What Polkadot’s new staking dashboard means for DOT

The 2022 crypto market crash has, so far, ensured that almost every cryptocurrency received a deep discount. And Polkadot is making an effort to ensure that those buying the dip can put their DOT to good use.

Polkadot recently revealed the rollout of a new crypto staking dashboard that was designed keeping user-friendliness in mind. The number of Polkadot nominators surpassed 30,000 shortly after the new staking dashboard was unveiled at Polkadot Decoded. This highlighted the level of demand or interest in DOT staking.

The new staking feature underscore’s Polkadot’s efforts to encourage investors to stake their DOT especially if they are long-term HODLers. Such measures might support a higher price floor for DOT because the more DOT holders stake, the lower the selling pressure.

DOT traded at $6.91 after a 0.59% rally in the last 24 hours at press time, but down by 4.67% in the last seven days. It is currently trading within the same price range as it did during the June 2022 lows, hence highlighting a price floor or support.

DOT is down by roughly 87% from its historic top. Its Money Flow Index (MFI) indicates significant outflows in the last few days. However, DOT can potentially bounce back from the current price floor if market conditions allow.

Is DOT due for some upside?

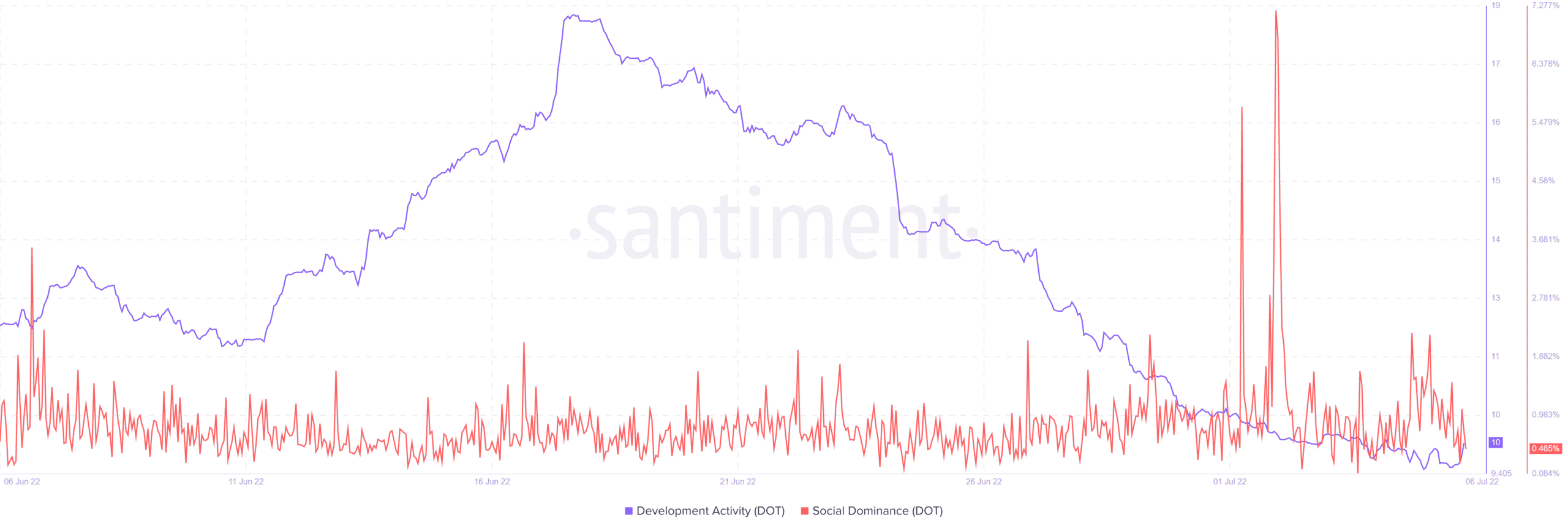

Polkadot’s new staking dashboard may not have an immediate impact on the price but its contributions might be more pronounced in the long run. DOT’s price remains restricted near its 30-day lows. This aligns with the drop in developer activity since mid-June, hence reflecting low investor confidence. However, its social dominance metric shows increased activity since the start of July.

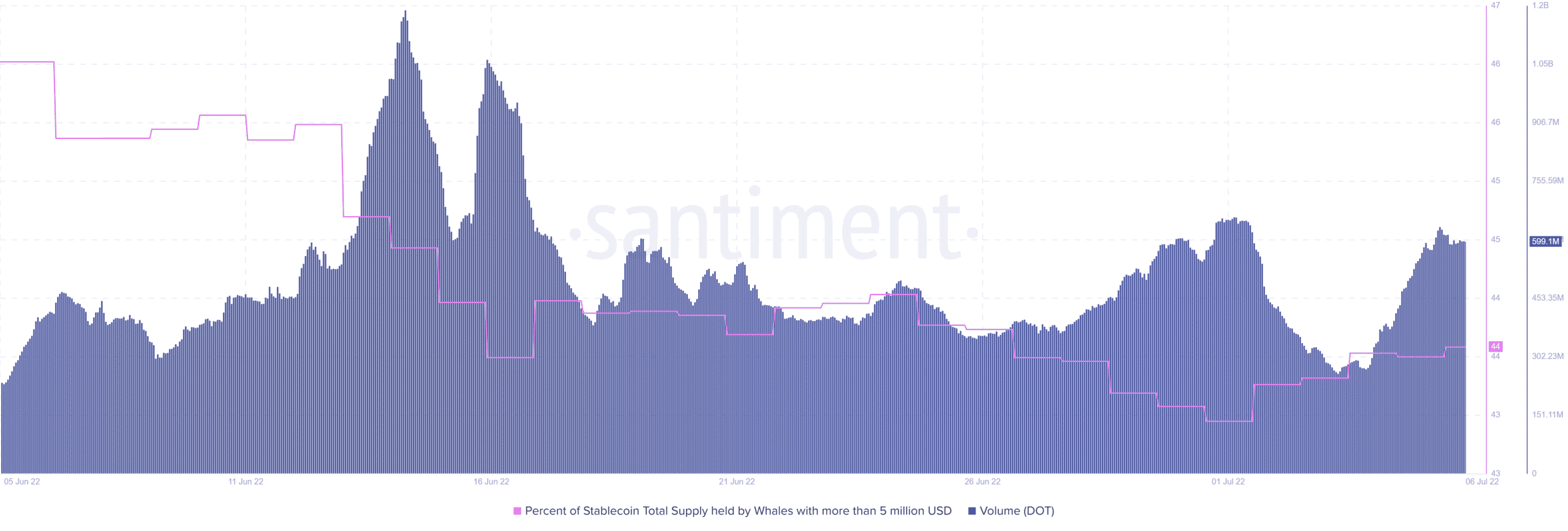

DOT’s subdued price action suggests that there is some level of uncertainty. However, some of its on-chain metrics suggest that investors have been buying DOT at its current discounted prices. For example, the supply held by whales metric registered an uptick from a 30-day low of 43.92% on 1 July to 44.54% on 6 July.

DOT’s volume metric also registered a notable uptick in the first six days of July.

A ‘DOT’ing future

The volume and supply held by whales uptick confirm that DOT experienced significant accumulation in the last few days. However, its price action remains subdued, suggesting the lack of enough buying pressure to support a major uptick.