What next for Ethereum’s price after 20.8M outflows on Binance

- Ethereum struggled below $4,000, with Binance outflows suggesting potential long-term accumulation.

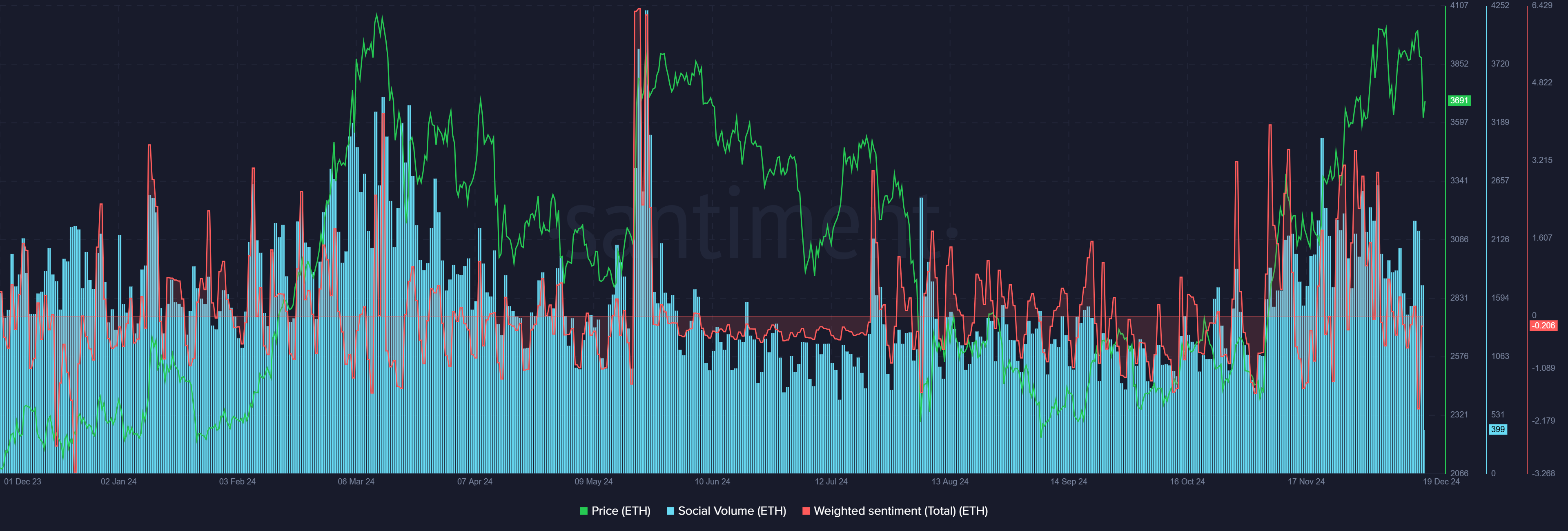

- Negative social sentiment mirrored December 2023 trends, potentially signaling a bullish recovery for ETH.

Ethereum’s [ETH] market has seen significant outflows from centralized exchanges like Binance, raising questions about its near-term trajectory. Despite these developments, Ethereum has decreased by 2.4% in the past 24 hours.

Its current trading price is $3,858, which is 21.1% lower than its all-time high of $4,878 reached in 2021. This decline, coupled with changing market dynamics, has sparked renewed interest in Ethereum’s price evolution.

The focus is on its current sentiment and market conditions over the coming weeks.

How large withdrawals could impact ETH price?

Approximately 20.8 million ETH have been withdrawn from centralized exchanges over the past two months, a trend reminiscent of the 2021 bull market. Binance has been central to this movement, accounting for over 7.8 million ETH, or 33-39% of the total outflows.

CryptoQuant analyst Crazzyblockk suggests these withdrawals may signal long-term accumulation or staking, reflecting investor confidence.

These significant outflows from Binance indicate the platform’s continued influence on the cryptocurrency market, especially in balancing supply and demand for Ethereum.

With Binance’s influence, backed by its 250 million global users and $21.6 billion in deposits, these outflows could reduce ETH’s supply on exchanges, potentially creating upward price pressure if demand remains strong.

Ethereum market performance

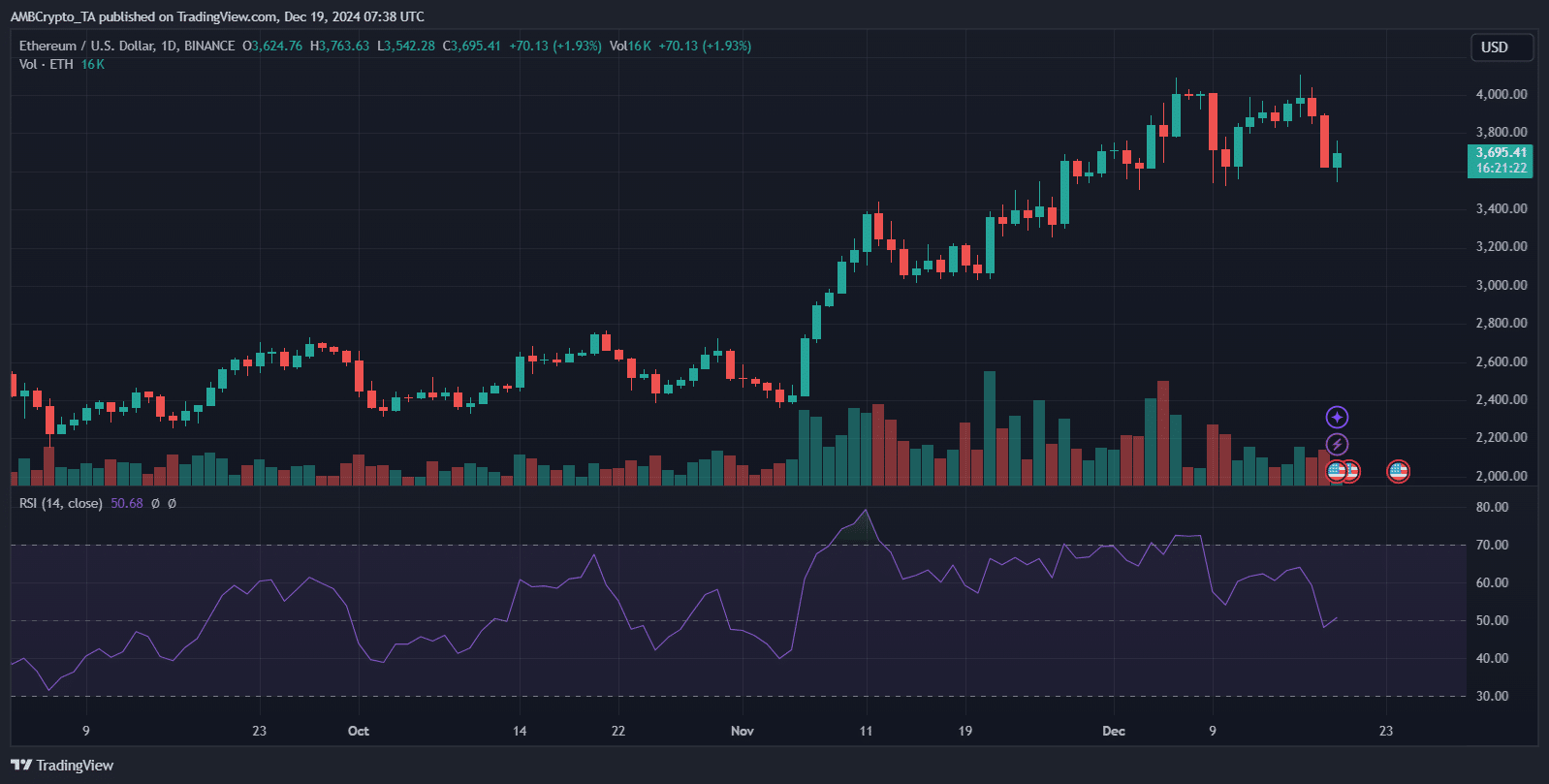

Ethereum has struggled to match Bitcoin’s bullish momentum, failing to breach the $4,000 resistance despite the broader crypto market rally.

While Bitcoin has posted new all-time highs almost monthly, Ethereum’s gains remain modest. Ethereum has seen a 2.3% weekly increase compared to Bitcoin’s 5%.

Even positive news, such as Deutsche Bank’s rumored Ethereum-based layer-2 blockchain leveraging ZKsync technology, has failed to inject upward momentum. Technical analysis suggests bearish signals, hinting at a potential price correction to $3,400.

Ethereum’s current lack of breakout potential highlights its challenges in maintaining investor confidence, despite recent outflows pointing to long-term accumulation trends.

Read Ethereum’s [ETH] Price Prediction 2024-25