Whale interest rises in Arbitrum: Are these events the reason why?

- ARB’s whale transactions rose significantly in the last week.

- The market was reacting to the upcoming Dencun Upgrade and ARB’s largest token unlock.

Large quantities of popular layer-2 (L2) token Arbitrum [ARB] were transferred to crypto exchanges in the last 24 hours, sparking interest and speculation in the broader market.

What are the whales up to?

According to on-chain data tracker Spot On Chain, two whale investors deposited a total of 2.77 million ARBs into Binance [BNB] during UTC afternoon hours on the 9th of March.

The transferred amount was worth $4.87 million at press time.

Upon digging deeper, AMBCrypto noticed that one of the whales transferred 916,787 tokens to Binance at the prevailing rate.

The whale withdrew this amount 2.5 months ago and might profit by $608k if they decide to cash out. Similarly, the other whale sent 1.85 million ARBs to Binance, sitting on unrealized profits of $2.67 million.

Together, the two entities stood to gain $3.3 million in profits if they decided to sell their holdings at the prevailing price.

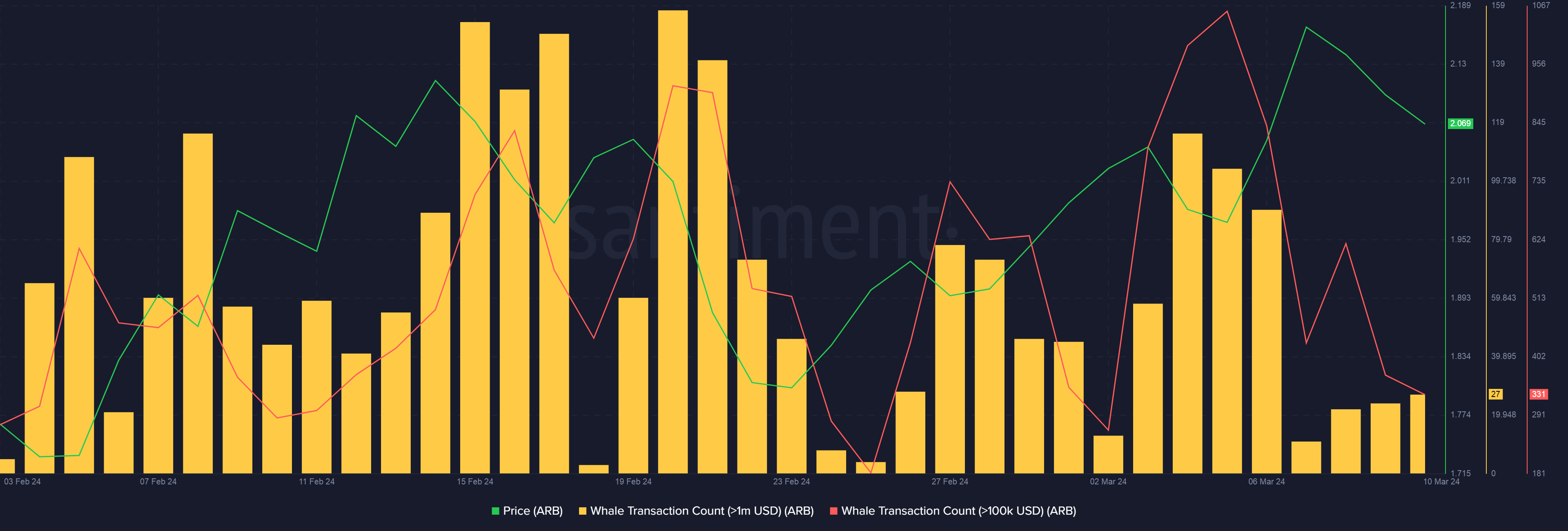

This development was part of a broader increase in ARB’s high-value transactions over the week, AMBCrypto noticed using Santiment data.

The spurt in whale transactions comes ahead of two pivotal events in Arbitrum’s ecosystem.

Dencun to boost ARB?

The first was the much-anticipated Dencun Upgrade scheduled for the 13th of March. The technical enhancement was expected to reduce transaction fees on layer-2 projects significantly.

Note that ARB doesn’t accrue any value from Arbitrum’s on-chain activity. That being said, it could benefit solely from the positive sentiment surrounding L2s, specifically Arbitrum.

ARBs set to flood the market

Secondly, ARB was set to witness its biggest unlock ever on the 16th of March. A humungous 1.1 billion tokens, accounting for 76% of the circulating supply, were set to be distributed to the team and investors.

Token analytics firm Token Unlocks said that if prices remain unchanged, ARB’s market cap would shoot up past $5 billion from the current $2.65 billion following the unlock.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Additionally, ARB could break into the top 25 cryptos by market capitalization list, from the current 50.

On the flip side, the influx of such a large supply into circulation could apply inflationary pressure on ARB, potentially resulting in significant losses.