What these Ethereum, Chainlink, Binance Coin market players are up to

The cryptocurrency market is evidently going through yet another free-fall period. In fact, the price of a major asset like Bitcoin has dropped below $35,000. With Ethereum, the situation was a little worse as its valuation dropped below $2,150 for the 1st time since 24 May.

However, while price action screamed bearish on the charts, whales have been pretty active over this volatile period. Here, it is also important to note that we are still amidst strong uncertainty, meaning bulls have a chance to recover in strength.

Keeping tabs on whale activity might allow us to approach particular altcoins with more confidence, or keep away from the ones with possible red flags.

Ethereum Whales are on fire!

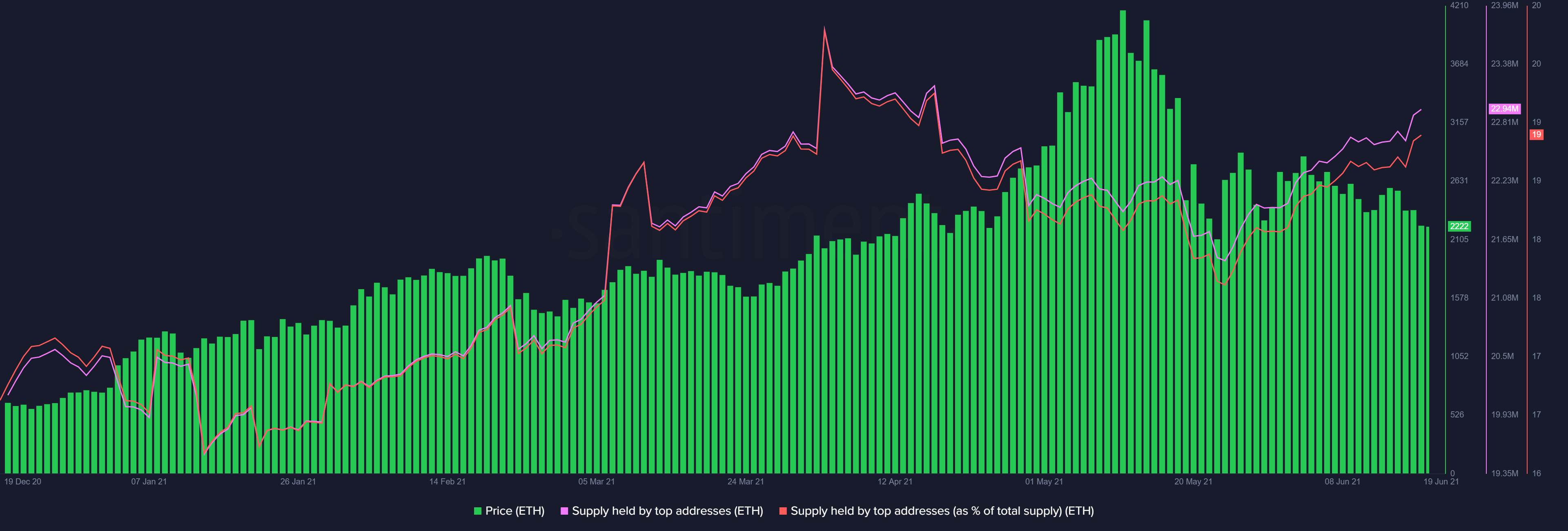

Ethereum’s value may have collapsed quickly from its ATH levels but since the aforementioned correction, the supply held by top addresses has steadily gone up. The percentage of the total circulating supply held by top ETH addresses had dropped down to 18.4% too, but it was 19.8% at press time. In quantifiable numbers, more than 1.3 million ETH has been accumulated by these whale addresses post the May 19th crash.

It is quite a contrary sight considering ETH’s price has been deflating, failing to break above $3,000. But, it can also be inferred that Ethereum’s future is what investors are concerned with. Ethereum is heading towards its largest Options Expiry on June 25th and it may have a strong impact on its price.

Additionally, it is largely anticipated that the London Hard fork is also going down in July, which will be introducing the EIP-1559 protocol. Ethereum also announced that on 24th June, the testnet for the hard fork will be going live.

Source: Santiment

For Binance Coin, the number of whale addresses increased as well and from a fundamental point of view, it made clear sense too. BNB runs everything related to Binance and the exchange’s position in the market is fairly strong, regardless of bullish/bearish conditions.

On a long-term basis, market recovery would always fall in line with a bullish recovery for BNB. The asset being 50% under its ATH levels can therefore be considered to be an ideal accumulation range.

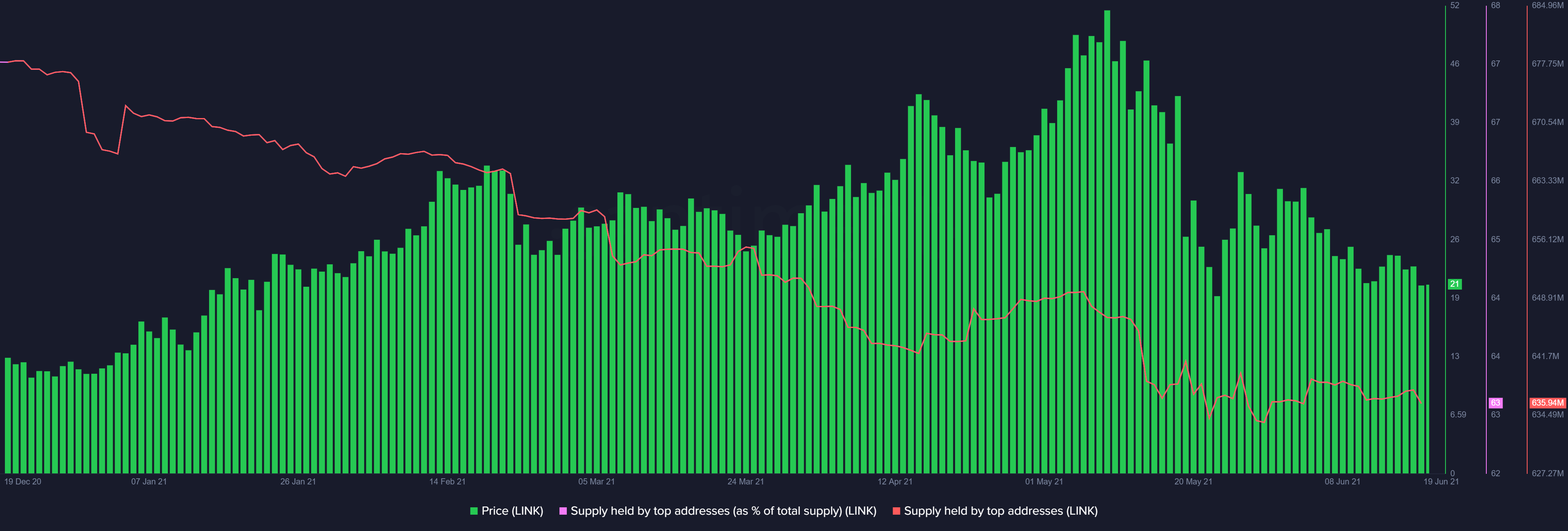

Chainlink – No more strength in Hodlers?

Surprisingly, Chainlink is one of the assets that has seen a consistent decline in supply held by top addresses. Here, it is also important to note that the decreasing whale activity has been ongoing since the beginning of 2021. Curiously, earlier last year, whale activity had dominated LINK’s network, so it is a complete change from its previous level of engagement.

From a development point of view, Chainlink continues to develop partnerships and collaborate with multiple organizations for DeFi improvements, so a decrease in whale addresses may also mean higher distribution. And yet, a lack of higher hodling addresses might be indicative of falling trust in its long-term valuation.