What do these metrics mean for Bitcoin?

The crypto fear and greed index showed extreme fear as Bitcoin traded below $35000. In the past two days, the index has gone from fear to extreme fear and this shift came at a time when Bitcoin’s price was recovering. Retail traders across exchanges seemed to disagree with the bullish narrative.

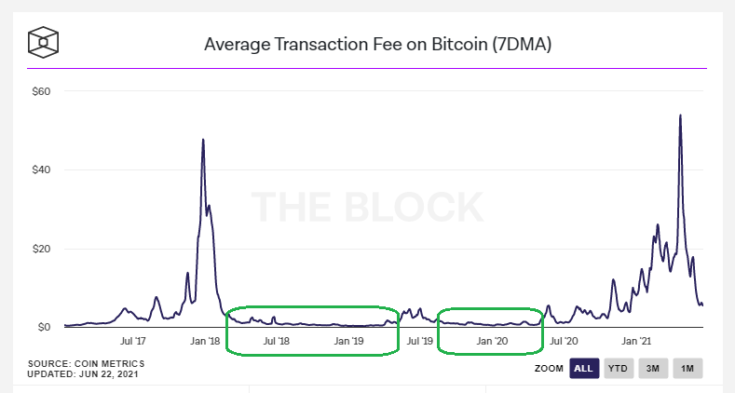

Based on the average transaction fee chart from the block, it is likely that Bitcoin’s price may take a bullish turn before the end of June 2021, and the price is likely to cross $40000 yet again.

BTC Average Transaction Fee || Source: The Block

The above chart shows the highlighted region of July 2018 to Jan 2019 when the average transaction fee dropped to this level, this time period corresponds with the increase in Bitcoin’s price as well.

Thus if the trend is followed, then it is likely that the recent drop in average transaction fee, the 7-day moving average will lead to an increase in price, a 20% minimum appreciation at the current price level, if the trend is followed exactly.

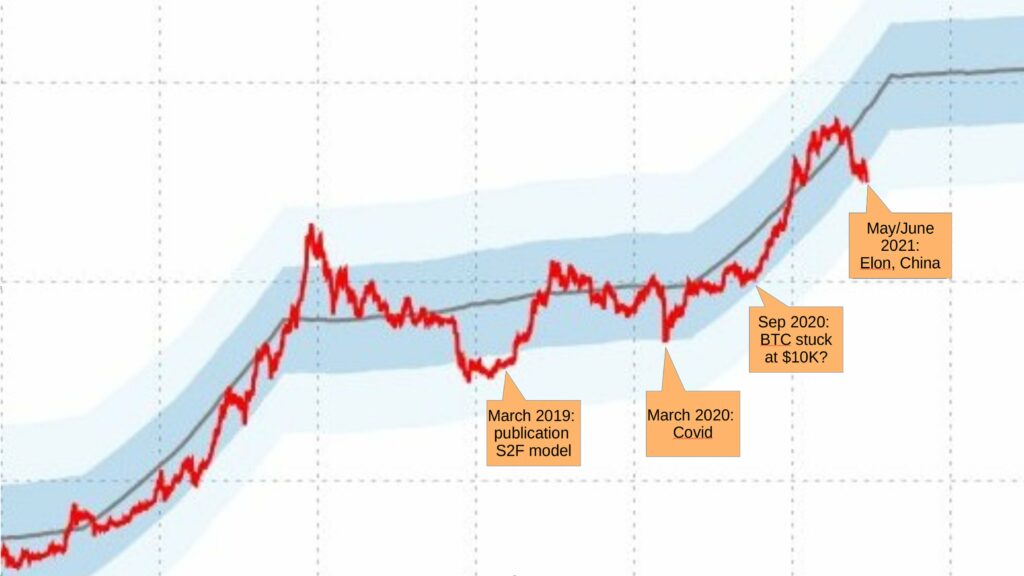

Analyst Plan B stated that even for him it is always a bit uneasy when Bitcoin price is at the lower bound of the stock-to-flow model. He added:

Will it hold (like Mar 2019 when I published S2F, or Mar 2020 Covid, or Sep 2020 with BTC stuck at $10K), and is this another buying opportunity? Or will S2F be invalidated?

Source: Twitter

Further supporting the bullish narrative, the entire market capitalization recovered over $200 Billion in a day based on data from coinmarketcap.com. If we would have entered the bear market, this recovery wouldn’t have occurred.

For the retail trader, there are several signs from the institutional side and from whales that this is bullish for Bitcoin. Data from derivatives exchange Deribit suggested that as BTC price was below $30000, fast money focused on the expiration on June 25, closed shorts, and booked profits.

In addition to the accumulation following the price drop, there were calls buying near-spot support, and institutions leveraged purchase fair price calls. These actions support Bitcoin’s long-term bullish narrative and its recovery. The dip is behind us and the bear market is not here yet.