What these metrics tell investors about Ethereum’s readiness for the Merge

With the Merge set for a launch in September, does Ethereum look ready for the next big step? For its part, ETH has registered an uptrend in price action over the month of July. However, the utility of Ethereum rests on many sectors of Web 3.0. While being the flagship altcoin, Ethereum heads other cryptocurrencies on a host of different fronts.

Countdown begins

The transition to a Proof-of-Stake mechanism is set to release on 19 September. This is being termed the biggest change yet on the Ethereum blockchain. Ethereum has responded well to the hype by taking the center stage among cryptocurrencies since early July. Ether has also performed in tandem with the growing hype surrounding Ethereum.

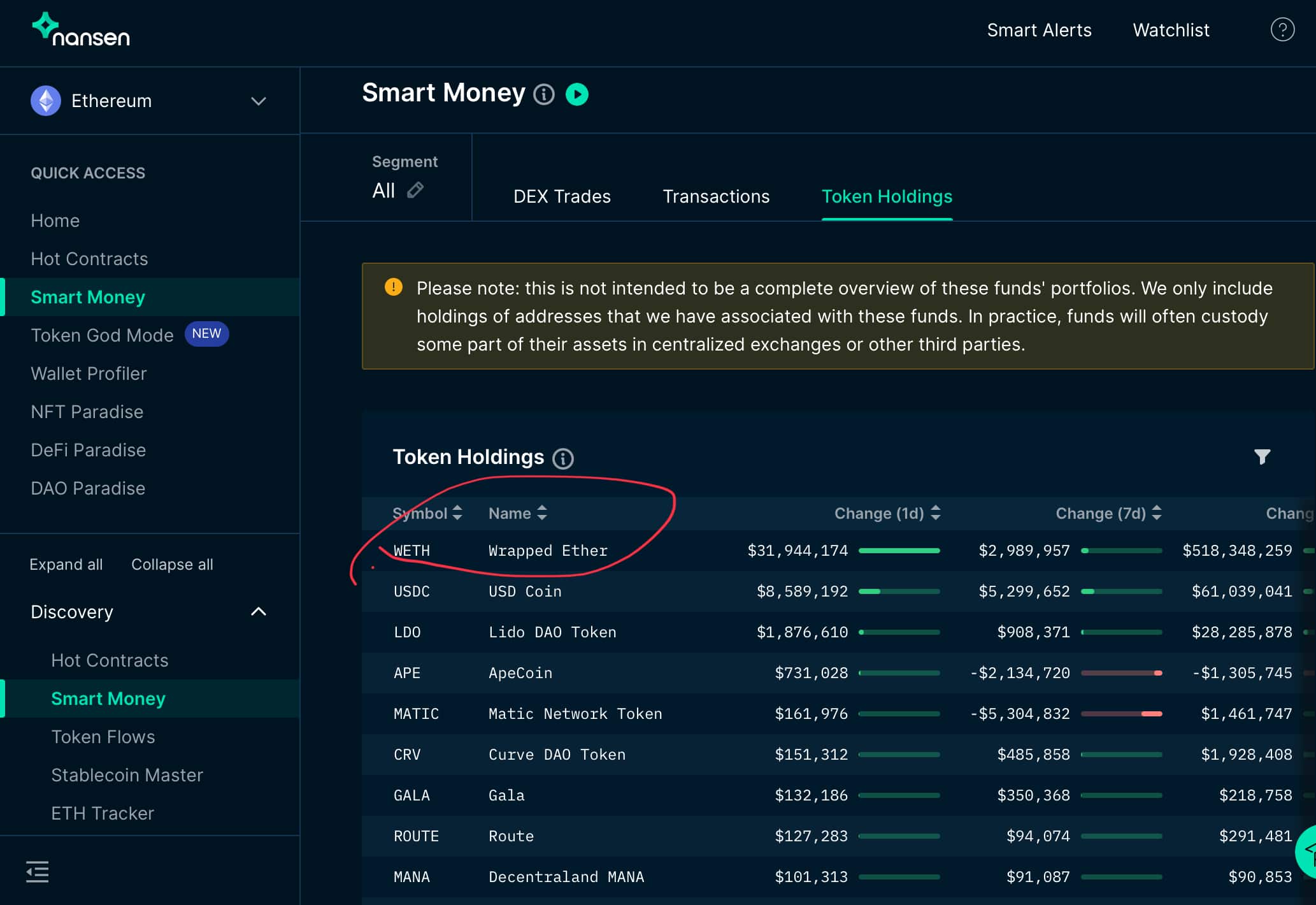

Data recorded on Nansen revealed that WETH remains the favorite token of smart money. There has been a dramatic increase in the accumulation of WETH since mid-April. Interestingly, the majority of smart money held WETH for a longer term, with 76% of tokens held for 1-2 years or more.

Unique addresses have risen on the network from 150k to almost 490k within 12 months. This remains a feat for Ethereum as the crypto-market tumbled for much of the aforementioned period.

There is also increasing investor confidence in the Merge with staking reaching new heights of late. Right now, 13.2 million ETH ($21.6 billion) have been deposited for staking. Among a total of 77.7K unique depositors, Lido Finance and Kraken head the list with 4.1M and 1.1M ETH, respectively.

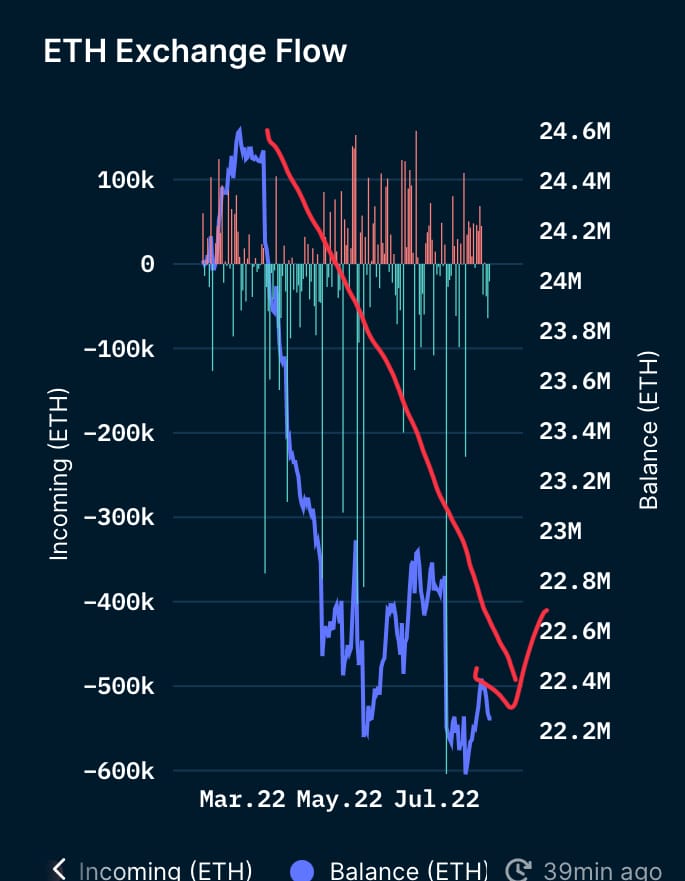

Supply on exchanges still remains an important signal for understanding trader sentiment. ETH has seen outflows from exchanges for a balance of 24.6M ETH to 22.2M ETH within just over five months.

In DeFi also, Ethereum leads the way among other cryptocurrencies with clear dominance. In fact, Ethereum smashes all Layer-1 competition in terms of TVL.

At press time, it had a 65.32% market share with $58 billion in TVL. BSC remains second best with a TVL of just over $6.7 billion.

Conclusion

This data helps issue a strong case for Ethereum to prosper post-Merge. They also certify the growth of the Ethereum ecosystem in the broader crypto-market. The Merge itself is expected to bring a greater stream for Ethereum holders. At the same time, ETH is reacting very well to increasing hype.

ETH prices have increased by more than 50% since last month and continue to flash green on the price chart. Ergo, there’s reason to be positive about the market going forward.