What yield farming projects AAVE, Balancer [BAL], Yearn.Finance [YFI] can offer traders

The altcoin rally has come to a brief standstill. However, among other trends in the current altcoin rally, the one that has emerged due to high ROI and popularity is the Yield Farming project craze.

Staking or lending other crypto-assets has helped traders earn high returns in yield farming assets. Though many have criticized these projects for the inherently high risk and volatility, in 2021, this has stood out as a top application of DeFi. This has made liquidity mining popular in the retail trading and HODLing community. Top Yield Farming projects are Compound, MakerDAO, Aave, Balancer, Synthetix and Yearn Finance.

AAVE hasn’t started rallying yet, however, the trade volume is increasing consistently. There is a demand for AAVE across top spot exchanges and BTC/ USDT markets.

AAVE’s network is growing steadily, at the same time; over 40% HODLers are profitable at the current price level – $361, based on data from coinmarketcap.com.

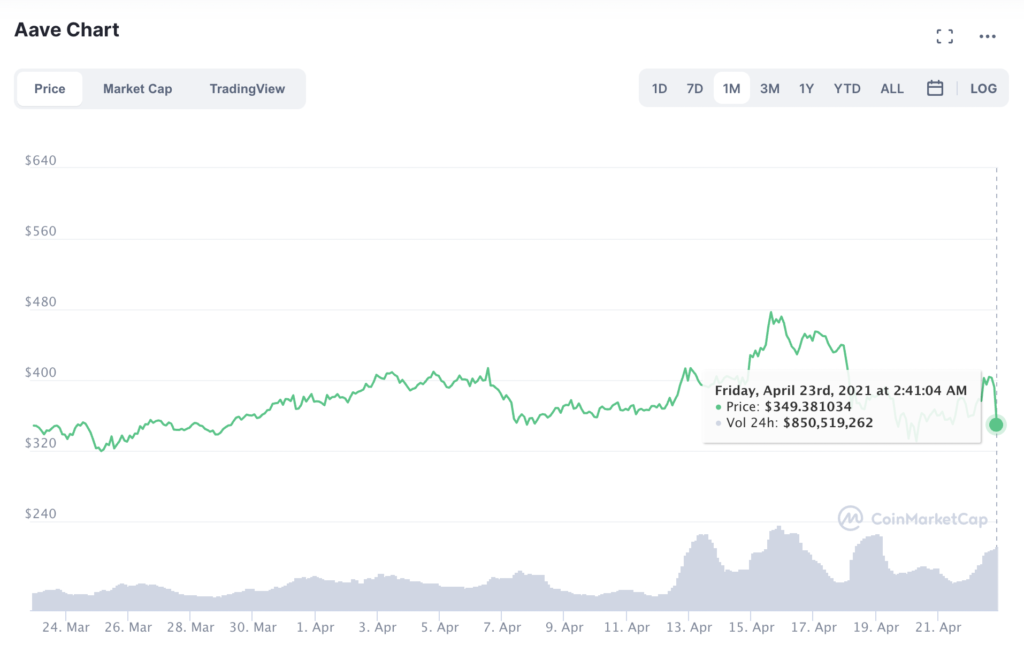

AAVE’s price chart || Source: Coinmarketcap.com

The current on-chain sentiment is neutral. The trade volume for this top Yield farming project has increased enough to offer high returns to traders. In the past 28 days, the price is up over 20%. This is the potential for short-term ROI, similarly projects like BAL and YFI offer high returns.

Balancer’s rally may have ended, but the current price level is the buy zone for Balancer, offering traders an opportunity to buy while the DeFi project consolidates. The price has started dropping, after over 176% in returns in the past 90 days. This is a relatively high return on a Yield Farming project corresponding with the time that Bitcoin and top altcoins like ETH, XRP and LTC rallied.

Both Balancer and Aave have contributed significantly to DeFi’s increasing TVL. When it comes to YFI, the price is less than 15% away from its ATH.

YFI’s volatility has remained largely high in the past month since the price has almost doubled. This suggests that despite neutral sentiment from traders, and a drop in demand across exchanges, YFI has offered high ROI on traders’ portfolios, making it a top pick for DeFi portfolio geared towards double-digit gains.

At $44593, based on YFI’s social sentiment and fundamentals it is undervalued. Yield farming has offered the highest returns and contributed significantly to TVL in the past 60 days and in the current rally AAVE, YFI, BAL are the top picks.

![Hedera [HBAR] defies market trend - All you need to know about altcoin's 27% hike!](https://ambcrypto.com/wp-content/uploads/2025/03/Hedera-1-400x240.webp)