Web3 gaming held on to its numero uno position in the dApp industry but…

- The Web3 gaming sector’s market share fell for the fourth consecutive quarter.

- Investments into blockchain gaming fell sharply in Q3.

Players’ ability to store objects on the blockchain was significantly driving the acceptance and application of Web3 gaming. Unsurprisingly, it has become one of the fastest-growing industry verticals in the blockchain sector.

Web3 gaming remains No. 1

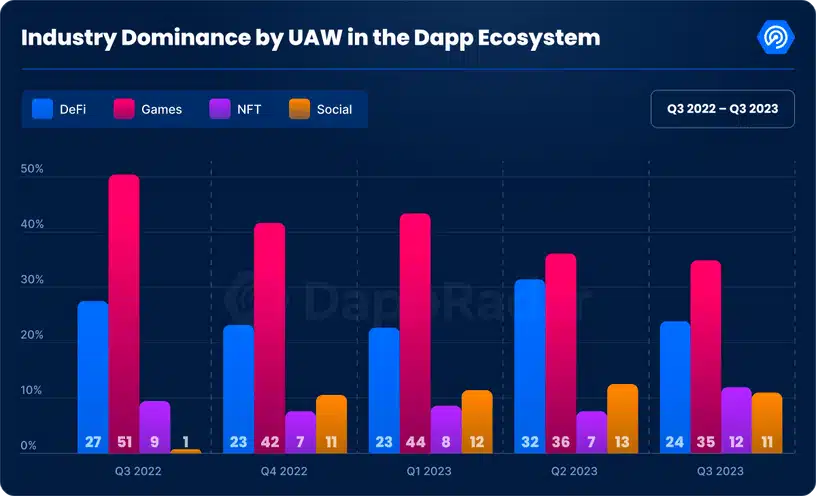

As per a recent report from analytics firm DappRadar, blockchain gaming continued to dominate the decentralized app (dApp) landscape in Q3. The industry had an average of more than 786,000 unique active wallets (UAW), representing a significant jump of 12% from the previous quarter.

However, despite being the leader of the pack, the sector’s market share fell for the fourth consecutive quarter. In Q3, Web3 gaming accounted for 35% of the dApp pie, a drastic fall from 51% in Q3 2022.

DappRadar attributed the drop to increased interest in other sectors like decentralized finance (DeFi), and non-fungible tokens (NFT), ruling out fundamental issues with blockchain gaming.

Alien Worlds, Sweat Economy, and Splinterlands were the top games in terms of user activity. Alien Worlds, especially, recorded a quarterly average of 527,000 UAWs. The report also drew attention to the rise of games based on move-to-earn models.

For the uninitiated, move-to-earn is a new phenomenon in Web3 gaming that rewards users for participating in fitness and sports-related activities.

Investments into Web3 gaming dips

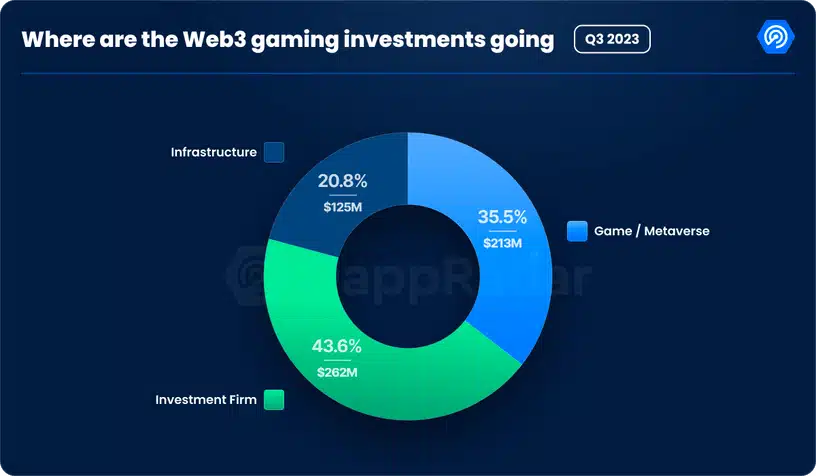

Web3 gaming projects attracted $600 million in investment in Q3 2023, marking a considerable drop of 38% from the previous quarter. The total investments in 2023 thus far reached $2.3 billion, constituting just 30% of last year’s tally.

While this was a definite cold shoulder from the investors, it was vital to consider it in the context of the bear market. In fact, crypto fundraising has been on a multi-quarter downtrend. Moreover, Q3 marked the worst performance since Q4 2020, according to a recent report by Messari.

However, it was interesting to discover that a sizable allocation of blockchain gaming investments – more than 43% – were directed toward investment firms. The report cited this as a sign of their “readiness to back forthcoming Web3 gaming sensations.”