What BNB Chain’s latest on-chain data reveals about the network

- BNB Chain’s latest weekly report underscored healthy network activity.

- However, BNB struggled to get out of the low range.

BNB Chain released its latest weekly data on 21 July, which revealed some noteworthy findings regarding its performance between 14 and 20 July. Notably, the network had a total of 4.32 million active weekly users during the weekly period. It also registered 22.94 million transactions during the week, with an average of 3.82 million transactions daily.

Numbers don’t lie ? pic.twitter.com/odp7q72klC

— BNB Chain (@BNBCHAIN) July 21, 2023

Is your portfolio green? Check out the BNB Profit Calculator

The weekly report underscored BNB Chain’s ability to maintain robust network growth numbers even under slow market conditions. One secret behind this performance was revealed in the weekly performance report.

The network’s average gas fee was 0.0039 BNB, which is equivalent to a $0.94 average transaction cost. BNB’s relatively low transaction fee is one of the main reasons why the network has achieved such strong user growth.

BNB Chain is also putting itself in a position to leverage more user growth in the future by onboarding new Web3 projects. Inasmuch, it has announced the rollout of five new dApps on its network.

New projects on BNB Chain ?https://t.co/JZqFYB688a

— BNB Chain (@BNBCHAIN) July 22, 2023

BNB Chain’s robust user activity, coupled with dApp growth, should, in theory, make for a strong BNB cryptocurrency. However, BNB’s latest performance suggested that it was heavily influenced by the overall market conditions.

BNB price analysis

BNB exchanged hands at $242.7 at press time. It has been in a slightly ascending range since around mid-June after experiencing a dip at the end of May. The sell pressure that prevailed since mid-July almost pushed for a retest of its short-term ascending support.

A strong bullish bounce could push back above the $260 price level.

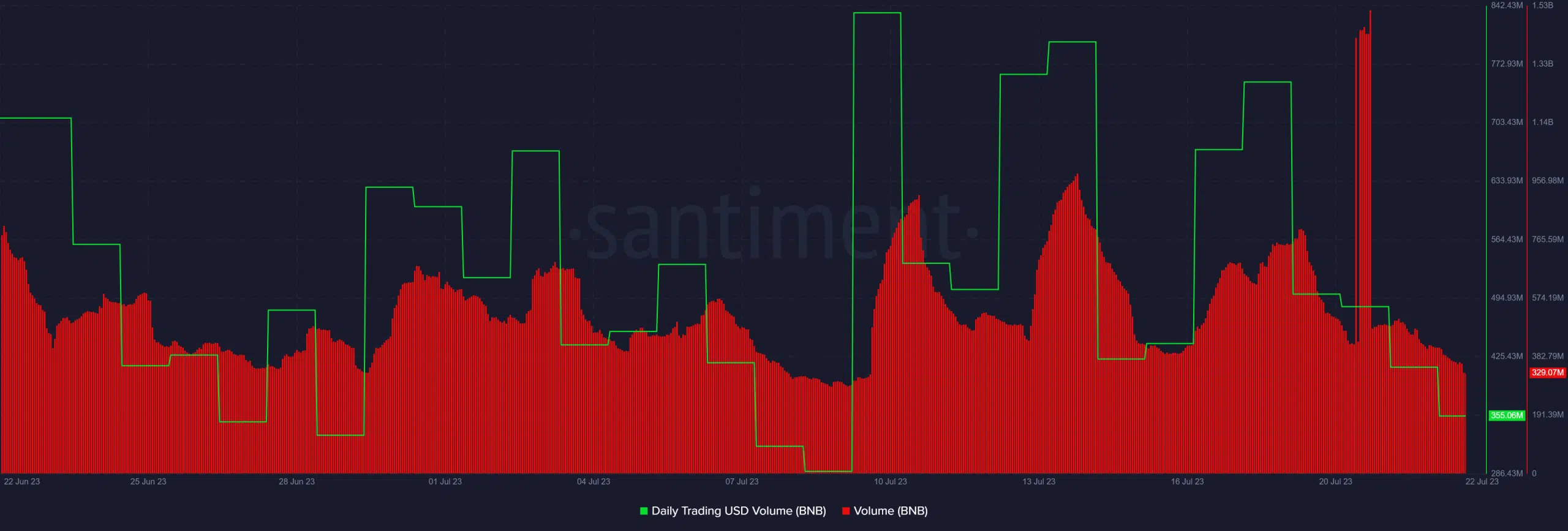

The above price chart confirmed that BNB was struggling to bounce back from this range. Nevertheless, the press time price level was characterized by low volume, and the daily trading USD volume slid significantly in the last few days.

Read BNB’s Price Prediction 2023-24

On the other hand, some data also showed that accumulation was taking place, and traders were willing to HODL. For example, the mean coin age has been on an upward trajectory for the last four weeks.

The same goes for weighted sentiment, which suggested that most users were holding on to bullish optimism. However, traders should still lean on the side of caution in case the market crashes again.