What this means for DeFi’s ‘blue chips’

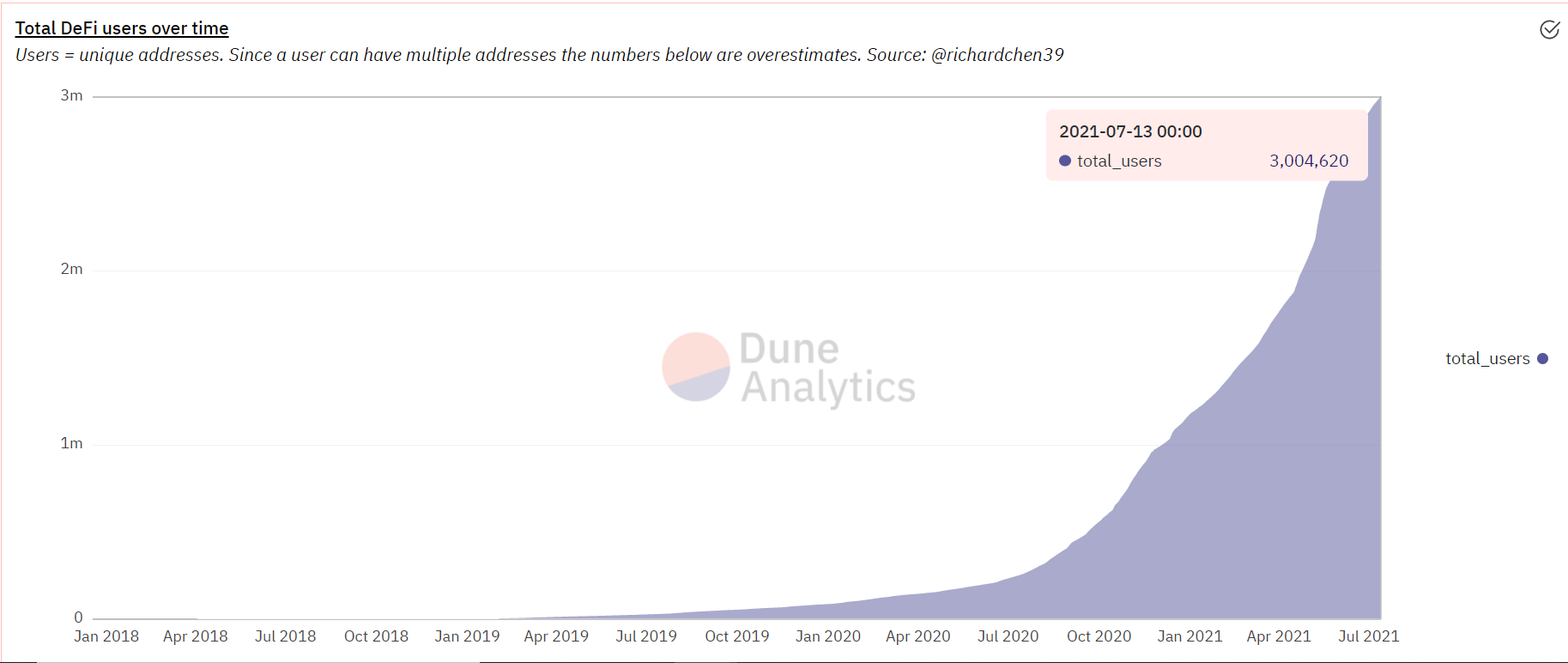

While the larger crypto-market sentiment seems to have taken a fall, DeFi adoption is keeping the flag up with an exponential growth pattern. The DeFi ecosystem is showing no sign of slacking off as it achieved a new milestone recently with its total number of unique addresses finally hitting the 3 million mark on 13 July.

Recent data underlined that the total number of unique addresses interacting with DeFi finally reached the 3 million mark. Crypto-enthusiast Richard Chen compiled the data onto a dashboard tracking a range of Ethereum-native protocols to establish the total number of unique wallets interacting with the ecosystem.

The dashboard further established Uniswap, Compound, Aave, Curve, and Balancer as the top user-favorite coins.

Source: Dune Analytics

One of Ethereum’s top decentralized finance protocols, Uniswap, emerged as the most popular DeFi platform with over 2.3 million unique addresses as per the data. The second spot was taken up by the decentralized money market, Compound, which managed to rack up 325,000 addresses since its launch.

At the beginning of this month, another report had highlighted a possible “comeback season for DeFi” by underlining that some of the largest DeFi tokens registered a sharp uptick in unique addresses activity.

A surge in demand wave for DeFi?

The growing number of unique addresses in DeFi protocols does signify a new demand wave for DeFi. While it would have been a little impatient to conclude the same during the beginning of the month, the sustained hike in address activity after half a month has gone by does signal growing network confidence and a possible bull run for Defi’s ‘blue chips.’

However, it is interesting to note that while some of the top DeFi assets like Uniswap and Compound have pictured price rallies and high social dominance, they lag in terms of development activity and network confidence or adoption.

For instance, Uniswap and Compound’s charts compared their social dominance and price with development activity and revealed that the latter has tested its early May and June levels for the assets.

It is also important to note that while reaching the 3 million unique addresses milestone is a significant achievement, many users operate multiple addresses, making the real number of unique users a little lower than the number of active addresses.

This, however, cannot overshadow the fact that DeFi has continued to see exponential growth amid larger bearish market sentiment. A lot of DeFi assets such as Uniswap, Synthetix, and Compound have surged in value following constant ecosystem-centric updates, new product launches, and better market adoption. This has been a major factor in pumping the space and has left many hoping for a possible DeFi summer.

The hope of a possible DeFi summer is high!

Research Analyst Mason Nystrom was quick to point out DeFi’s exponential growth, noting that it took just 78 days for the unique addresses to jump from the 2 to 3 million mark. Additionally, a poll created by the analyst showed that 53% of the respondents think the 4 million mark will be reached in the next one to two months.

142 days from one million to two million

78 days from two to three millionHow many days until four million? https://t.co/vEQ5mCcN8p

— Mason Nystrom (@masonnystrom) July 12, 2021