Was Terra UST fiasco premeditated? Here’s how large investors were able to escape unhurt

Latest report says large investors were able to get out earlier than the small investors during the Terra collapse. The report was published by Jump Crypto, a crypto market-making unit of Jump Trading.

Jump Crypto has published a report this Thursday titled “The Depegging of UST”. This report breaks out the silence of Jump despite being heavily linked with the Luna Foundation Guard. As Bloomberg reports, Jump’s president, Kanav Kariya, is listed on the foundation’s website as a member of its governing council, the report does not discuss his firm’s role in the stablecoin drama.

Jump jumps out of wilderness

In an earlier article, we carefully dissected the Terra collapse and how seven well-funded wallets carried out the attack. The report also studied the pattern of liquidity across these wallets during the Terra crash.

This Jump Crypto report discussed emerging factors from publicly available blockchain transactions. The study showed how large depositors “fled” early while small depositors were exposed to the exposure.

The report says:

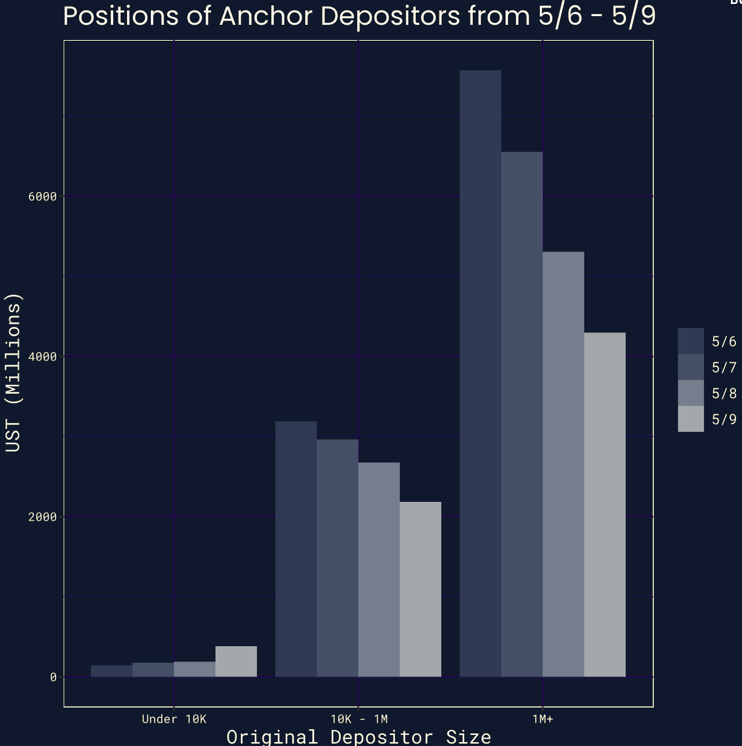

- Large depositors (wallets with over $1 million in Anchor deposits on 6 May) fled the protocol quickly, running down almost 15% of their position almost immediately and over 40% of their position over the first three days of these events.

- Mid-sized depositors (wallets with $10,000 – $1 million in Anchor deposits on 6 May) fled the protocol less rapidly, running down 5% of their position immediately and 30% over the first three days.

- Small depositors (wallets with less than $10,000 in Anchor deposits on 6 May) increased their exposure to Anchor. However, their total position size was an order-of-magnitude smaller than that of mid-sized and large depositors, and so this increased exposure was insufficient to counteract the outflows.

“However, their total position size was an order-of-magnitude smaller than that of mid-sized and large depositors, and so this increased exposure was insufficient to counteract the outflows,” the report concluded.

The report considers it unlikely that the wallet that helped touch off the meltdown was associated with a professional trading entity, based on analysis of the wallet’s history. On 7 May, the mysterious wallet reduced its UST position through a series of transactions by about $85 million, a move that the crypto market has concluded was the first in a series of events that triggered the larger disaster.

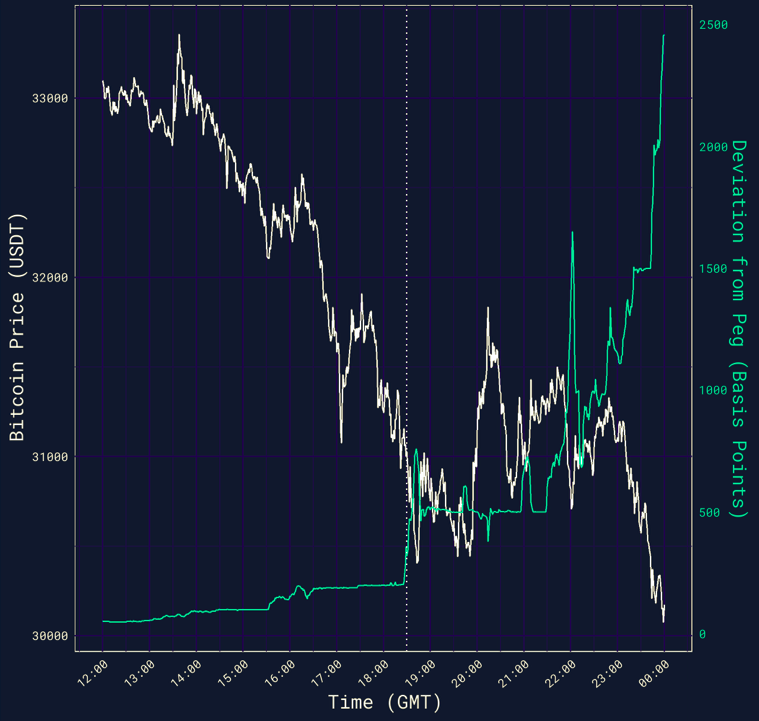

Another important takeaway from the report is the fall in BTC price as UST depegged on the crucial evening of 9 May. The first major drop in BTC price happens during the first large de-peg instance of UST. The pattern correlates further as we go on as shown in the chart below.