What BUSD’s fallout means for Binance Coin’s [BNB] future

![What BUSD’s fallout means for Binance Coin’s [BNB] future](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-14T081310.345.png)

- BNB price fell, its trading volume hit monthly high, whales dumped BUSD after regulator’s 13 February decision.

- Traders short BNB as NFDFS shared reason for earlier resolution.

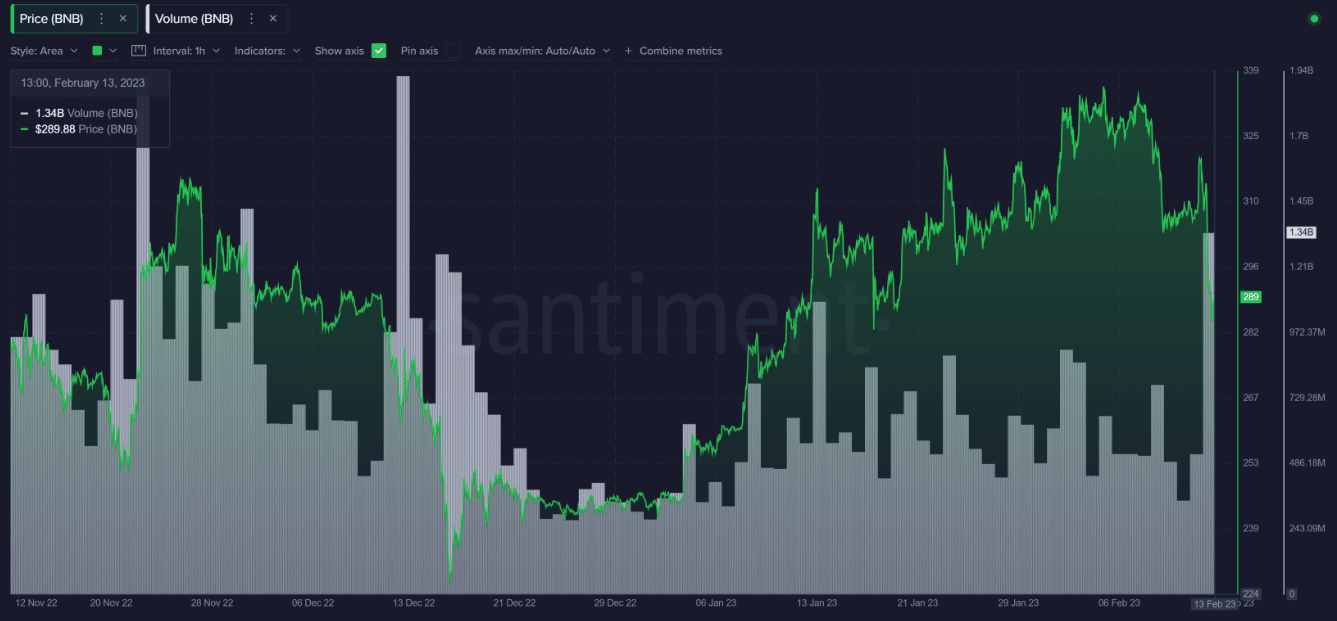

Binance Coin [BNB], the exchange coin of the world’s largest cryptocurrency exchange, felt the repercussions of the NYDFS’ decision to halt further minting of Binance USD [BUSD]. According to Santiment, it was almost inevitable for BNB to be spared in the wake of the unfolding events. In its 13 February assessment, the on-chain platform pointed out the BNB hit its highest trading volume since December 2022.

How much are 1,10,100 BNBs worth today?

BNB: An associate to take the fall

Ordinarily, the volume describes the amount of transactions that pass through a network within an interval. The spike in this metric considers both transactions in losses and gains. But the action by investors would have mostly ended in taking responsibility for dumping the asset.

This was because BNB, at press time, had lost 7.34% of its value in the last 24 hours. A 108% increase within the same period, coupled with a 10.97% seven-day shred, would have surely left holders’ portfolios in the red.

This condition means that BNB could not curtail impending decline like it did when there was a massive FUD around Binance in December 2022.

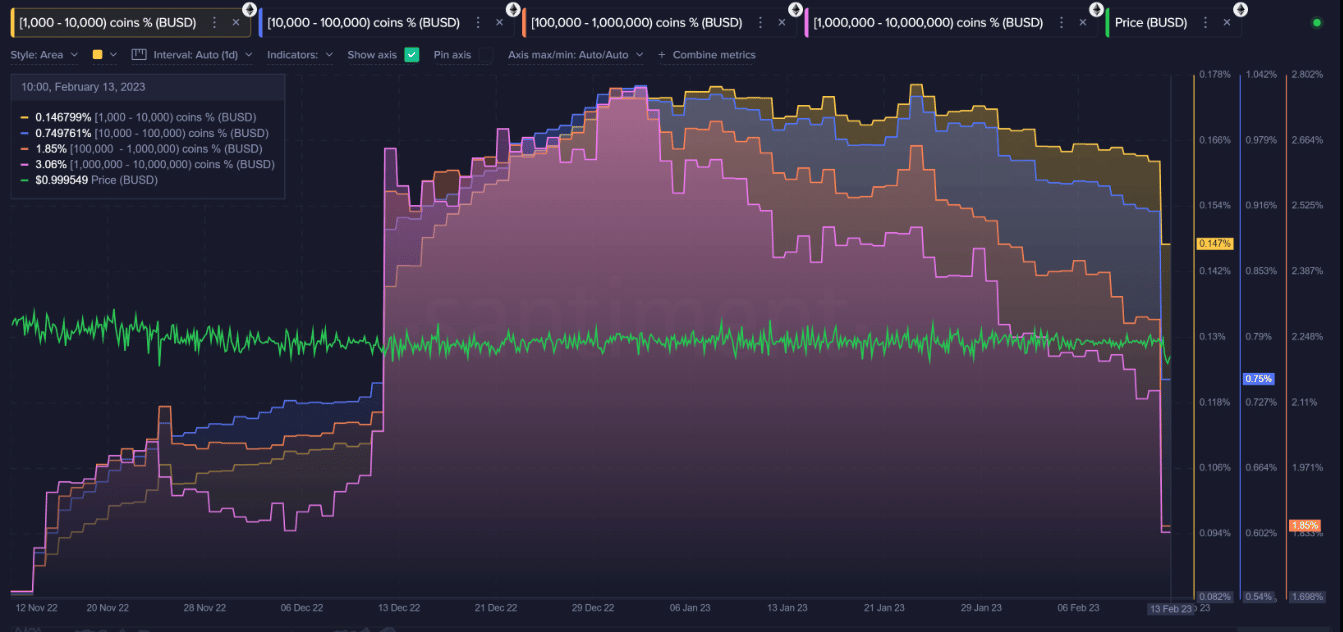

As rightly confirmed by Binance’s CEO, CZ, on 13 February, BUSD’s market cap would continue to decrease because of the regulatory decision. Interestingly, the fall from its current seventh position might come faster than expected.

The reason for this projection was because of the actions of whales and sharks. Based on Santiment’s data, addresses holding 1000 to 10000000 BUSD have jointly dumped over $200 million worth of the stablecoin in the last 24 hours. BUSD’s projection to stop hovering around the $1 mark could have been vital to the decision.

As expected, this has happened with the likes of Tether [USDT], Circle [USDC], and DAI, all benefiting from immense accumulation.

NYDFS offers clarity as traders go short

Considering the back and forth about NYDFS’ decisions, the regulatory body released its reasons for clarity. According to the memo, NYDFS admitted that Paxos had unresolved issues. The regulator related these issues to the un-authorization of BUSD on any other blockchain except Ethereum [ETH].

Meanwhile, the body also noted that it would monitor Paxos’ redemption as the firm ended its relationship with Binance. The notice read:

“Paxos is required to redeem their Paxos-issued BUSD tokens for U.S. dollars through Paxos at a 1:1 exchange rate pursuant to compliance protocols for customers in good standing.”

Is your portfolio green? Check out the Binance Coin Profit Calculator

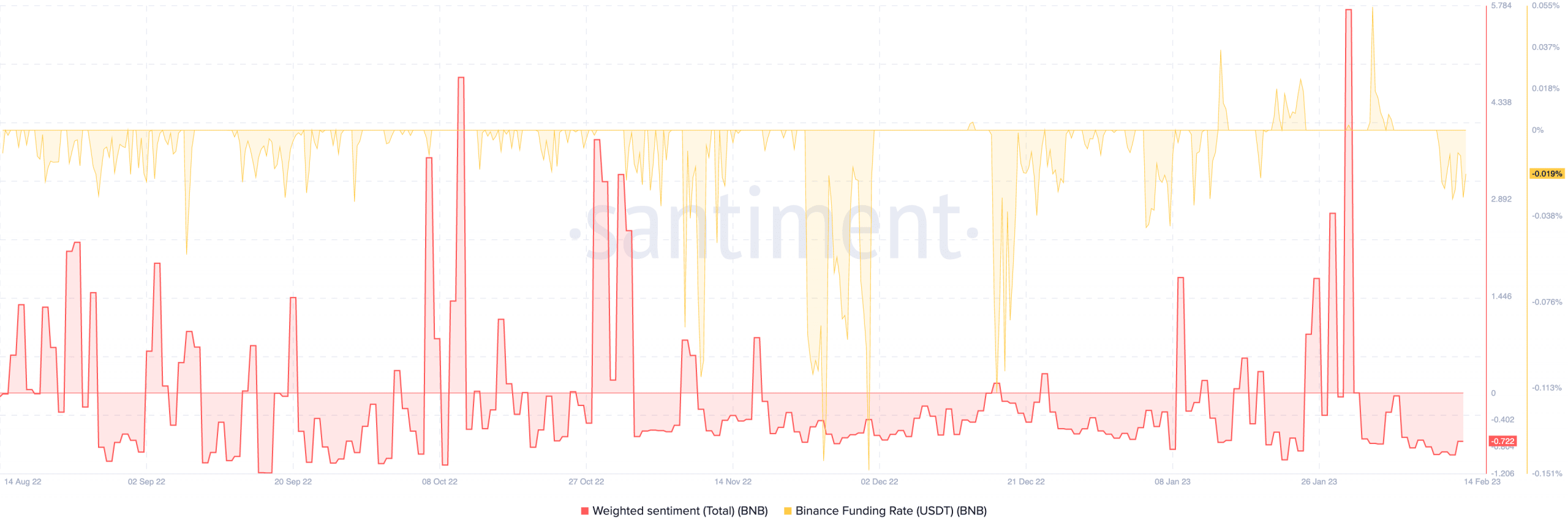

Following the development, the BNB funding rate had reduced. This implied that traders were less optimistic about gains on the coin. Moreso, the weighted sentiment positioned at -0.0722 meant that the perception towards BNB was negative and traders were mostly shorting the coin.

In conclusion, there was a chance that BNB could falter in the next few days. However, an end to the FUD might extend to stopping a further decrease.