What did Q2 have in store for DeFi’s market performance

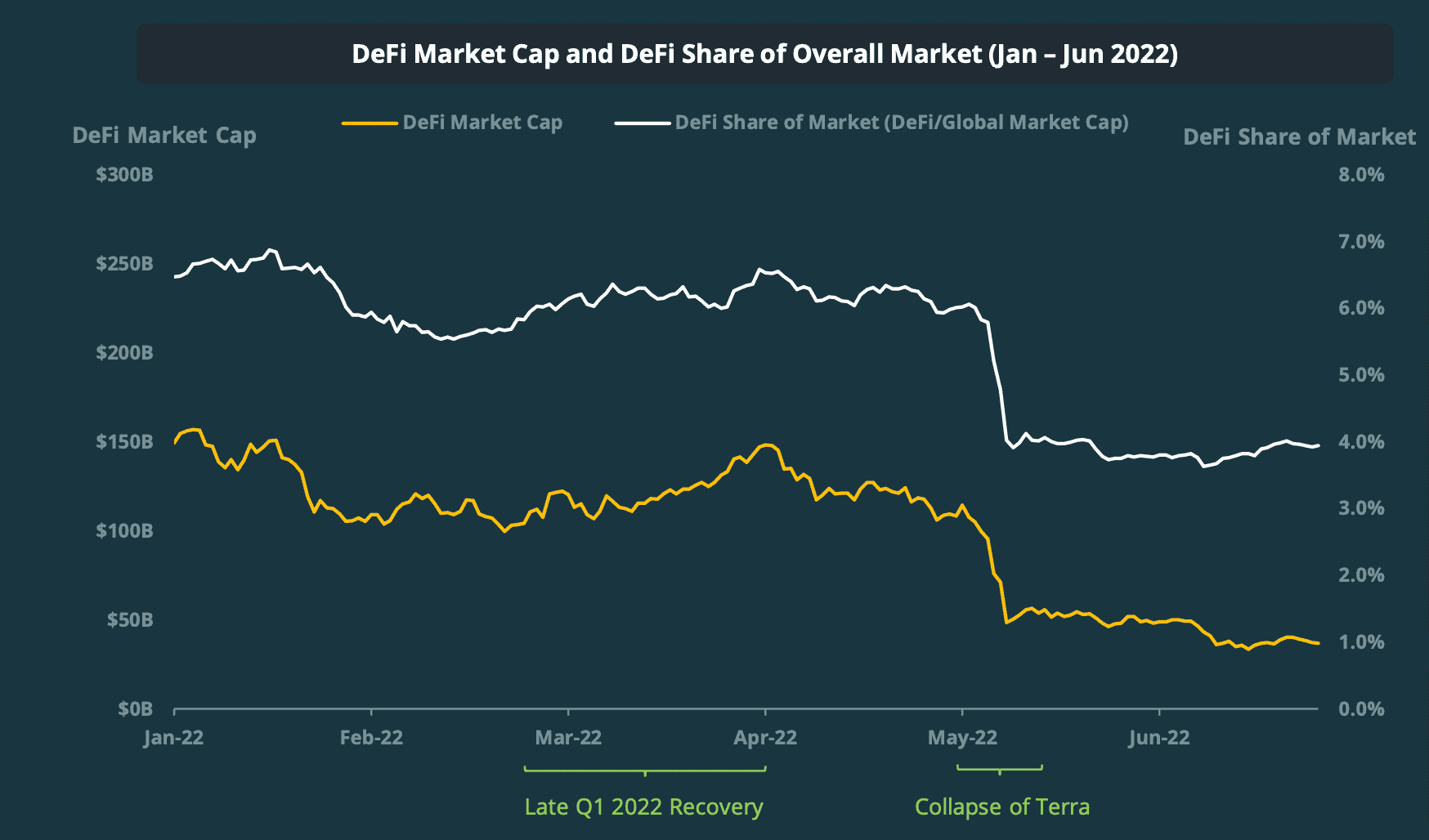

In a newly published report, leading crypto-assets data provider CoinGecko found that the Decentralized Finance (DeFi) ecosystem registered a 76% decrease in market capitalization over the last quarter. Between April and June, while the entire cryptocurrency market was plagued by a full-on bear run, DeFi market capitalization declined from $142 million to $36 million.

According to CoinGecko, the same can be attributed to the collapse of Terra and its stablecoin, UST, and a spike in DeFi exploits.

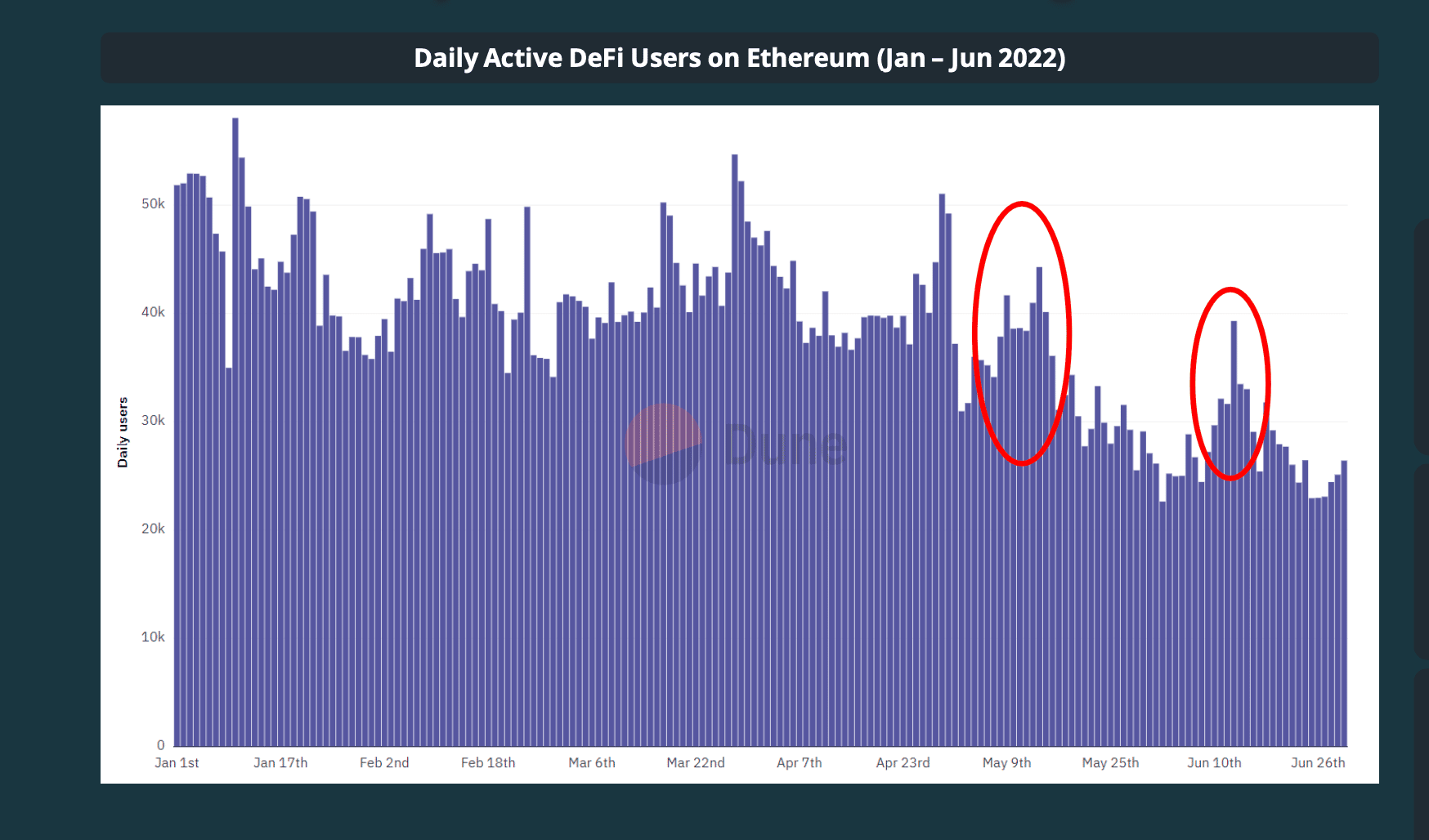

Daily active users in Q2

The report also found that the last quarter was marked by a 34.5% decline in Average Daily DeFi Users, compared to 1 April.

Interestingly, CoinGecko also found that despite the significant decline in DeFi market capitalization, activity with the ecosystem generally was above average. It stated further that although daily active users across DeFi protocols declined by up to 40%, “there were multiple instances in Q2 where the need for DeFi truly shined.”

“In early May, the number of DeFi users spiked during the Terra collapsed, as CEXs halted trading sporadically. As such, trading volumes on Curve Finance and Uniswap skyrocketed as holders were eager to sell their LUNA & UST. In the wake of Celsius’ withdrawal restrictions on 13 June, daily users of DeFi protocols spiked by 24%. In both events where centralized entities have failed, users have flocked to enjoy DeFi’s permissionless nature.”

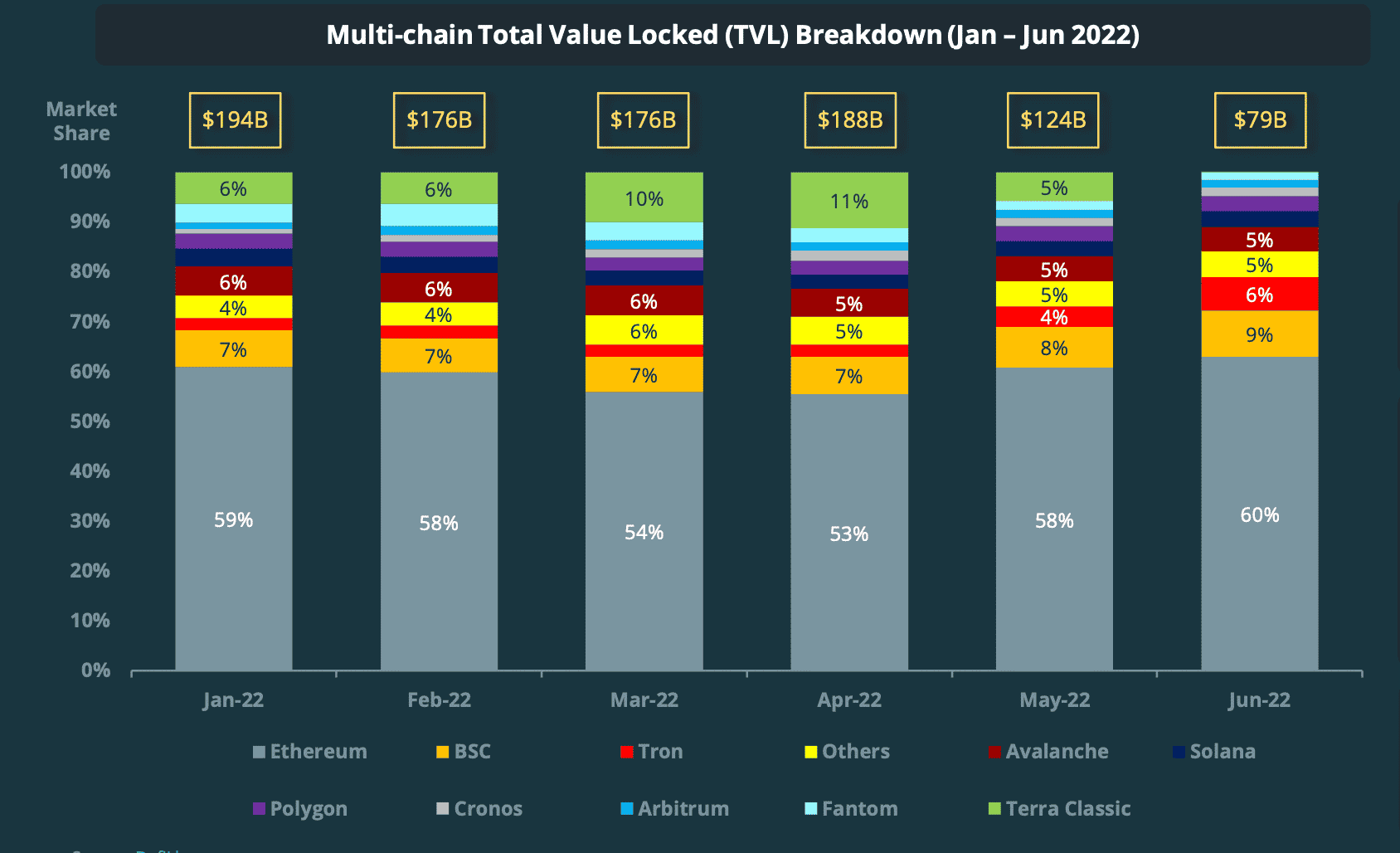

DeFi multichain marketshare in Q2

Furthermore, it was reported that there was a 55.1% decline in DeFi Total Value Locked (TVL) across leading chains over the last quarter. Commenting on the performance of Ethereum, the report revealed that Ethereum increased its share of the total TVL of all chains from 54% to 60%. This, despite its overall TVL logging a 52% decline over the quarter.

Within the period under review, data from DefiLlama showed that the TVL of Avalanche, Polygon, and Solana fell by 75%, 64%, and 67%, respectively. Thanks to its algo-stablecoin, USDD, Tron’s TVL share, however “tripled from 2% to 6%” in the last quarter.

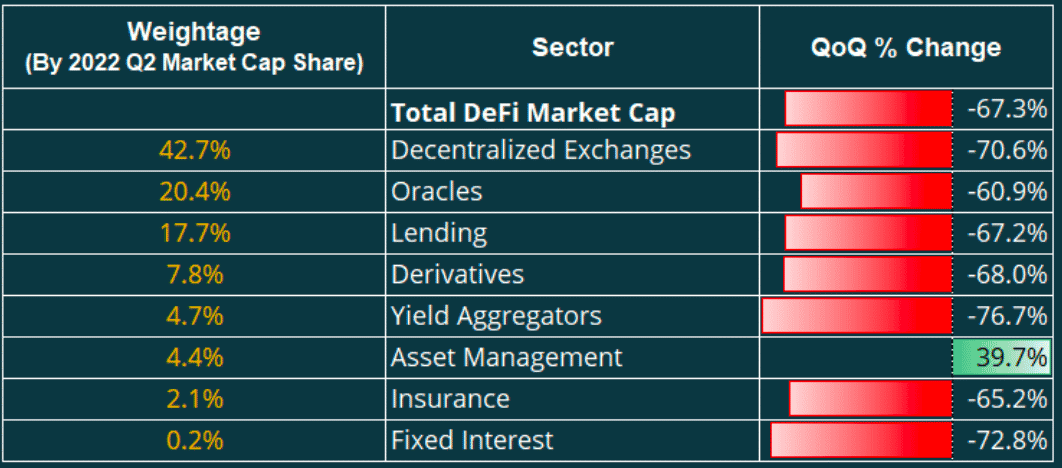

Major DeFi sectors saw declines

A look at the QoQ performance of major DeFi sectors revealed a significant decline in the market capitalization of most sectors. According to CoinGecko,

“In its entirety, the DeFi sector lost ~67% of its market cap compared to the previous quarter, in line with Ethereum’s plunge from $3,300 to $1,100.”

Interestingly, amidst the general decline, it was also found that the asset management sector saw a 40% uptick in its market capitalization. This led to a growth in its share of the market from 1% to 4.4%.

With a sustained decline in DeFi market capitalization, recovery may be far from sight. Especially with greater regulatory involvement, more volatility prompted by macroeconomic factors, and a higher number of DeFi exploits.