What Bitcoin’s falling volatility says about investor sentiment

- Most investors were moving coins out of the market to HODL.

- The number of BTC coins across exchanges has dropped to its lowest level since January 2018.

The crypto market’s slump has put the spotlight back on one of the most-talked about topics in the sphere – Bitcoin’s [BTC] volatility.

How much are 1,10,100 BTCs worth today?

According to data provider Kaiko, the 90-day annualized volatility for the largest digital asset on the planet has plunged to 50%, nearly halving from the highs observed during the 2021 bull market.

Volatility is perhaps the best lagging indicator of #crypto activity.

90D vol for #BTC and #ETH is at multi-year lows, a near identical trend line with trade volume. pic.twitter.com/CEBrGDTEcf

— Kaiko (@KaikoData) June 19, 2023

What looked like the start of another extended bull market phase during the first quarter of 2023 has turned on its head. As evident from Token Terminal, BTC’s monthly trade volume has been on a downward spiral since April.

Bitcoin’s perceived value

Bitcon’s declining volatility may be due in part to how investors have started to perceive it. Glassnode’s Liveliness metric, which shows how likely it is for Bitcoin owners to spend or keep their tokens, was on a multi-year downtrend.

This suggested that most investors were moving coins out of the market to HODL.

This translated to the idea that the king coin was increasingly seen as a long-term investment option, rather than a short-term speculative asset. Furthermore, recent actions by U.S. based regulators on major market participants have contributed to HODLing sentiment as well.

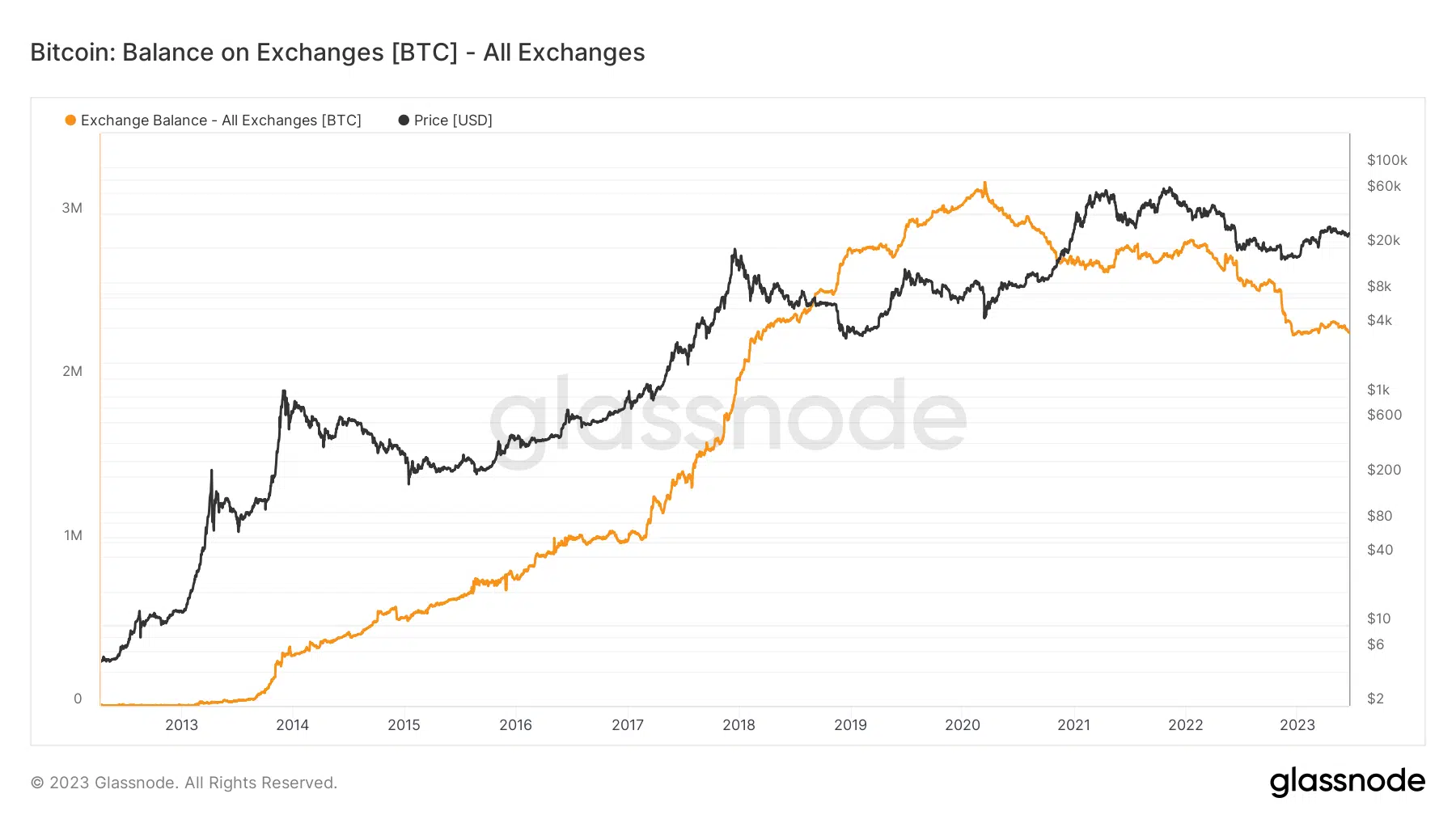

As evident from the graph below, the number of BTC coins across exchanges has dropped to its lowest level since January 2018, about 2.28 million at the time of publication, implying the lack of willingness on the part of investors to trade.

Furthermore, there were signs that the Bitcoin market has matured and was gaining the attention of leading financial institutions. Recently, the world’s largest asset management company, BlackRock, filed for a spot Bitcoin Exchange-Traded Fund (ETF).

This move had the potential to make Bitcoin a legitimate asset class for investors with varying degrees of risk tolerance.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Speculative interest drops

Bitcoin’s Open Interest (OI), or the dollar value locked in outstanding contracts on futures markets, plummeted to a fresh 1-month low, as per a tweet by Glassnode dated 19 June. The OI has been trending downward since the start of June.

BTC exchanged hands at $26,797 at the time of writing, having gained 1.4% in value over the last 24 hours, data from CoinMarketCap showed.

? #Bitcoin $BTC Open Interest in Perpetual Futures Contracts just reached a 1-month low of $401,719,790 on #Deribit

Previous 1-month low of $401,773,460 was observed on 18 June 2023

View metric:https://t.co/SpnaOACZab pic.twitter.com/wZqjb8VVSf

— glassnode alerts (@glassnodealerts) June 19, 2023