What is driving Trader Joe’s [JOE] recent surge in DEX trading volume?

![What is driving Trader Joe's [JOE] recent surge in DEX trading volume?](https://ambcrypto.com/wp-content/uploads/2023/04/jOE-1-1.jpg)

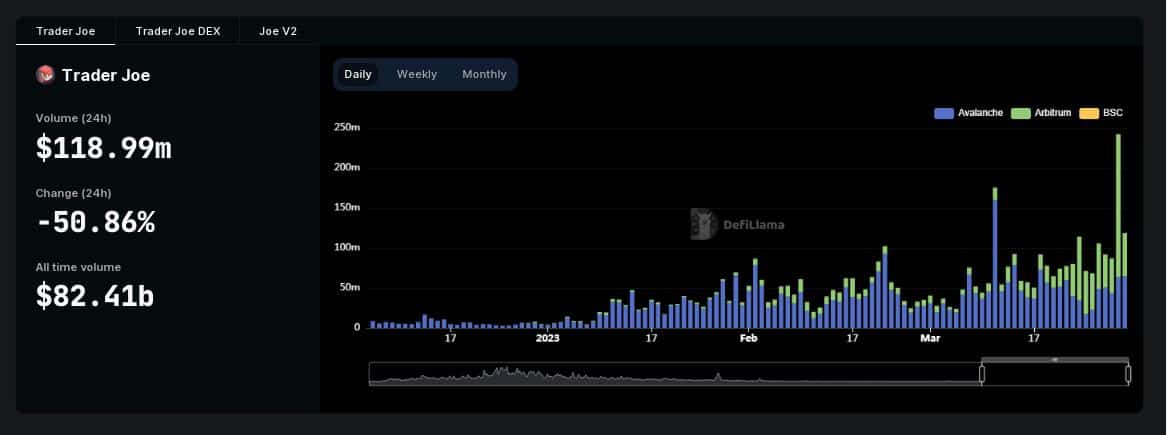

- Weekly DEX volume on Trader Joe surged 35% at press time.

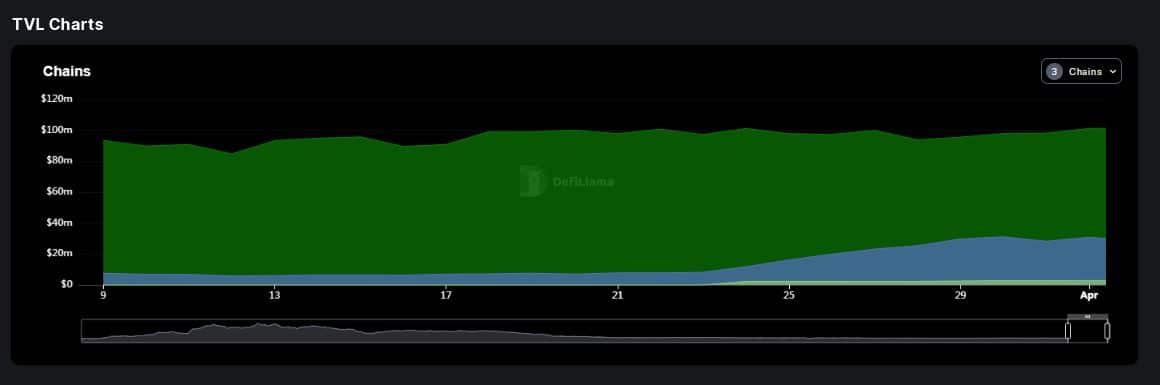

- Trader Joe’s total value locked on the Arbitrum chain more than tripled since ARB’s AirDrop

Trader Joe [JOE] registered a phenomenal growth in its trading activity over the past week. As per a tweet on 31 March, the 24-hour volume on the decentralized exchange (DEX) was second only to DeFi behemoth Uniswap [UNI].

Read Trader Joe’s [JOE] Price Prediction 2023-2024

Though it slipped to the sixth position in the list at press time, its achievements were noteworthy. While weekly DEX volume on Uniswap declined by 36%, the number of trades getting settled on Trader Joe increased by 35%, per data from DeFiLlama.

Over the past 24 hours, Trader Joe ($JOE) was the second highest DEX by volume across all of DeFi, exceeded only by Uniswap.

5 charts that show Trader Joe's massive recent growth ? pic.twitter.com/HwDkITa49X

— Patrick | Dynamo DeFi (@Dynamo_Patrick) March 31, 2023

Joe brings ‘Joy’!

Volume on the DeFi protocol has grown emphatically over the last four months. From an average of less than $10 million in the latter half of 2022, Trader Joe expanded to clock its nine-month high of $240 million on 30 March.

Trader Joe was originally launched on the Avalanche [AVAX] network in 2021. However, it expanded its services to Arbitrum [ARB] towards the end of 2022.

Evidently, Trader Joe’s trading activity swelled after its launch on Arbitrum, with nearly 74% of its nine-month peak volume coming from the activity on the layer-2 solution.

The trading activity was boosted by the recent airdrop of ARB tokens on 23 March, as pointed out in the aforementioned Twitter thread. Since the day of the airdrop, Trader Joe’s total value locked (TVL) on the Arbitrum chain had more than tripled until press time.

It is worth mentioning that Trader Joe received more than 900,000 ARB tokens as part of the AirDrop.

Incentives Program attracting LPs?

On 2 March, Trader Joe introduced a Liquidity Book Rewards program wherein liquidity providers (LPs) are incentivized to deposit ARB and Ethereum [ETH] tokens and earn rewards based on the trading fees.

How much are 1,10,100 JOEs worth today?

The program was currently in its third epoch, where more than 300,000 JOE tokens were up for grabs. This program could have brought many users to the DEX.

Additionally, JOE’s increasing price was a big factor for users to actively participate in the program. The native token reaped the benefits of the increase in trading activity, skyrocketing 87% in March, growing by over 53% over the last week, per CoinMarketCap.