Watch out for these signs with these alts – Solana, Compound, Dent, Maker and Sushiswap

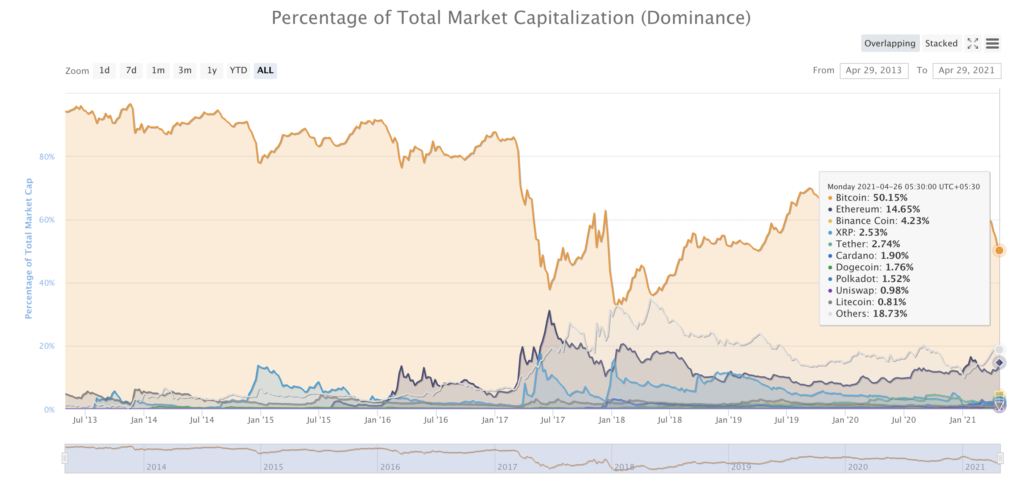

Bitcoin’s dominance was below 50% and this was unique to the current bull run. Though Ethereum’s market capitalization was above 15%, top altcoins, which rank in top 50, experienced a price surge, leading to an increase in the market cap. This drop in Bitcoin’s dominance was key to the boost in price of SOL, COMP, DENT, MKR, SUSHI and the likes, since the sentiment of traders was affected by market cap.

Altcoin dominance vs Bitcoin dominance || Source: Coinmarketcap.com

The dominance noted in above charts is a clear indicator for trends observed in altcoins like SOL, COMP, DENT, MKR and SUSHI. When it comes to the popularity and ROI from DeFi activities like farming, swaps and new token launches, SOL tops the list, after ETH.

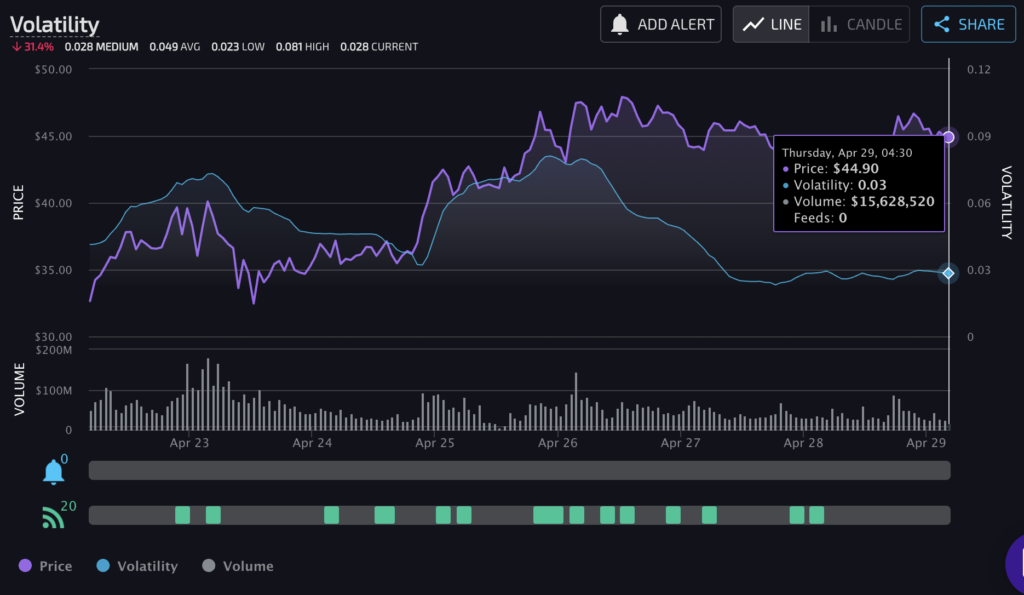

SOL was trading at the $44 level with a market capitalization of $12 Billion. The trade volume was rising steadily across exchanges; it was currently up nearly 12%. With the planned opening ceremony for Solana Season today, the price rise has a rational explanation unlike tokens that derive value based on the thriving meme culture.

SOL Volatility vs Price || Source: Lunarcrush

HODLers who accumulated the dip are likely to profit from the upside. Since the on-chain sentiment is bullish, COMP’s price is rallying.

The trade volume for COMP has dropped over 40%. This drop could be a response to the increased selling pressure or the dip in large value transactions. Either way, concentration by large HODLers was over 90%; this is likely to support the price above the current level of $644.36 based on data from coinmarketcap.com. With increasing demand and 89% HODLers who held COMP for less than a year, the price rally may be extended.