What next for Bitcoin, Ethereum as $9.3B options expiry looms

- Most of the bets predicted a bullish close for BTC and ETH.

- ETH might drop below the max pain point while BTC might end the week above it.

More than 96,000 option contracts of Bitcoin [BTC] and 978,000 for Ethereum [ETH] are set to expire on Friday, 26th April.

According to derivatives exchange Deribit, the BTC contracts were valued at $6.2 billion while ETH contracts were worth $3.1 billion, bringing the total to a mind-blowing $9.3 billion.

With options, traders can purchase contracts that allow them to buy or sell a cryptocurrency at a predetermined price. As options near expiry, traders must decide if to buy, sell, or close the contract.

Optimism rises despite the decline

Details AMBCrypto got from Deribit showed that the BTC put-call ratio was negative. This indicates that most of the bets were calls and traders were bullish on the coin price.

It was a similar case for ETH. For those unfamiliar, buying a call option means that a trader will make money if the price goes up. On the other hand, a put option is a bearish bet, meaning a trader will make profits if the price declines.

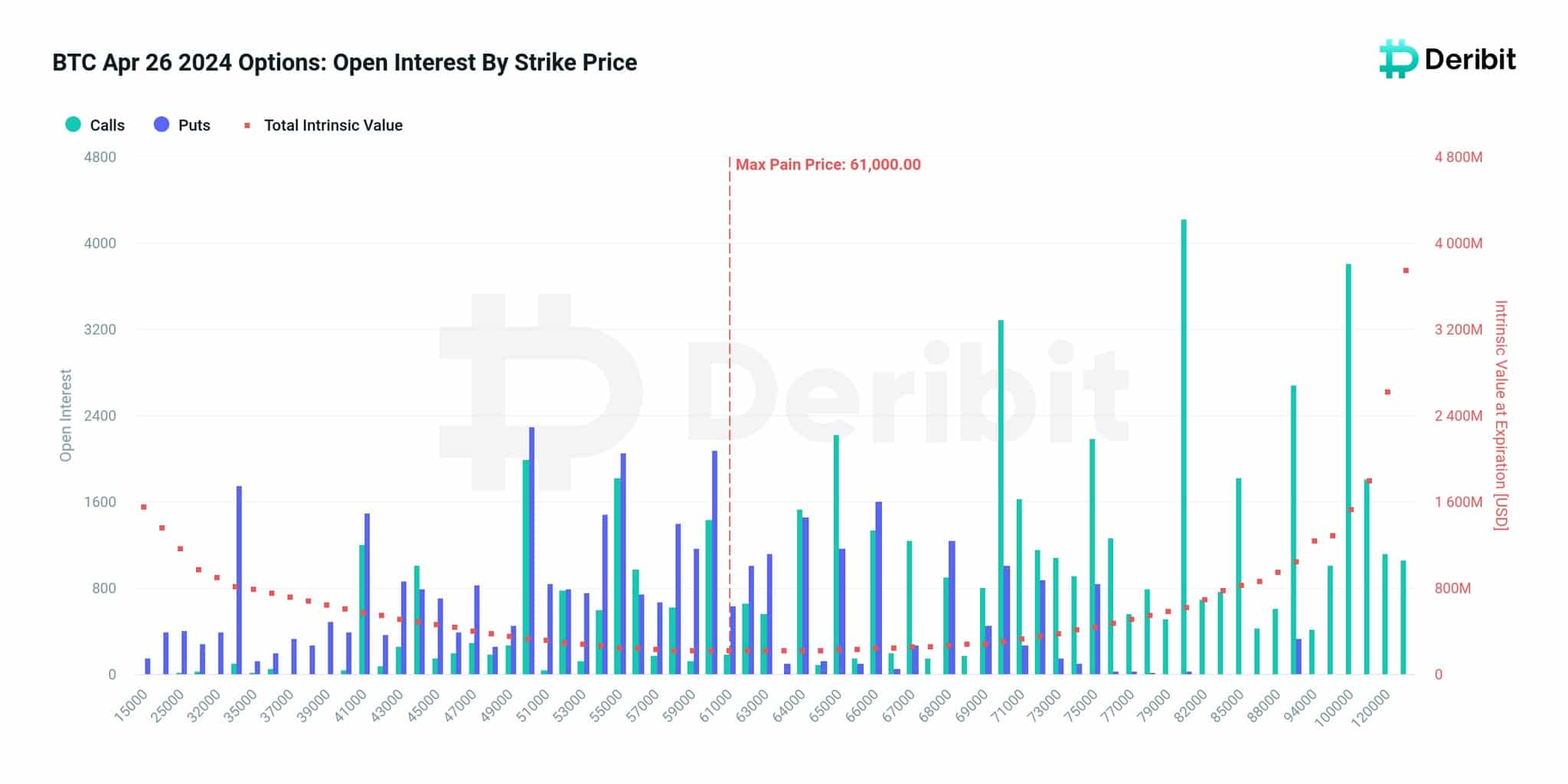

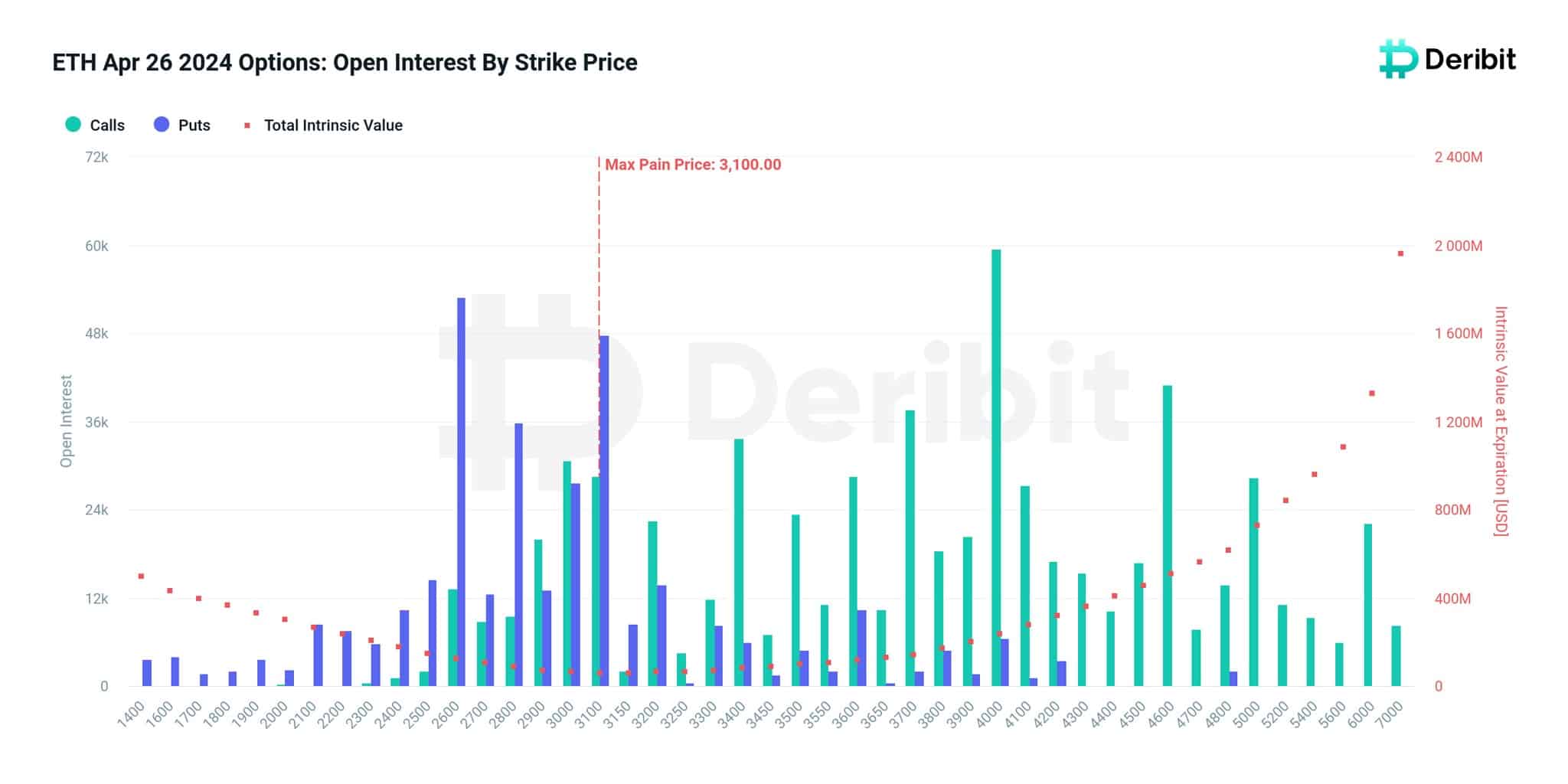

Depending on where BTC and ETH prices close, the exchange noted that sellers might gain the most if BTC hits $61,000. In ETH’s case, buyers might lose a lot of money if the value of the altcoin reaches $3,100.

“Bitcoin options and the removal of a 61k max pain price point, together with the expiring open interest of nearly $3 billion in Ethereum options and the removal of a $3.1k max pain price point.”

At press time, BTC’s price was $64,140, representing an 8.52% decrease in the last 30 days. ETH, on the other hand, changed hands at $3,129— a 12.46% 30-day decrease.

Different patterns for the top two

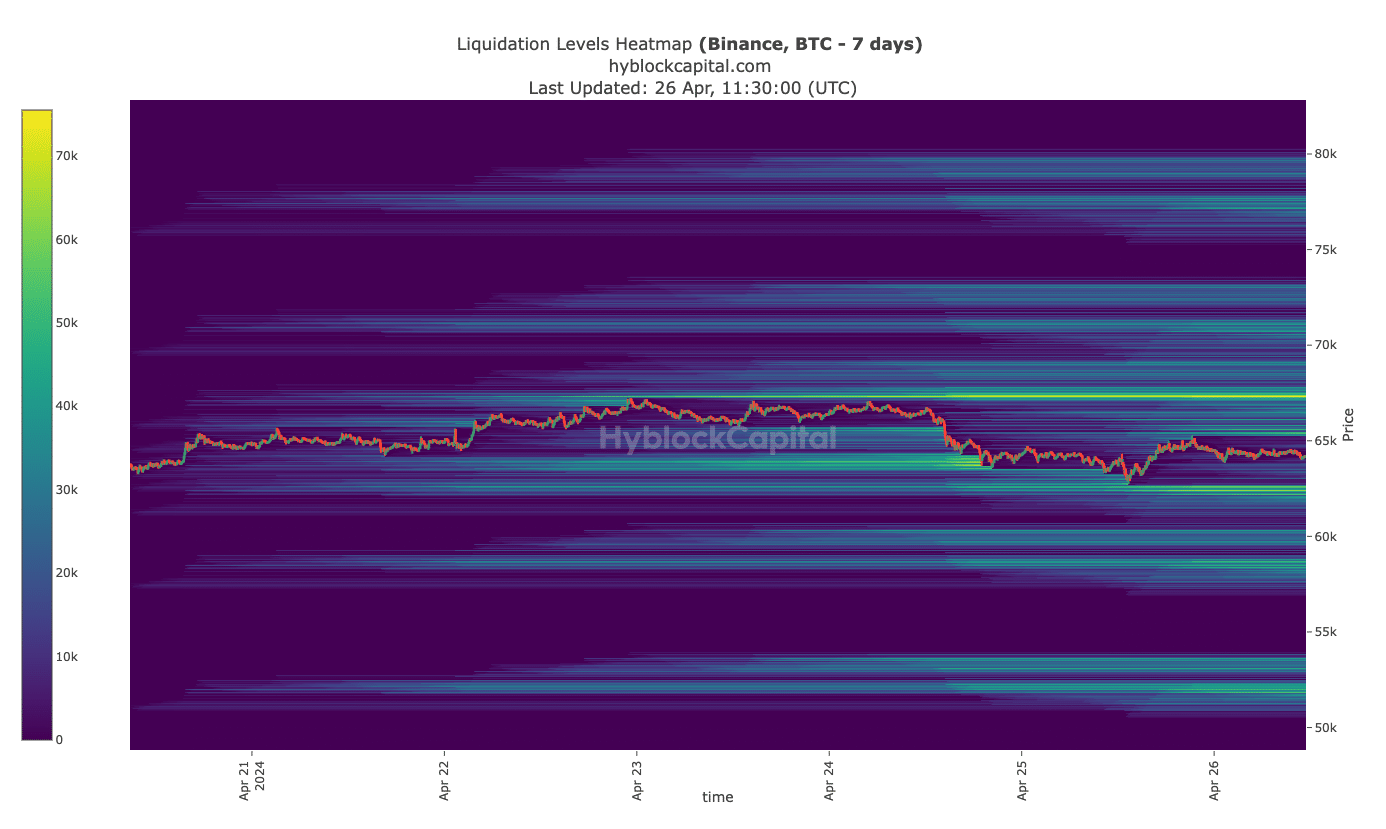

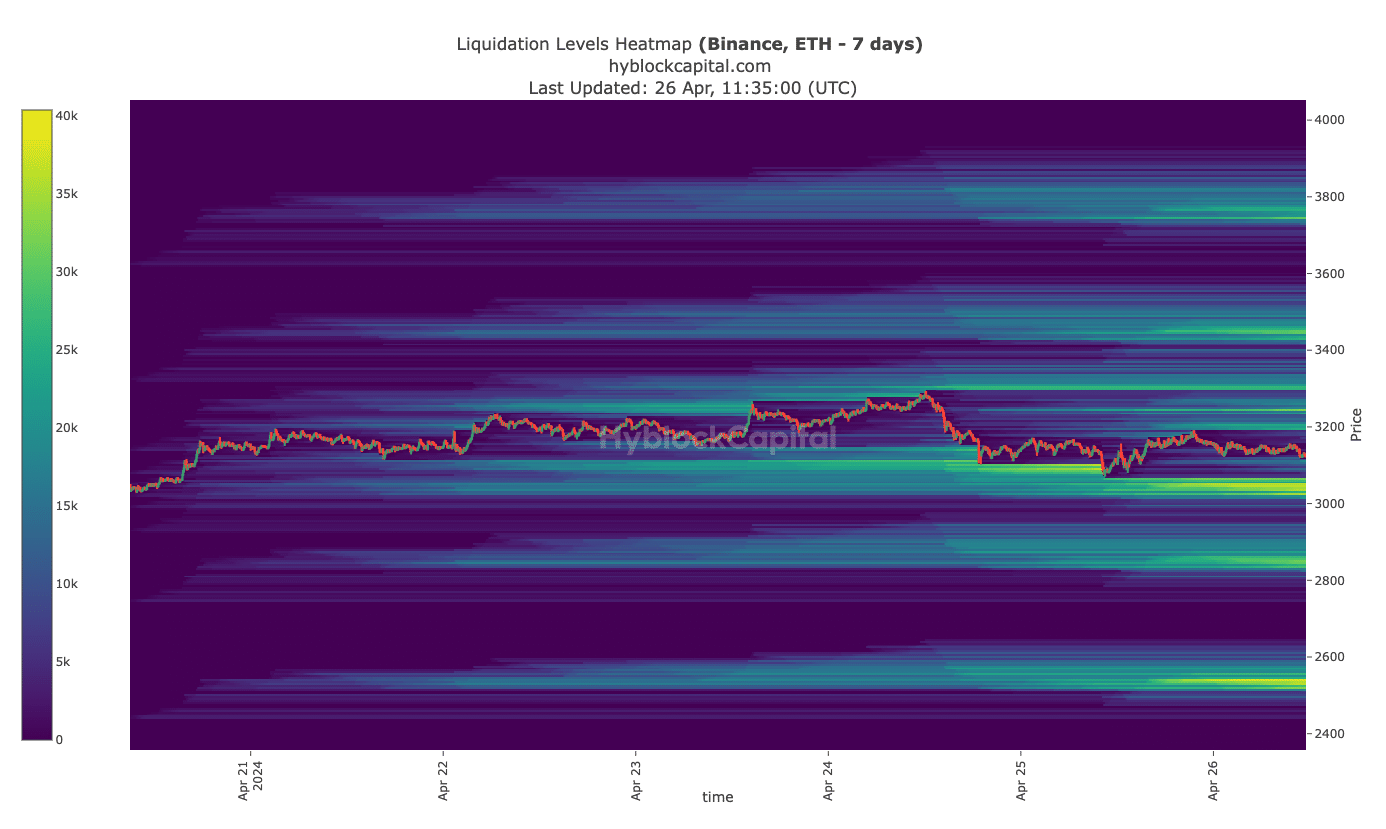

To ascertain where the price might close this week, AMBCrypto looked at the liquidation heatmap. Liquidation heatmap shows traders high areas of liquidity (magnetic zone).

This helps to identify potential large liquidation points, and the possibility of prices moving toward certain regions. According to data obtained from Hyblock, a magnetic zone (colored yellow) appeared on the BTC liquidation heatmap at $67,250.

To the downside, another magnetic area was at $62,600. If Bitcoin’s price moves toward $67,250, then most option contracts will end up making money from their bets.

On the other hand, a decline toward $62,600 could cause losses. However, the pain might be minimal as long as the price does not hit $61,000.

However, it might not be the same case for traders who went with the ETH call option.

Realistic or not, here’s ETH’s market cap in BTC terms

At press time, the high area of liquidity was around $3,025, indicating that the price might decline below the $3,100 max pain threshold.

If this happens, a large part of the $3.1 billion set to expire could be wiped out. However, if ETH stays above $3,100, puts might not be the only ones to gain from the price action.