Why crypto attracts South Korea like iron to magnets

- South Korea was the third largest cryptocurrency market in the world at press time.

- In contrast to the ‘Digital Gold’ narratives in the west, the growth is largely based on the trading of cryptocurrencies.

Bitcoin [BTC] and other cryptocurrencies are not considered legal tender or financial assets in South Korea as of this writing, yet the market has grown extensively in the last few years. As a result, investors and analysts have begun to pay close attention to the performance of cryptos in the economic powerhouse of East Asia.

Popular crypto and DeFi analyst Ignas recently released a blog article in which he shared views on the South Korean crypto industry and why Koreans have been drawn to these virtual assets like a magnet.

Crypto miracle on the Han River

Based on the findings of a market report that was previously published, Ignas highlighted that South Korea was the third largest cryptocurrency market in the world as of H2 2022, with more than 8% of the total market share.

The crypto boom first hit the country in 2017 and South Korea quickly became one of the biggest markets for BTC and Ethereum [ETH]. The spread was dramatic, and people of all classes and ages began to actively discuss and trade cryptocurrencies.

In line with global trends, the popularity exploded with the historic bull run market of 2021 during which Bitcoin and other top assets hit their all-time highs.

This was backed up by a report published on data aggregator site Statista. According to the same, daily trading volumes in 2021 jumped 12x compared to the previous year and even surpassed the value of shares traded on the stock exchange.

But why cryptos?

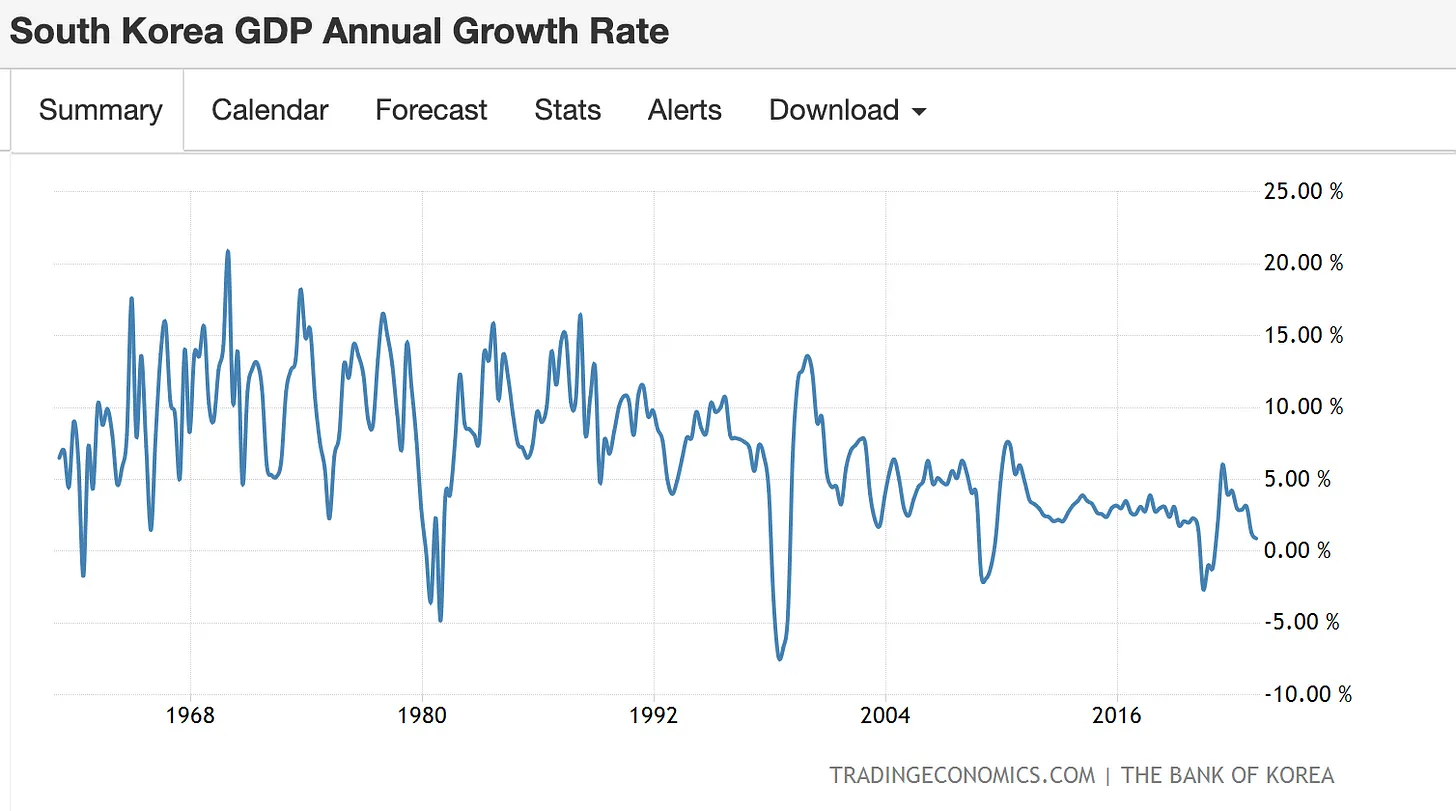

In the blog post, Ignas pointed towards the ‘fast’ mentality of the Korean lifestyle behind the rapidly growing usage of cryptos. Right from infrastructure creation to technology adoption, everything happened at breakneck speed, transforming one of the poorest nations to one of the richest in a very short span. The desire to get rich fast is thus embedded in the narrative.

However, economic growth considerably slowed down in the last decade, bringing with it issues of rampant youth unemployment. During 2020, the unemployment rate ranged from 7.5% to 11%, continuing a similar pattern into 2021, according to TradingEconomics.com.

With other investments like stocks, casino gambling, horse racing being limited and often unprofitable for a large section, the focus shifted to cryptos to get rich ‘fast’. Based on personal experiences, Ignas stated that Koreans see crypto exchanges as a way to get rich quickly.

In contrast to the ‘Digital Gold’ narratives prevalent in the West, South Korean market’s growth is largely based on the trading of cryptocurrencies. Other sectors like the crypto asset management market are underdeveloped.

The curious case of Kimchi Premium

The blog post brought attention to a period when BTC traded at a big premium on local exchanges, nearly 40% more than that of U.S.-based trading platforms.

Historically, South Korean exchanges have witnessed higher price of popular tokens compared to foreign exchanges. This phenomenon is called Kimchi Premium and is driven by a high demand for cryptos in the country.

While this could be conducive to arbitrage trading, South Korea’s stringent capital controls, which restrict the flow of money that can move out of the country, made it unprofitable. To offset this, Korean investors routinely indulge in schemes like pump-and-dump. The anomaly was highlighted some time back by the CEO of blockchain analytics firm CryptoQuant.

Hence, it’s not surprising to see a sudden spike in trading volume for certain assets in South Korea. Earlier in the year, payments-focused crypto Ripple [XRP] clocked very high volumes on Upbit. At one time, XRP’s share surpassed cryptos with higher market caps like BTC and ETH.

Regulations tighten grip

Because of the meteoric rise in crypto trading, the South Korean government began regulating the overheated market. Aside from various new regulations, the directive to register all crypto trading platforms with the financial regulator introduced in 2o21, forced many players to toe the line, with many ending up shutting their operations.

As of this publication, Upbit and Bithumb were the two largest exchanges in the country. As per Coingecko, Upbit was the second-largest exchange by trading volume globally in the last 24 hours, with trades worth more than $3 billion getting settled on the platform.

Reluctance towards DeFi

Ignas stated that despite the popularity of cryptos, Koreans were yet to warm up to decentralized finance (DeFi). One of the reasons put forward behind the low adoption was more trust in centralized financial entities. As a result, the notions of self-custody don’t find enough takers.

Apart from this, the comparatively complicated processes such as setting up wallet, protecting keys, and overwhelming UI/UX experience prove to be a big hassle for Koreans.