What GMX’s ‘swift action’ means for the state of the protocol, its token

- GMX issues statements about the volatility that could impact the protocol in the near future

- Interest in both the protocol and the token remains high

The USDC saga has taken the crypto-markets by storm. For its part, however, GMX has been swift in taking action to deal with the volatility of the prevailing market. In fact, a statement released by GMX on Twitter revealed that the protocol spreads for de-pegged stablecoins went into effect on GMX, once asset prices deviated by >1.0%.

Read GMX’s Price Prediction 2023-2024

These spreads may impact leverage positions, swaps, and other transactions on the protocol that involve de-pegged assets. Due to the nature of these spreads, the protocol advised traders to proceed with caution while trading.

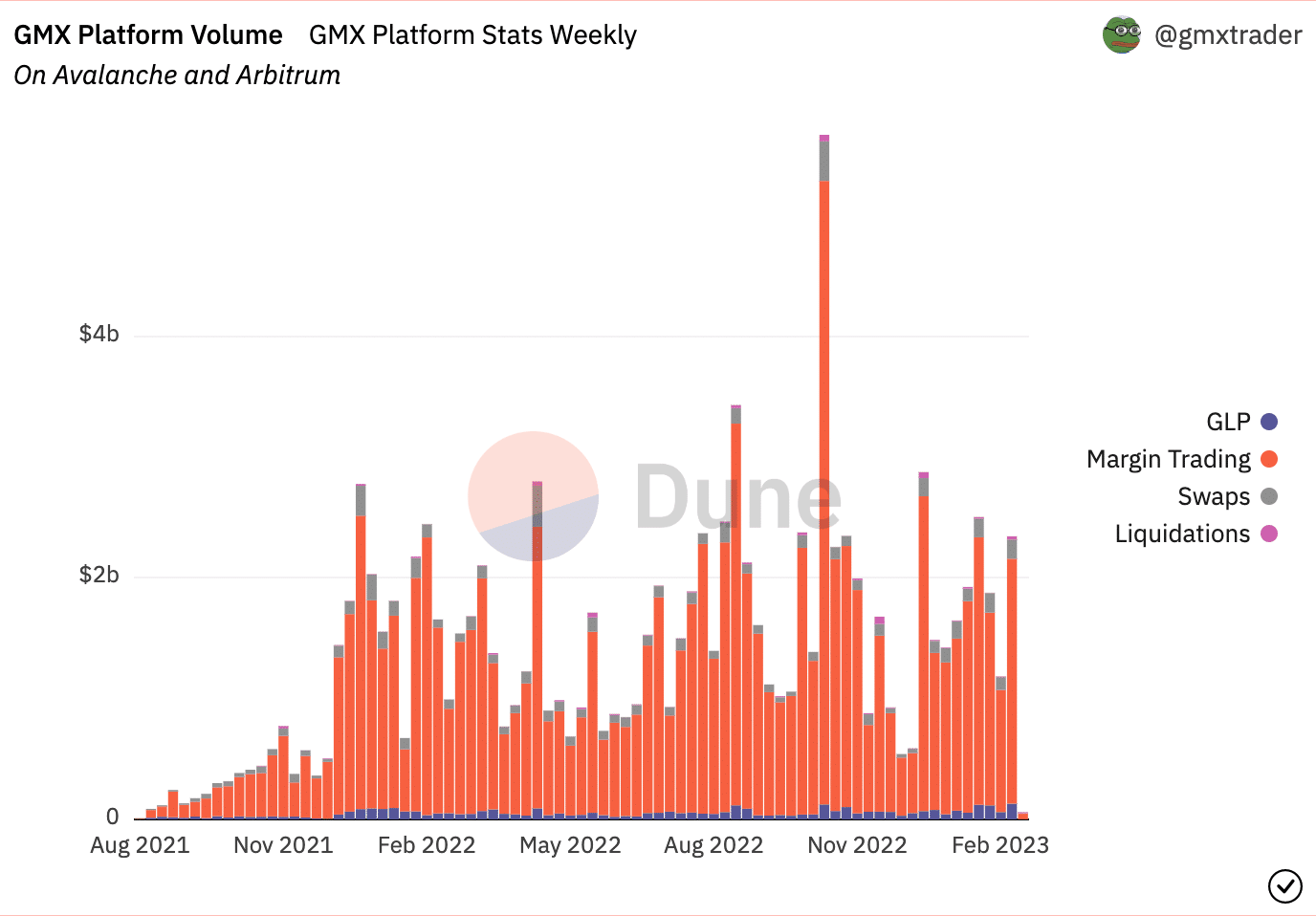

Despite the high volatility, the overall activity on the network has continued to rise. The spike in activity also helped spur volume on the platform. Over the last few months, the volume on GMX through margin trading alone appreciated from 1.75 billion to 2.03 billion.

Margin traders made the highest contribution to the GMX protocol. This, despite them coming in second to users who use the protocol for Swaps.

No bears in sight

The GMX’s token paralleled the growth of the protocol as its prices continued to rise. Coupled with that, there seemed to be a surge in GMX’s velocity, one which implied high activity for the token.

Another indicator of the protocol’s health is its growing volume, which increased from 29.2 million to 100.6 million.

However, the protocol’s network growth declined during this period – Evidence of a decline in interest in the token from new addresses.

Even though new addresses may not be currently interested in the GMX token, current addresses are likely to hold their tokens.

Realistic or not, here’s GMX’s market cap in BTC’s terms

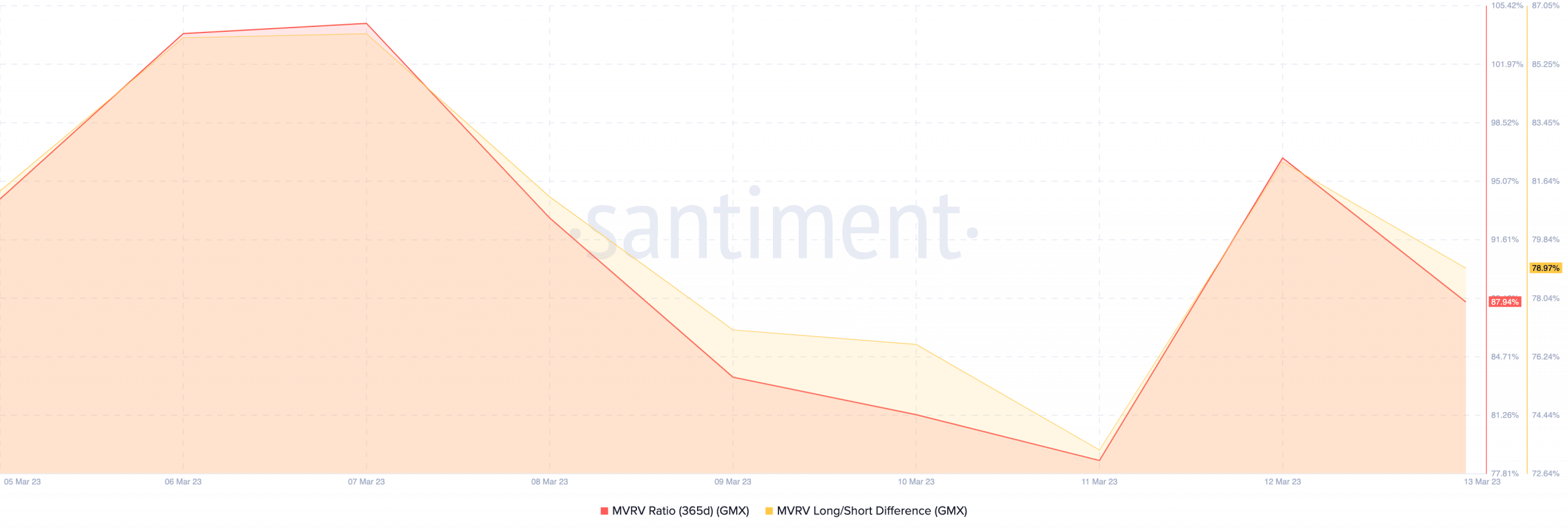

This notion was supported by the MVRV ratio for GMX as it declined steadily over the past month. This implied that the token has been moving away from the overbought zone and addresses are less likely to sell.

The long/short difference also fell over this period, implying that many long-term holders had exited their GMX positions.

Here, it’s worth noting that even though on-chain metrics didn’t point to any bearish outlook, short positions towards GMX started to increase at a rapid pace. In fact, over the last few days, the percentage of short positions taken against GMX hiked from 47.5% to 53.02%.