What’s causing Bitcoin miners’ fees to slump?

- BTC’s miner revenue derived from fees has dropped to a three-month low.

- BTC miners refuse to sell their coins as the Exchange to Miner indicator grows.

Sitting at 2.61% at press time, the percentage of miner revenue derived from fees paid to use the Bitcoin [BTC] network dropped to its lowest level in the last three months, data from Messari showed.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The fall in BTC miner revenue from fees in the past few months was attributable to the steady decline in transaction fees paid to use the network, despite the surge in transaction volume on the Layer 1 (L1) network.

According to on-chain data provider IntoTheBlock, total fees paid to process transactions on the Bitcoin network have fallen by 38% since March to touch its lowest point in four months.

#Bitcoin fees dropped to their lowest since March, despite transaction activity rebounding pic.twitter.com/xT9VMYoXOP

— IntoTheBlock (@intotheblock) July 14, 2023

Once upon a time…

According to data from Messari, the value of the mean fee paid per transaction on the Bitcoin network rallied to a high of $30.36 on 8 May, the highest daily fee in the last year.

The surge in transaction fees was due to an uptick in trading volume on the Bitcoin network when the hype around Ordinals NFTs collection overran the market. Per data from Glassnode, an average of nearly 600,500 daily transactions were logged in May, dragging up the fees paid to use the network.

When Bitcoin’s average transaction fee touched its one-year high on 8 May, the percentage of miner revenue derived from fees also jumped to 33%, its highest in five years.

However, as the Ordinals’ craze fizzled out, transaction activity returned to normal, causing transaction fees to dip. Consequently, the percentage of miner revenue derived from fees suffered a decrease as well.

Miners say “no” to letting their bags go, but here is the catch

According to pseudonymous CryptoQuant analyst Tarekonchain, an assessment of BTC’s Exchange to Miners indicator revealed that while mining revenue from fees might have taken a hit in the last few months, miners on the L1 network have refused to sell their BTC holdings.

The Exchange to Miners indicator tracks the flow of cryptocurrency from miners to exchanges. When this rallies, it suggests increased BTC accumulation by miners on the Bitcoin network.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Tarekonchain noted:

“The pronounced spike in the Exchange to Miners Indicator suggests that miners are actively accumulating Bitcoin and opting to hold onto their assets rather than swiftly converting them back to stable coins or fiat currencies.”

On what this means for the general market, Tarekonchain concluded:

“Miners’ preference for retaining Bitcoin in their wallets may signify a long-term positive sentiment regarding the future value of Bitcoin. It reflects a belief among miners that holding onto Bitcoin could yield greater profitability over time.”

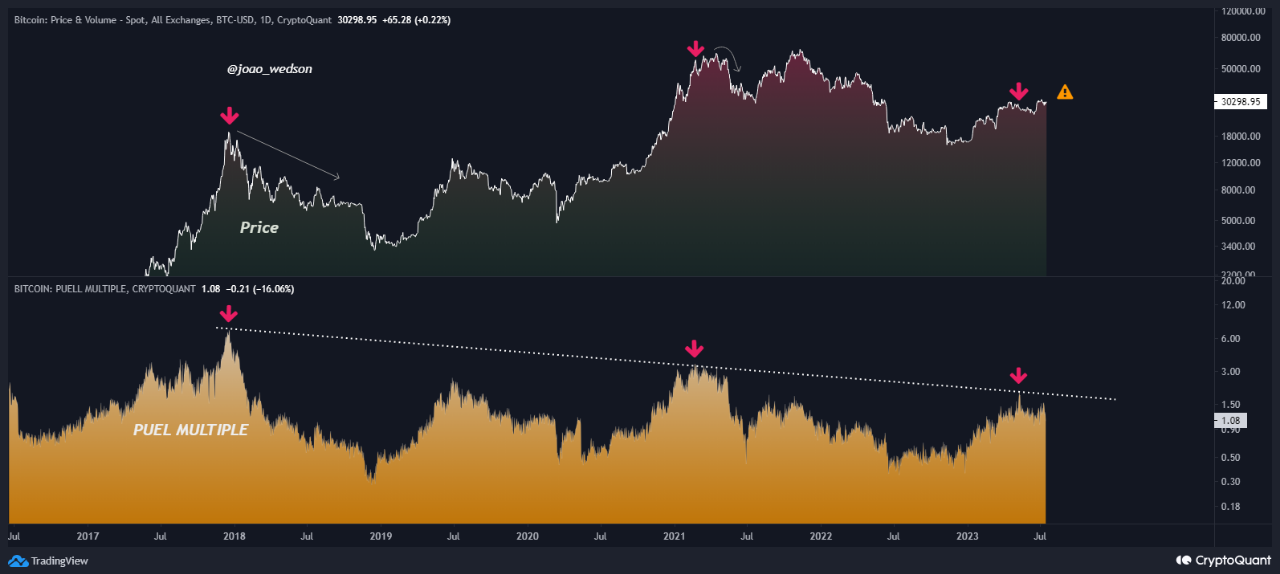

However, paying attention to Bitcoin’s Puell Multiple indicator is key. This indicator provides insights into the profitability of mining operations and helps identify potential turning points in the cryptocurrency market.

When the Puell Multiple climbs to a high value, it suggests that mining revenue is relatively high compared to the long-term average. This situation often indicates that miners have a strong incentive to sell their newly mined BTC, potentially increasing selling pressure on the market. On the other hand, a low Puell Multiple indicates that mining revenue is relatively low compared to the historical average, which may discourage miners from selling and potentially lead to a decrease in selling pressure.

According to CryptoQuant analyst Joao Wedson:

“The Puell Multiple recently reached a long-term trendline dating back to 2017. It is interesting to note that in 2021, when the price rose after the indicator hit resistance, a subsequent downward trend occurred, marking the end of the bullish cycle.”

![Bittensor [TAO] rebounds 13%—Golden Cross in sight, but will $500 break?](https://ambcrypto.com/wp-content/uploads/2025/05/Gladys-62-400x240.jpg)

![Binance Coin’s [BNB]](https://ambcrypto.com/wp-content/uploads/2025/05/Kelvin-_11_-400x240.webp)