What rising Bitcoin fees mean for BTC investors

- Bitcoin transaction fees surged, raising questions about their impact on the ecosystem.

- Miner revenue increased as network difficulty rose.

Bitcoin [BTC], the flagship cryptocurrency, experienced a notable uptick in transaction fees, raising questions about its impact on the broader Bitcoin ecosystem.

Read Bitcoin’s Price Prediction 2023-2024

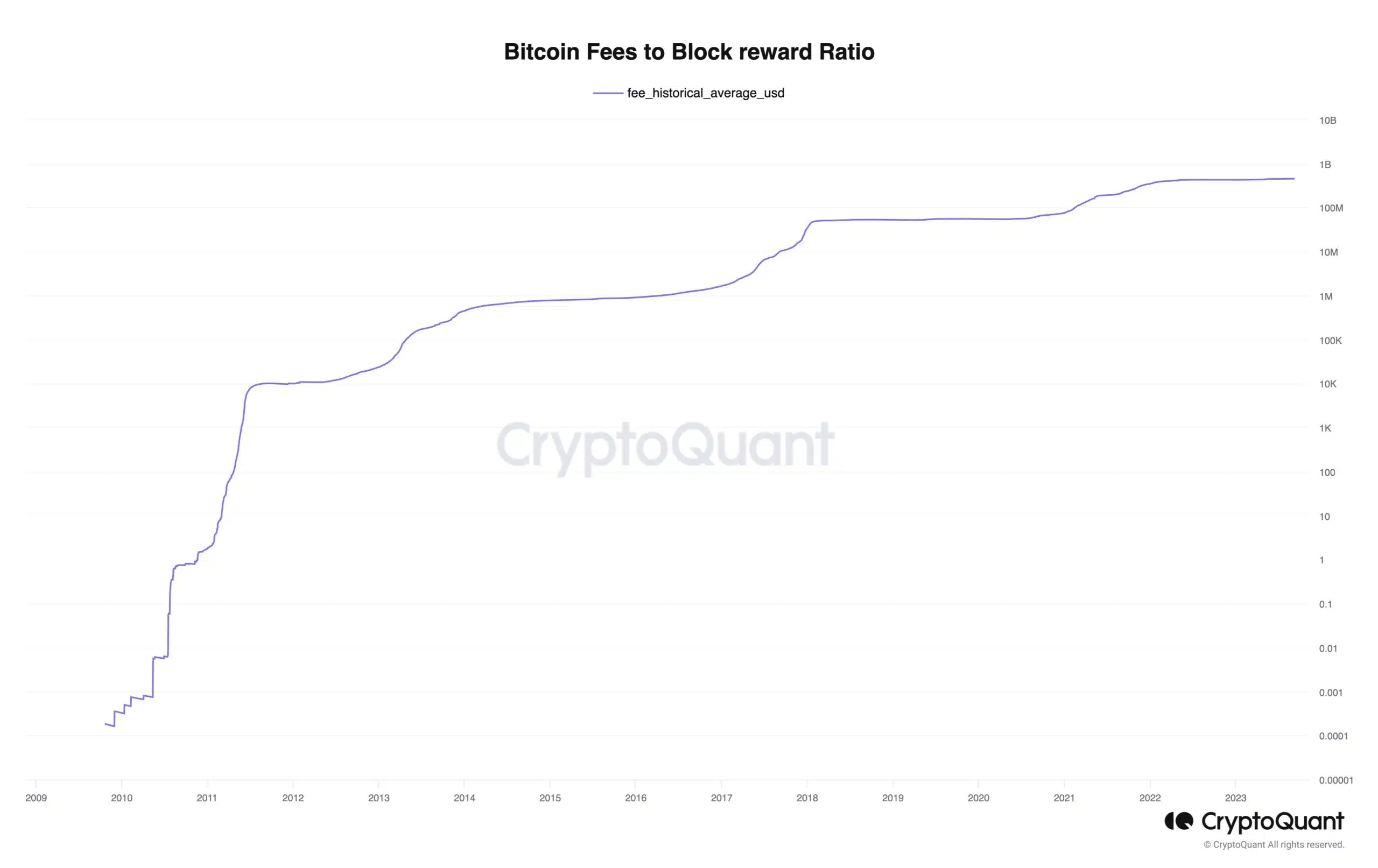

According to CryptoQuant’s data, the transaction fees for Bitcoin have grown significantly in the last few days. Transaction fees are an integral part of the Bitcoin network, as they incentivize miners to validate and add transactions to the blockchain.

How are miners doing?

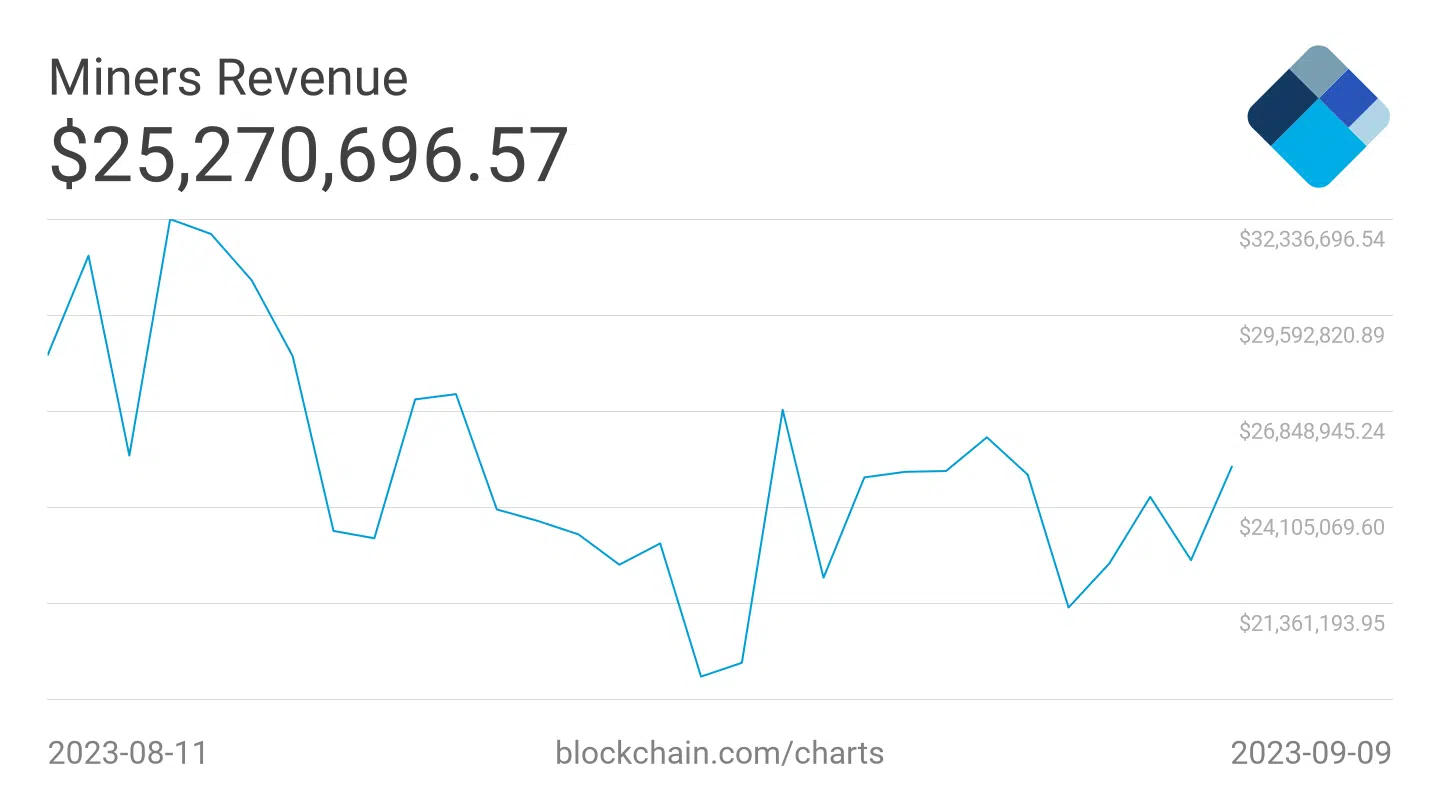

Bitcoin miners, who play a critical role in the network’s security and transaction processing, are witnessing a substantial surge in revenue in tandem with the rising transaction fees. This surge in mining revenue can have a positive impact on Bitcoin’s price, as miners might be less inclined to sell their holdings, reducing selling pressure.

Another factor to note is the network difficulty, which has started to decline. Network difficulty is a measure of how challenging it is for miners to solve complex mathematical problems required to add blocks to the blockchain. A decrease in network difficulty can imply changes in mining dynamics and the overall health of the network.

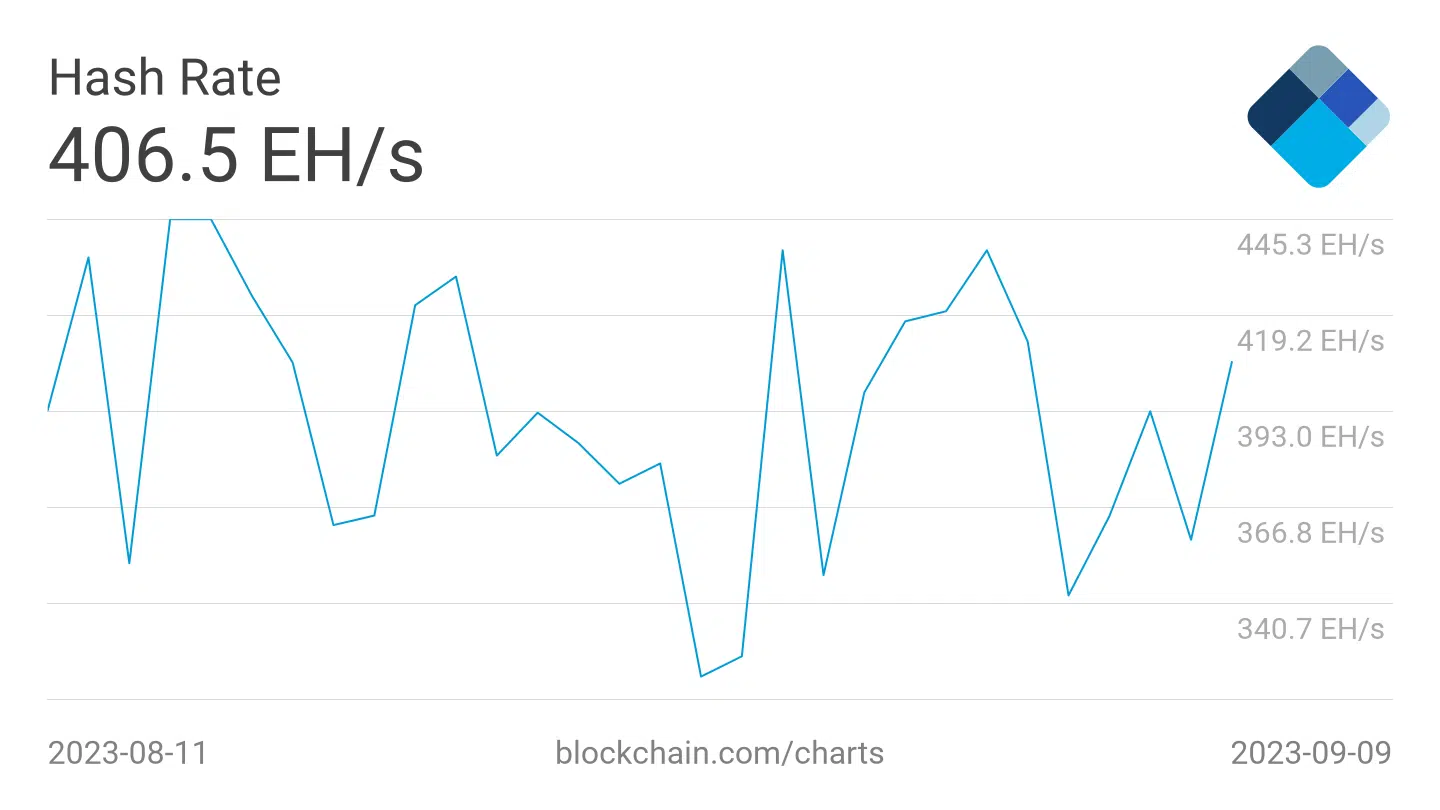

Furthermore, Bitcoin’s hashrate, which represents the computational power dedicated to mining, experienced a notable uptick in the last week. A growing hashrate can enhance the network’s security and resilience, making it more attractive to investors and traders.

Investors still hopeful

Retail interest in the king coin is also on the rise, as indicated by the rising number of addresses holding at least 0.1 BTC. This milestone suggested growing participation and interest from individual investors in BTC despite falling prices.

? #Bitcoin $BTC Number of Addresses Holding 0.1+ Coins just reached an ATH of 4,480,624

Previous ATH of 4,480,465 was observed on 09 September 2023

View metric:https://t.co/hZY8dBLpzX pic.twitter.com/lONrPBQSL2

— glassnode alerts (@glassnodealerts) September 10, 2023

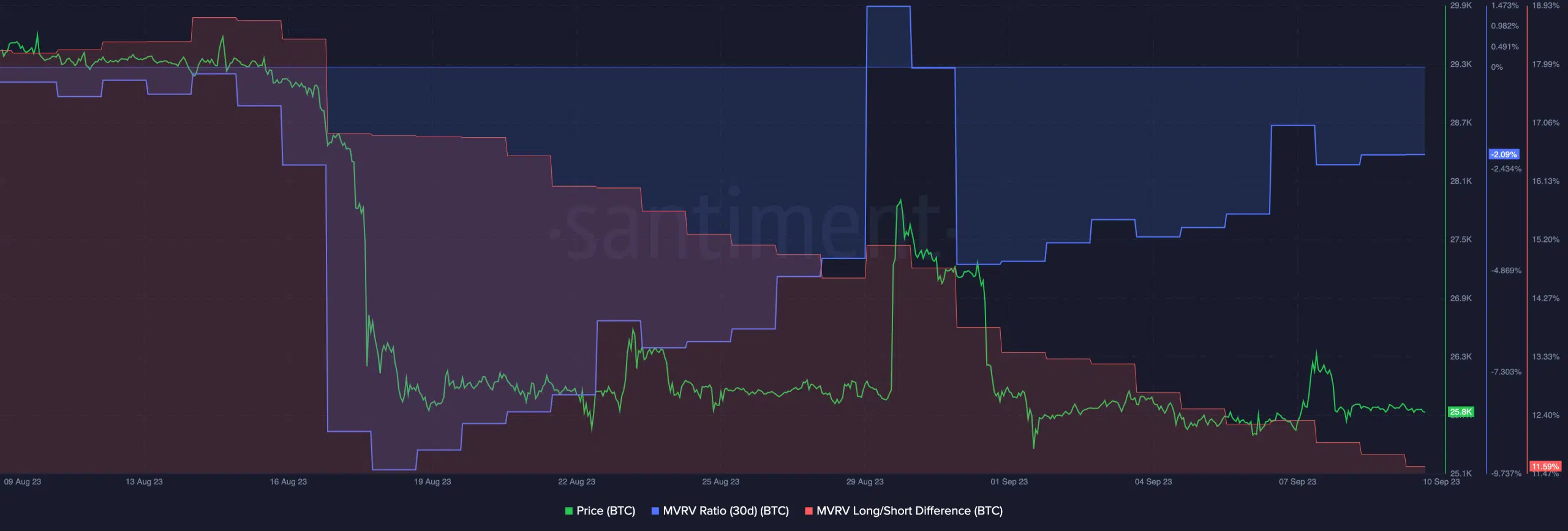

Additionally, The MVRV (Market Value to Realized Value) ratio for Bitcoin also witnessed a significant decline. This metric compares the current market price of BTC to the average price at which coins were last moved.

A lower MVRV ratio indicates that most addresses were not as profitable, potentially reducing selling pressure on Bitcoin.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Moreover, the long-short difference for Bitcoin decreased, suggesting a surge in short-term holders. This shift in holder dynamics can influence price volatility and market sentiment.

Overall trader sentiment appears divided, with 51.57% of all traders holding short positions. The balance between long and short positions in the market can influence price trends and the level of market confidence.