What are Bitcoin [BTC] whales up to? Decoding…

- BTC’s accumulation trend was interesting and could influence BTC’s price.

- On-chain metrics painted a neutral picture as a few of them supported the bulls.

On 23 February, Santiment pointed out an interesting trend in Bitcoin [BTC] accumulation among sharks and whales. As per the tweet, addresses with 100-1000 BTC became stagnant while BTC’s price hovered within the range of $23,000 – $25,000.

?? The amount of shark & whale #Bitcoin addresses are staying flat as the $23k to $25k price range continues. If the 1K-10K $BTC addresses begin to rise the way the 10-100 and 100-1K $BTC addresses have in the past 3 months, it would be a breakout sign. https://t.co/xs7D99BzQ1 pic.twitter.com/P7HwCGeMoT

— Santiment (@santimentfeed) February 23, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-24

On the other hand, addresses with a balance of 1,000 – 10,000 BTC continued to decline. The tweet also highlighted the possibility of a northbound breakout of BTC’s price if addresses with 1,000 – 10,000 BTC registered an increase in the coming days.

This can be a good buying opportunity

Joaowedson, an analyst and author at CryptoQuant, published an analysis on 24 February, which pointed out the current market trend for BTC. As per the analysis, the 350-day moving average (MA) and the 100-day exponential moving average (EMA) of the Taker Buy Sell Ratio indicator can identify changes in Bitcoin’s price trend.

Local bottoms and tops in the price of bitcoin can be identified when the 100-day exponential moving average crosses a fixed value line of 1. Looking at the current chart, there was a good buying opportunity as the 100-day EMA reached the fixed value line of 1.

Where is the market heading?

According to CoinMarketCap, BTC’s price registered a decline of nearly 2.5% in the last 24 hours, and at the time of writing, it was trading at $23,942.46 with a market capitalization of more than $462 billion. A deeper look at BTC’s on-chain metrics provided by CryptoQuant gave a better understanding of the market condition and shed light on the path BTC might take in the coming days.

Is your portfolio green? Check the Bitcoin Profit Calculator

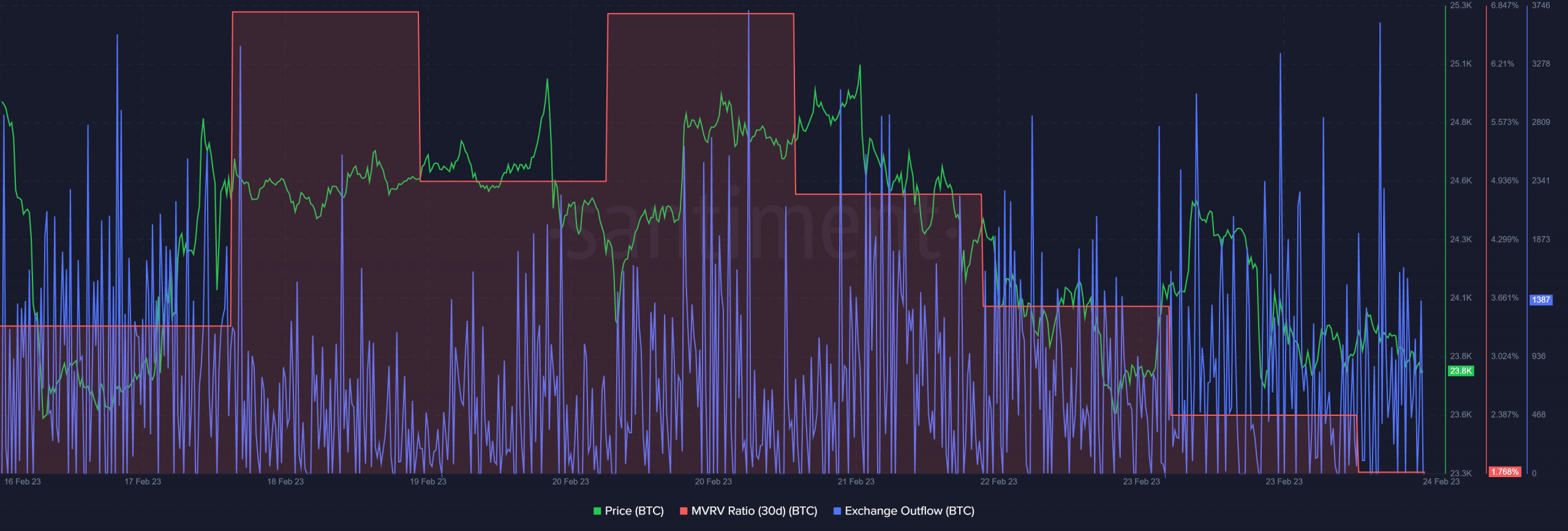

For instance, BTC’s exchange reserve was decreasing, which was a development in the buyers’ favor, as it indicated lower selling pressure. Another positive metric was BTC’s funding rate, as the long position traders were dominant and willing to pay short position traders. Moreover, BTC’s exchange outflow was also consistently high, which was a bullish signal.

However, not everything was working in BTC’s favor. The king coin’s MVRV Ratio registered a decline over the last week. BTC’s aSORP was also red, suggesting that more investors were selling at a profit.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)