What traders need to know about AAVE, Uniswap, and COMP

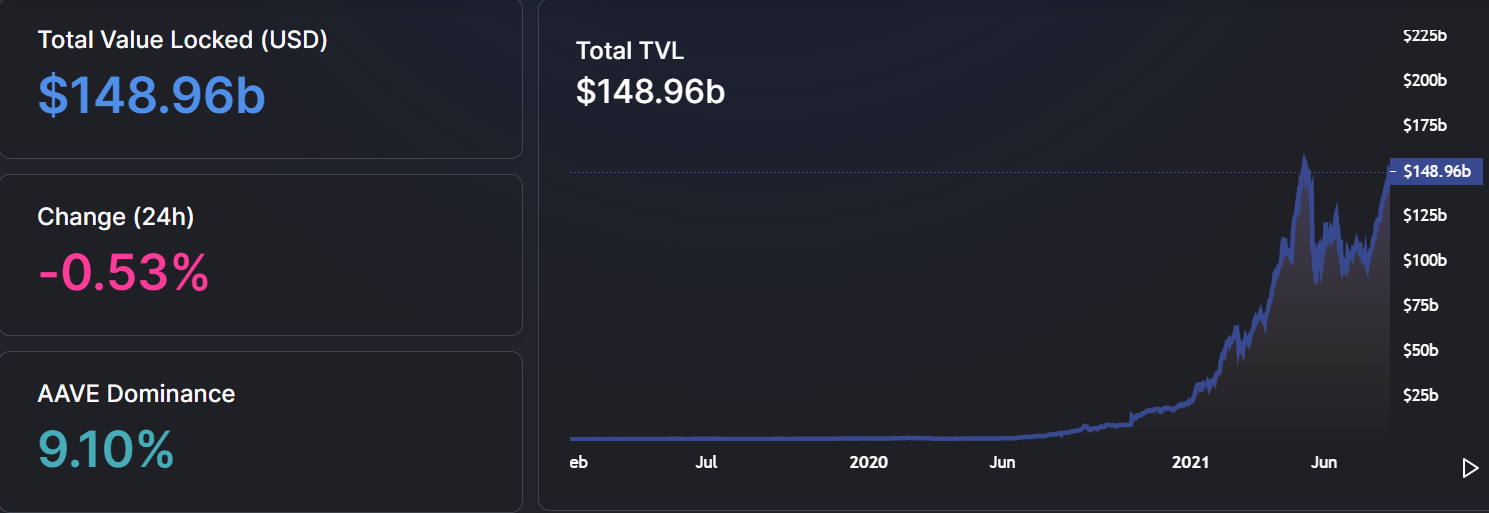

The hype around Defi summer has led to the growth of the market by almost 40 times. In fact, at the time of writing, total value locked neared the all-time high of $155 billion and stood at $148.96 billion. While the Defi space highlighted some solid inflows, some of the top Defi tokens struggled at their major resistance. What could be the reason behind the simultaneous growth of the Defi space, while its coins seem to struggle?

Still some time for Defi summer

Defi Assets index highlighted that over the past month, a majority of the top 10 Defi tokens gained more than 20%, with the top gainer, Terra (LUNA), seeing its price increase more than 116%. At the time of writing, though, Uniswap had the largest market cap of all Defi tokens, standing at $16.9 billion.

Primarily there was a bullish case for Defi tokens according to certain metrics like total value locked and a high number of new users in the space. Notably, the total value locked (TVL) in Defi platforms was inching closer to its previous $155 billion all-time high. This rise in TVL underlined the rising token values and increased activity and deposits in the ecosystem.

Source: Defi Llama

Further, the rise in daily trading volume on decentralized exchanges (DEX), led by Uniswap, was notable. Other than that, there has also been a steady rise in the unique addresses over time with the current value standing at an all-time high of 3,199,168. The growing number of users entering the Defi space further highlighted that Defi activity and token values were continuing to rise.

Source: Dune Analytics

However, the fact that this growth has been steady amid both bull and bear market conditions with no anomaly or hike signified that there hasn’t been an out-of-the-blue growth in the space. Thus, while undoubtedly the Defi space shows signs of growth, there seems to be a slim possibility of Defi summer.

Defi tokens, too, need to wait for another rally

The recent bull market was a good time for alts to rise and many did, while most Defi tokens saw a decent rally too they failed to reach close to their ATHs. AAVE, Uniswap, and Compound (COMP) all three Defi tokens struggled to breach their major resistances.

On a one-day chart, AAVE saw a major resistance at $416 and even though investors anticipated a blasting rise above that, it didn’t happen. Further, Uniswap and COMP faced resistance at $30 and $485 respectively, and weren’t able to break above the same.

Thus, while the Defi space saw an all-over growth, Defi tokens seemed to struggle at the moment.