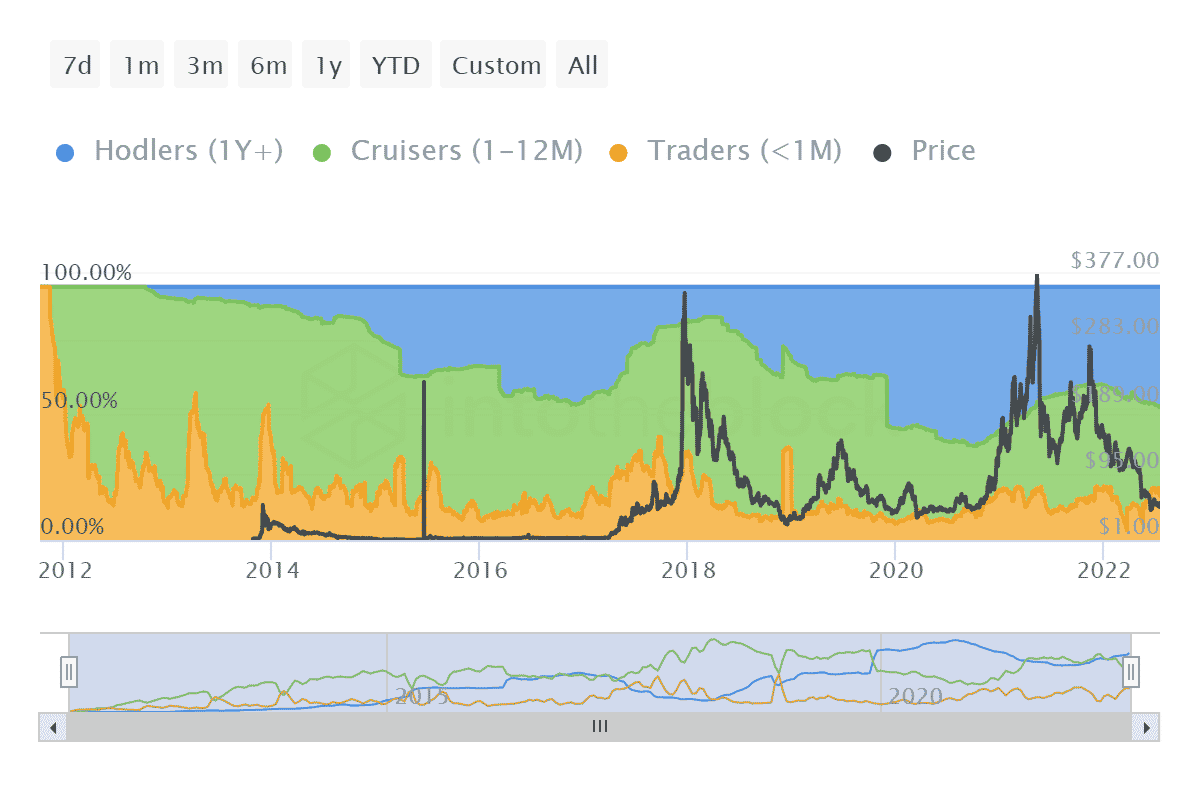

As a result, at press time, this cohort commanded 47% of the entire LTC supply, along with the mid-term holders (potential LTHs) controlling 34.7% of the circulating LTC.

Litecoin will continue existing no matter what and these investors won’t exit anytime soon. And, this will provide Litecoin the push it needs to jump to $74 by the end of July.

Litecoin investor distribution | Source: Intotheblock – AMBCrypto