Here’s what Solana can look forward to

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Solana continued its short-term bullish rally to flip the $20 psychological level back to support.

A recent price report highlighted the possibility of a rally for bulls from the $18.86 support level after bears cracked the $20 psychological level. The release of Solana’s network update might have served as a catalyst for the bullish pullback.

SOL registered gains of 9.7% over the past seven days, riding on Bitcoin’s [BTC] climb to $27k over the same period. Could this be the start of a sustained bullish reversal for Solana?

Bullish comeback spurred by increased volume

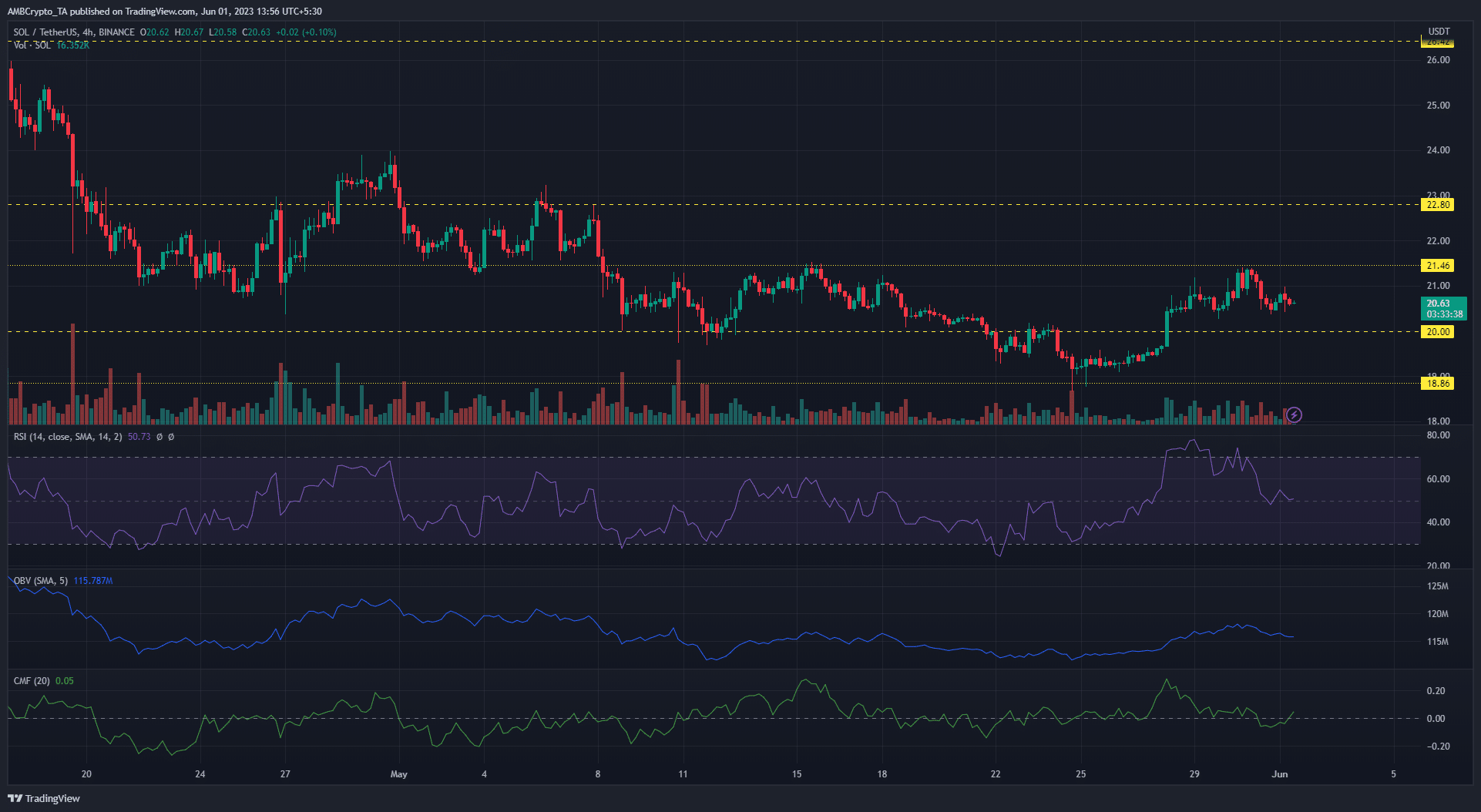

Solana has been under sustained selling pressure since mid-April. This has seen its market structure remain bearish on the higher timeframes, breaking through key supports at $22.80 and $20.

However, Solana bulls were able to mount a comeback from the $18.86 support level, registering rapid gains to recover the $20 support level.

The strength of the bullish pullback was reflected by the on-chart indicators. The RSI rose sharply into the overbought zone before dipping back to the neutral 50 mark.

The OBV also experienced a 2.58 million uptick in volume while CMF remained positive at +0.05 to signal steady capital inflows.

The bullish comeback met resistance at the $21.46 price level, although the H4 structure remained in an uptrend. Bulls will be keen to press on with another move upward, especially if Bitcoin continues its push toward $30k.

On the flip side, bears could look to retest Solana’s $20 support level to continue the bearish trend on the lower timeframe.

Market sentiment leaned slightly toward bullish continuation

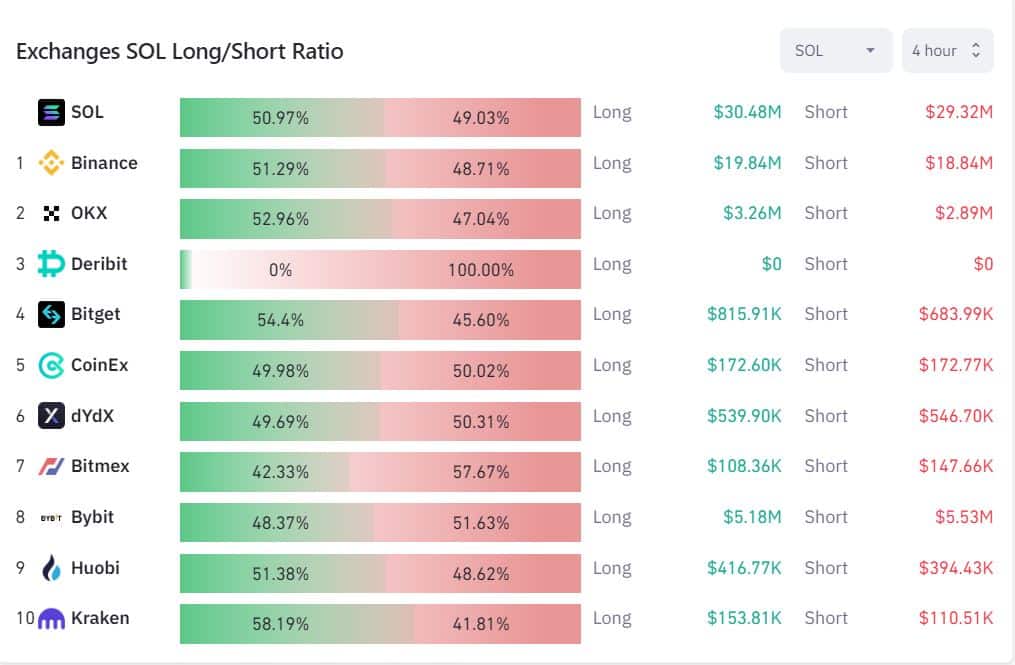

A look at the long/short ratio on Coinglass showed market speculators seeking to position themselves for either another upward move or a downward retest.

Read Solana’s [SOL] Price Prediction 2023-24

As of press time, longs held a marginal 50.97% advantage. This hinted at speculators leaning toward another upward trend for Solana.

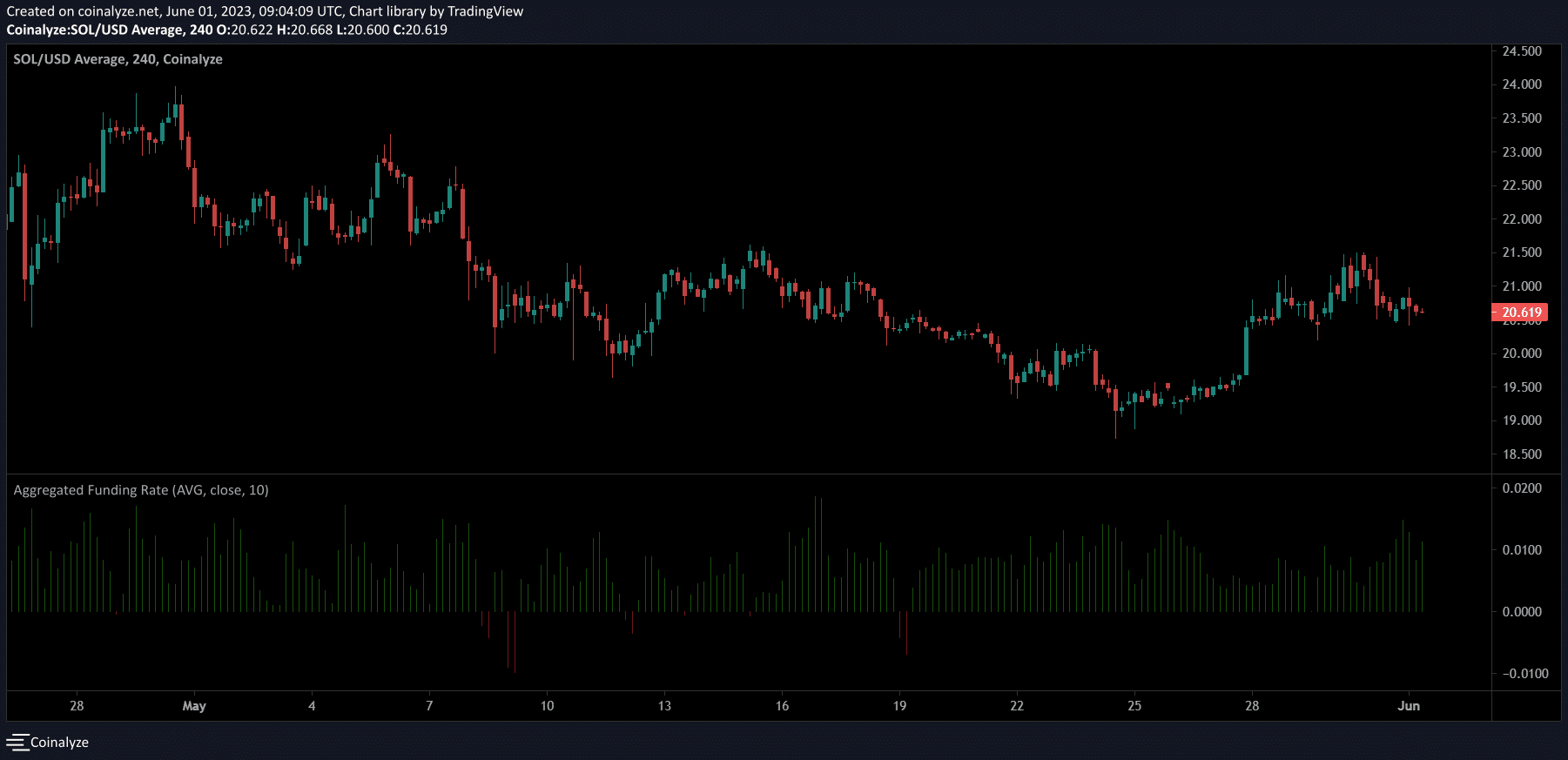

Furthermore, the Funding Rate remained strongly positive in the four-hour timeframe to signal continued demand for Solana. Taken together, they showed the short-term bullish comeback could yet register more gains.

Source: Coinalyze