What does post-Vasil Cardano [ADA] share with post-Merge ETH

Livestreamed by over 40,000 people, the Cardano Vasil Hard Fork upgrade was implemented on 22 September at 9:44 p.m. UTC. Needless to say, it was soon declared a success.

That’s not all, however. Following the hard fork, ADA’s price rallied by over 4% to close the 22 September trading session at $0.458 on the price charts.

For a while, ADA continued on its upward price trajectory to exchange hands at a high of $0.4789 on 23 September. Soon after, the crypto-market’s bears took over to initiate a price movement down south. At press time, ADA was trading hands at $0.4572, having declined by 5% since the high of 23 September.

Juxtaposing ADA’s performance after the Cardano Vasil Hard Fork upgrade with that of ETH after the Merge, data from CoinMarketCap revealed that the price of the leading alt rose momentarily by 3%. Following the same, the price immediately plummeted. Over the seven days that followed the Merge, the price of ETH dropped by 16% on the charts.

With the bears spotted to be in control of the ADA market, the altcoin appeared poised to follow in the footsteps of ETH.

Sellers on a rampage

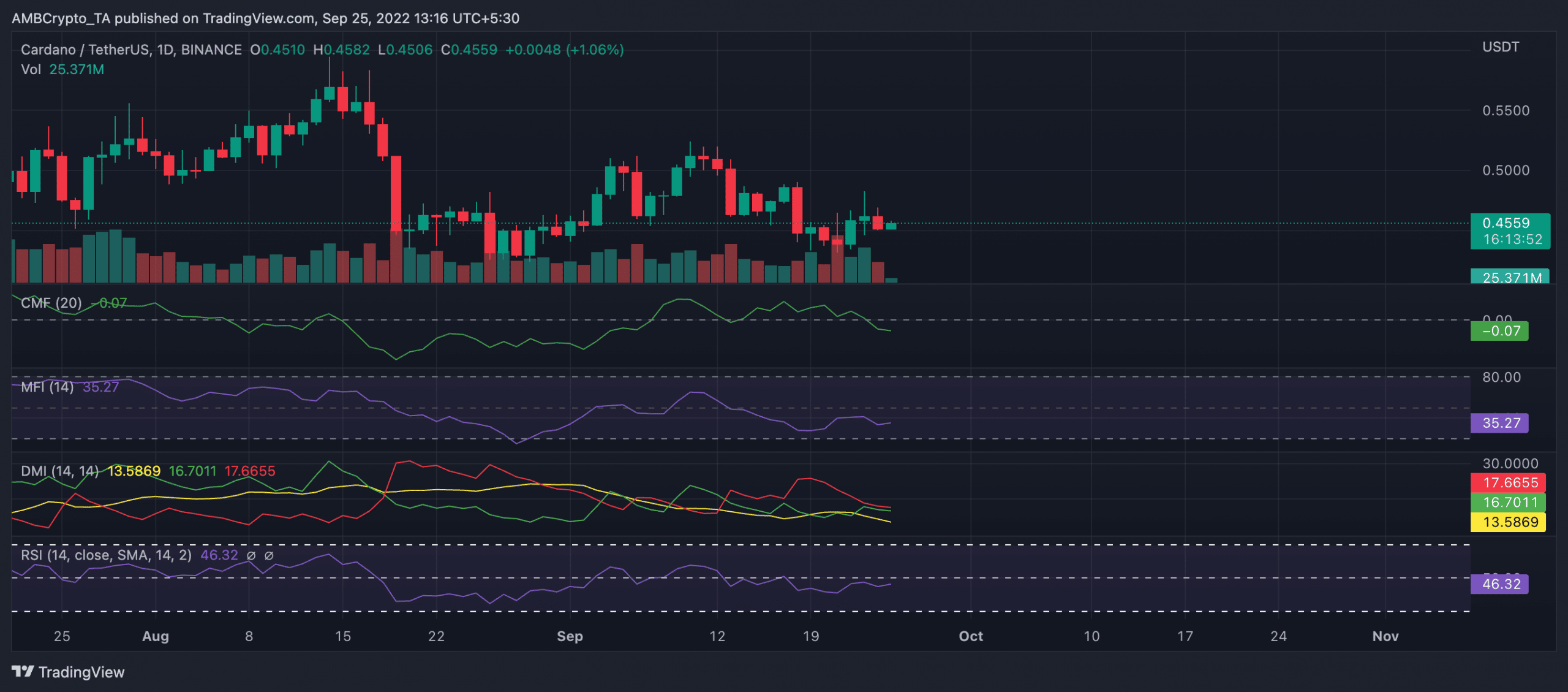

On the daily chart, following the Vasil Hard Fork, selling pressure for ADA rallied. Positioned in downtrends, key indicators revealed low buy order volumes since the upgrade. At press time, ADA’s Chaikin Money Flow was positioned at -0.07. Headed towards the oversold zone, ADA’s Money Flow Index (MFI) was found at 35.

Furthermore, a look at the Directional Movement Index (DMI) revealed that ADA sellers had control of the market. The strength (red) at 17.66 was positioned solidly above the buyers’ (green) at 13.58. Also, the Relative Strength Index (RSI) was placed at 46.32 at press time.

Vasil led to a ‘downgrade’

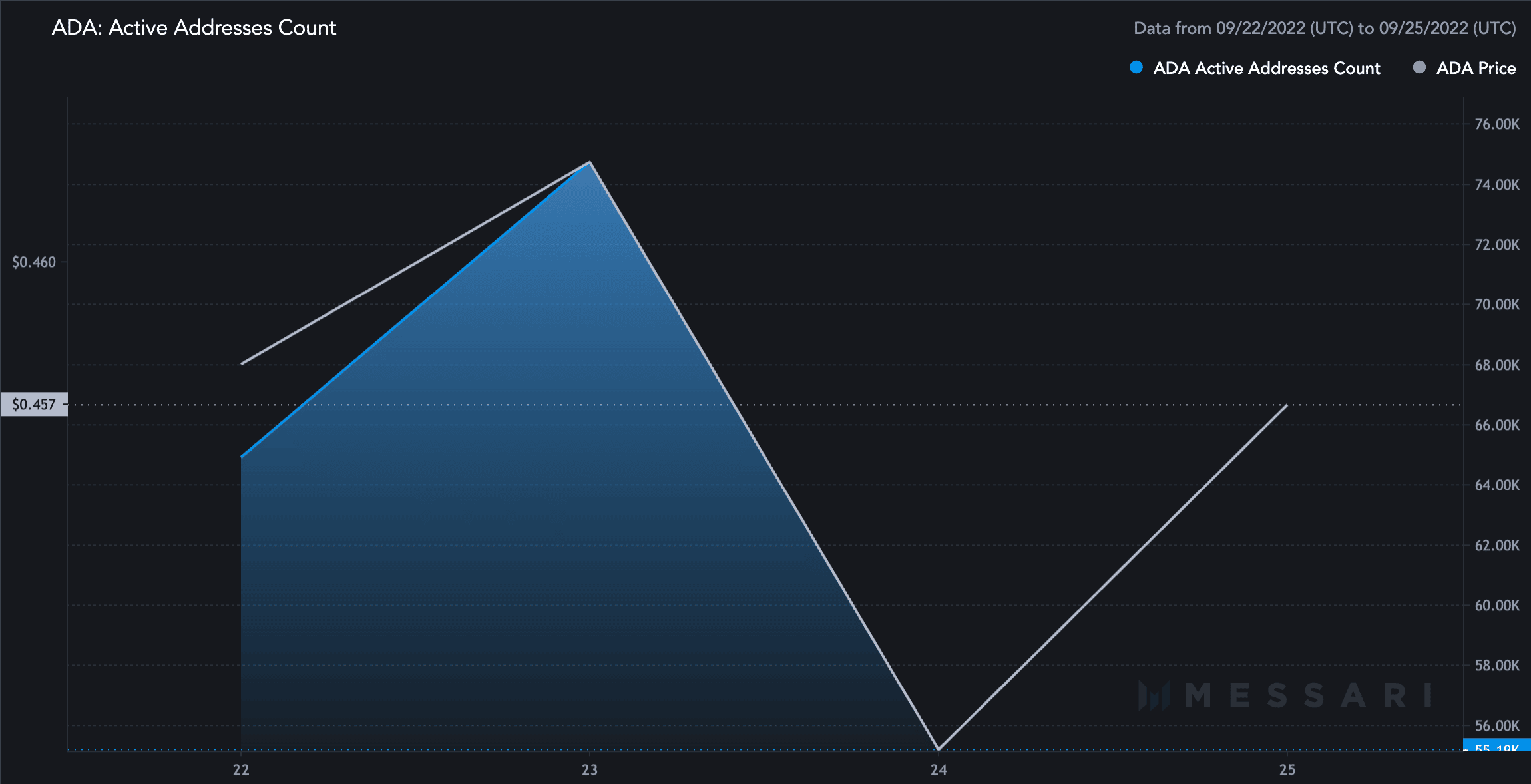

According to on-chain data from Messari, active addresses that have traded ADA since the Vasil Hard Fork upgrade have fallen by 14%. At press time, active addresses on the ADA network stood at 55,194. On the day of the upgrade, figures for the same were as high as 64,919.

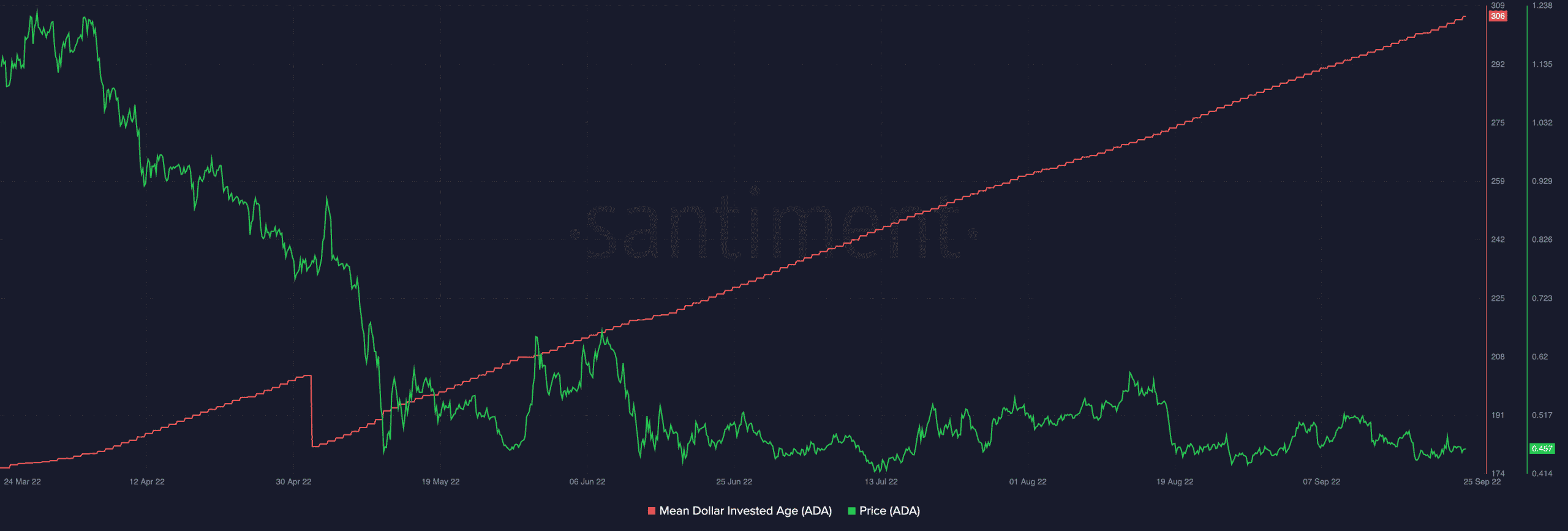

On a 30-day moving average, ADA’s market-value-to-realized-value (MVRV) posted a negative value, indicating that an average ADA holder has held at a loss over the last month. So far, the Vasil Hard Fork has not led to a reversal in this trend. At press time, ADA’s 30-day MVRV stood at -3%.

Furthermore, in spite of the upgrade, the general market remained skeptical about the asset’s performance. For instance, the weighted sentiment, at press time, was -0.168.

According to CoinMarketCap, the price of ADA has declined by over 150% since the year started. With the last six months marked by dormancy on the ADA network, a significant rally in the crypto-asset’s price might be far-fetched.

Only time will tell if this is proven to be true.