What Polygon’s growing trading volume means for your holdings

- MATIC’s trading volume has grown significantly in two days, along with its price.

- Whales have increased accumulation as their profit grows.

The trading volume of Layer 2 token Polygon [MATIC] has seen a significant increase in the past two days, data from Santiment revealed. According to the on-chain data provider, during that period, MATIC’s trading volume went up by 29%.

Is your portfolio green? Check out the MATIC Profit Calculator

The growth in trading volume coincided with a growth in MATIC’s value. Exchanging hands at $0.741 at press time, MATIC’s price has recorded a 7% price uptick since 10 July, per data from CoinMarketCap.

The surge in MATIC’s price and trading volume is attributable to the growth in new demand for the token. Recent data from Santiment revealed that the count of new wallet addresses created daily to send or receive MATIC tokens went up by over 28% in the last month.

Further, an assessment of the token’s exchange activity revealed a consistent decline in MATIC’s supply on exchanges since the beginning of June. MATIC’s supply on exchanges has fallen by 15% in the last month. As of this writing, only 8% of the token’s total supply was held on cryptocurrency exchanges.

A fall in an asset’s supply on exchanges is a bullish sign as it signals less sell-offs. It typically shows that traders and investors alike are more interested in holding on to their assets, which generally helps forestall any unprecedented decline in the asset’s value.

Whales accumulate amid growing profits

On-chain data revealed that traders that hold between 1 and 100,000 MATIC tokens intensified accumulation in the last month. With this investor cohort holding 6.8 million MATIC tokens at press time, their total holdings have grown by 10% in the last 30 days.

Moreso, the number of bigger whales holding between 100,000 and 1,000,000 MATIC tokens increased by 6% during the same period.

A close connection exists between an asset’s whale activity and price performance. Increased whale accumulation over an extended period often signals improved sentiments, enough to drive new liquidity into the market.

How much are 1,10, 100 MATICs worth today?

With MATIC seeing its whales grow their bags, its price may grow further as long as sentiment continues to improve. The surge in MATIC’s whale accumulation in the last month might be due to the increased profitability of the asset during the same period.

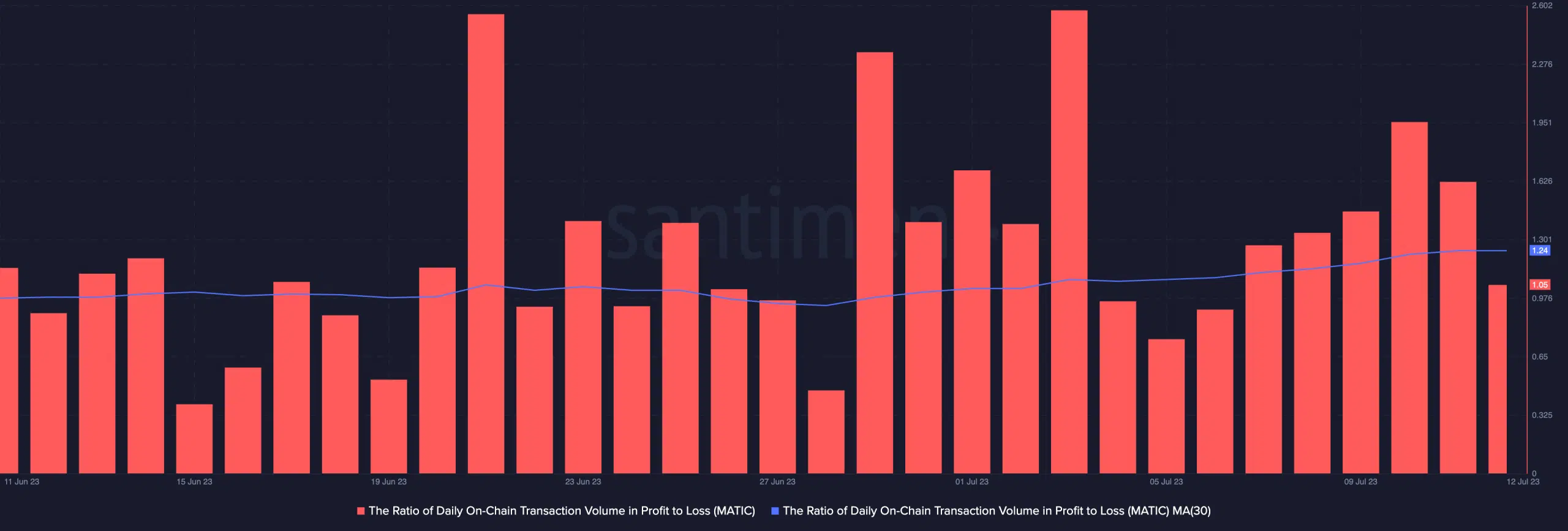

Per data from Santiment, on a 30-day moving average, the ratio of daily MATIC transactions in profit was 1.24, suggesting that more transactions resulted in profits for traders than losses.