Was ApeCoin just another sophisticated rug-pull? Here’s what metrics seem to suggest

ApeCoin was one of the most hyped news in the second half of March. It was all the rage with Bored Ape Yacht Club owners getting airdropped these coins only to sell them off immediately for basically free money. But few things have come up that suggest ApeCoin might just have been a one-off, the profit-making opportunity for these BAYC owners and Yuga Labs, the venture capital fund that backed the project.

Seems like it was bound to be doomed. Why? Let’s take a look.

Bound to be doomed?

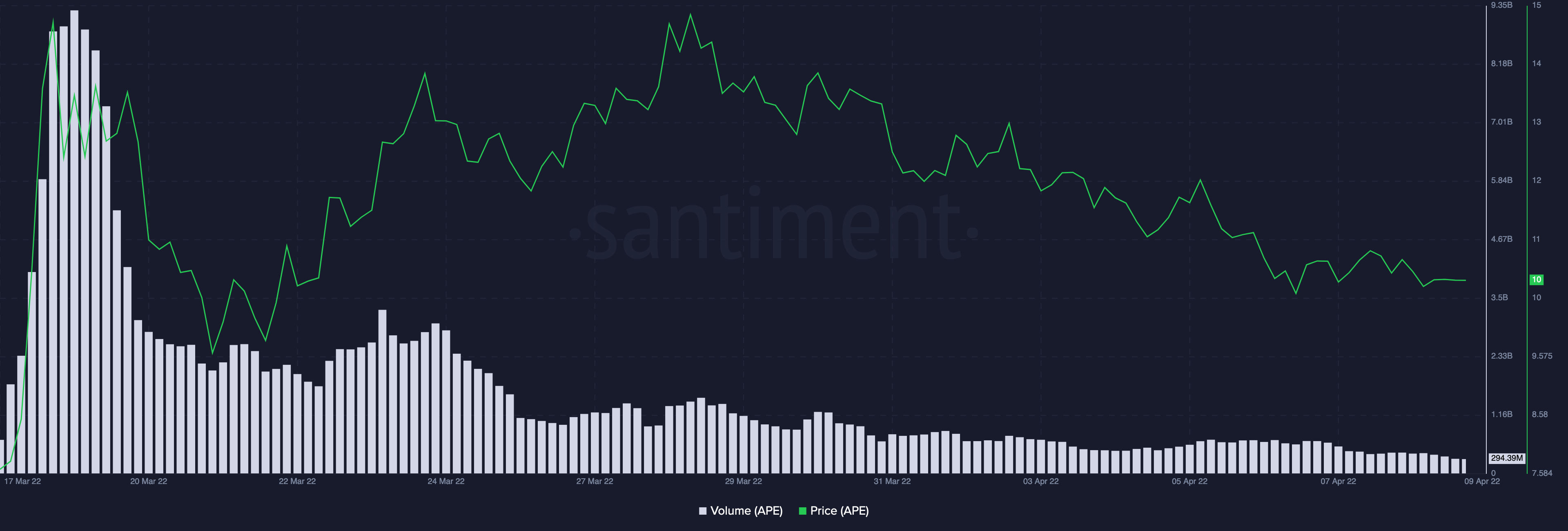

ApeCoin has been on a steady decline ever since its listing day on 17 March. Since then, it never managed to cross its ATH – which is quite a rare case considering the amount of hype that was backing this coin up. Unless of course, this was just another sophisticated rug-pull but more on that later.

It tried to recover slowly but couldn’t go too far. It has been in a gradual downward channel since the end of March and seems like it is going to continue in the same way.

On-chain metrics also seem to lend weight to the above-mentioned idea. This was just a suave way to put a couple of more million dollars into the pockets of the already extremely wealthy owners of BAYC. Well, money is sweeter than honey, they say.

On-chain volumes for ApeCoin have been negligible in the past few weeks. It only saw a spike for a few days post the launch but since then, volume action has been extremely poor.

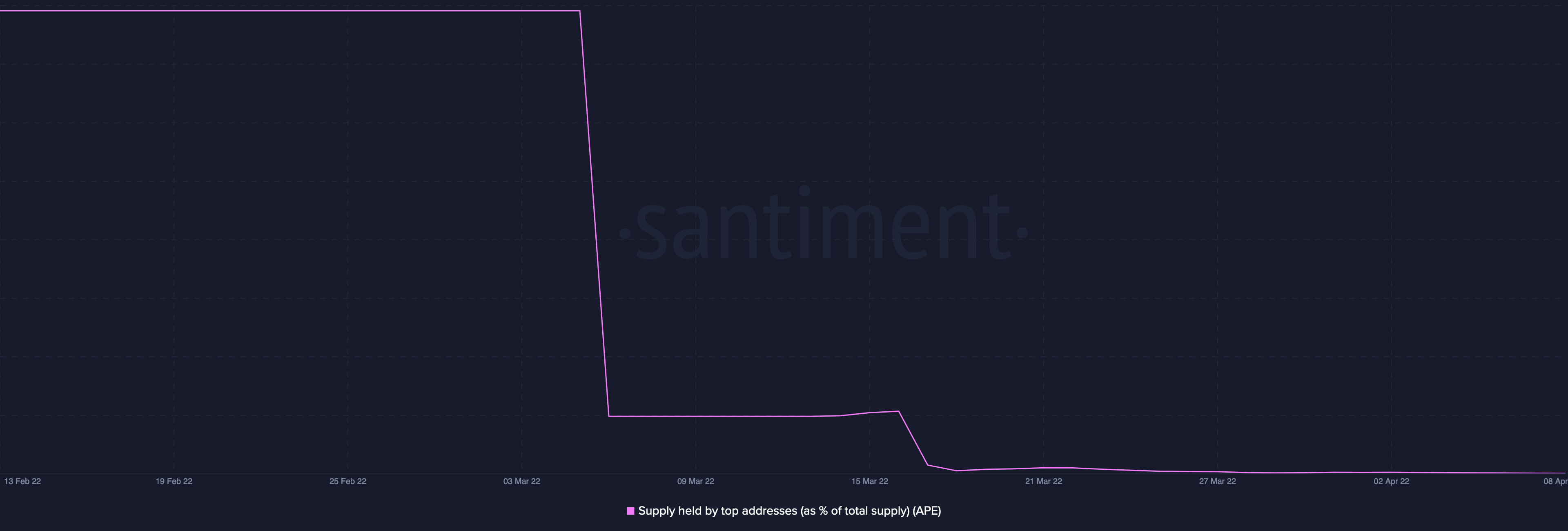

Funnily enough – the supply held by top addresses as a percentage of the total supply fell from 21% to around 10% on the launch day itself (17 March) and has continued to slowly fall further from there too.

In line with the above two pointers, its daily active addresses have also been gradually dipping downwards – further lending weight to the idea presented at the beginning itself.

Fuzzy ethics

This begs the question – was this a carefully executed rug pull in the image of a giveaway? An article by TheVerge from 23 March explains this perfectly – tokens promise to decentralize the web, so why are insiders reaping most of the profits?

The supposed ApeCoin DAO in place has managed to give most of the ApeCoins as a ‘gift’ to the project’s earliest backers – who from the looks of it managed to make a quick buck. In this regard, general investors need to stay aware as the crypto industry matures more, the nature of compromises and hacks it will face will mature too.