What’s causing Cardano’s price struggles? Analyst says…

- Analyst noted that nobody is using ADA technology, and investing in unused technology in 2024 is not a smart move.

- Based on the historical price momentum, there is a strong possibility that ADA could decline by 10%.

The overall cryptocurrency market is struggling a little bit, while Cardano [ADA] appears bearish due to its potentially underutilized technology as reported by a crypto analyst.

At present, major cryptocurrencies like Bitcoin [BTC], Ethereum (ETH), and Solana (SOL) are experiencing a sort of price correction following an impressive price surge over the past few days.

Why is Cardano struggling

A crypto analyst made a post on X (previously Twitter) and shared Cardano’s current transaction per second (TPS) data, which currently stands at 0.41.

Highlighting the lower TPS, the analyst remarked that nobody is using ADA technology, and investing in unused technology in 2024 is not a smart move. The Analyst also stated, “Keep it real focus on facts and data.”

This data suggests that this could be why Cardano’s ADA has been struggling for so long and finding it difficult to rally upward.

Cardano technical analysis and key levels

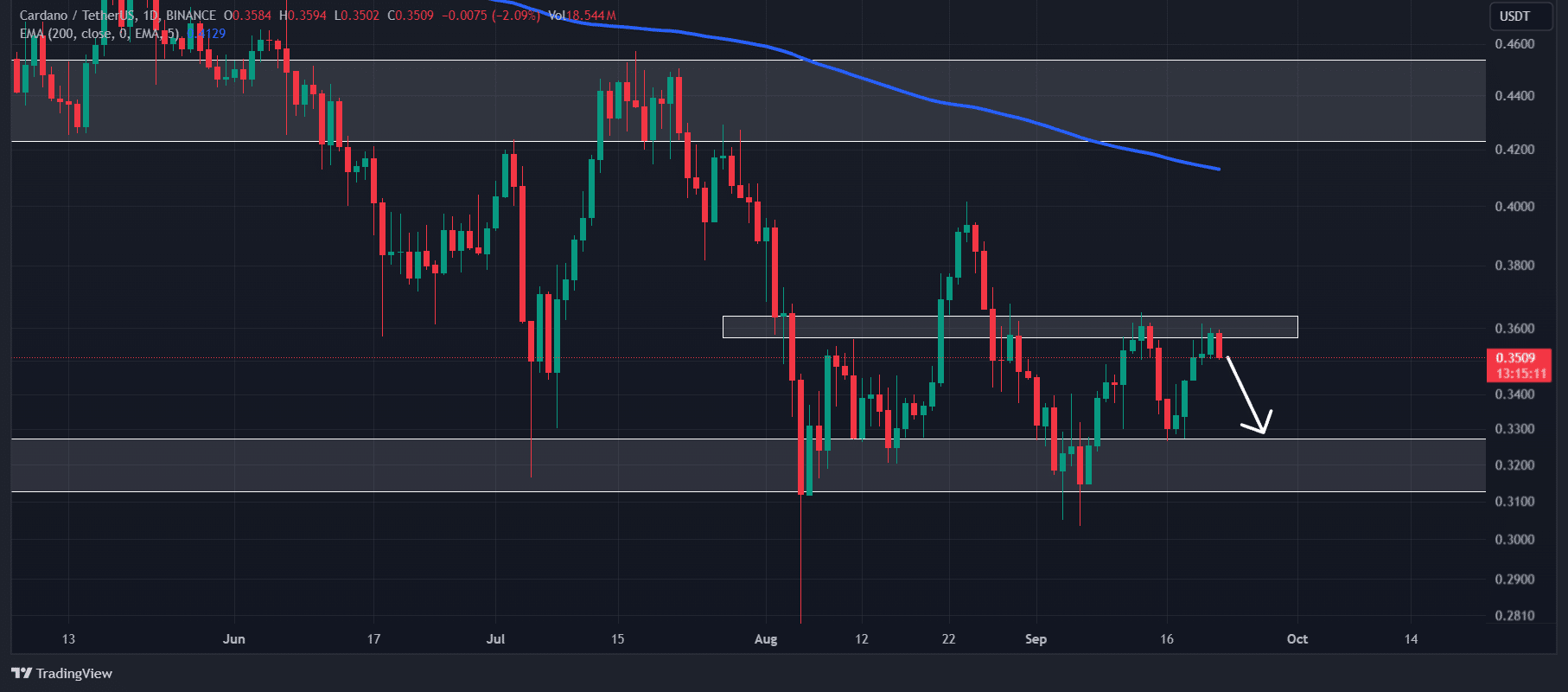

According to expert technical analysis, ADA is in a downtrend, as it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

Traders and investors often use the 200 EMA to determine whether an asset is in an uptrend or downtrend.

In addition, ADA is currently experiencing a price reversal from the strong resistance at the $0.36 level. This isn’t the first time the asset has faced selling pressure from this level.

On September 4, ADA experienced a similar price reversal and fell nearly 10% in just three days.

Based on the historical price momentum, there is a strong possibility that ADA could decline by 10% to reach the $0.325 level in the coming days. This bearish thesis would invalidated if ADA closes its daily candle above the $0.365 level.

Bearish on-chain metrics

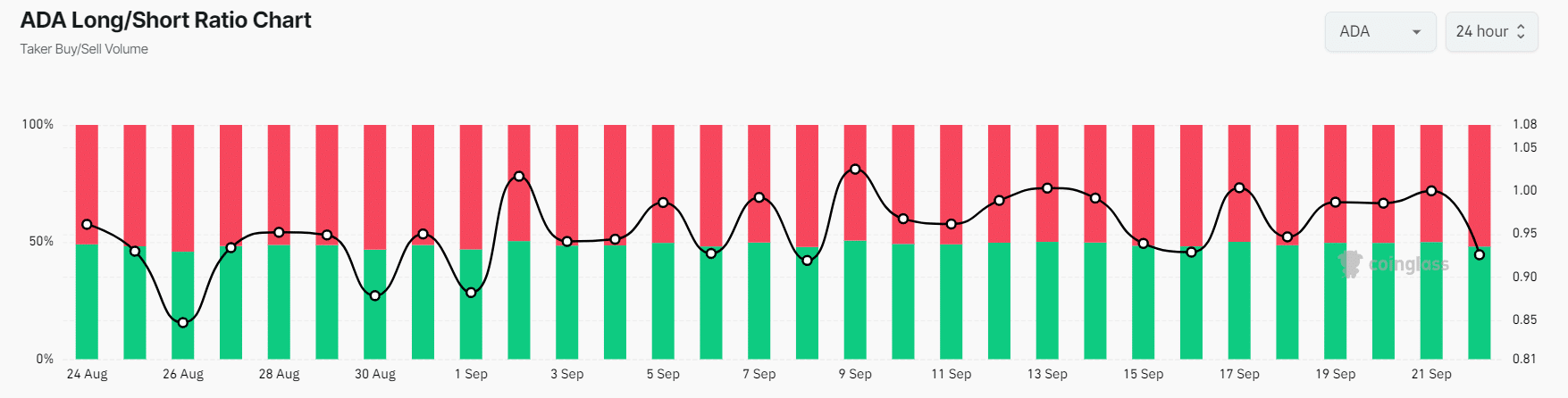

However, this negative outlook is further supported by the on-chain metrics. Coinglass’s ADA Long/short ratio currently stands at 0.926, indicating bearish market sentiment among traders.

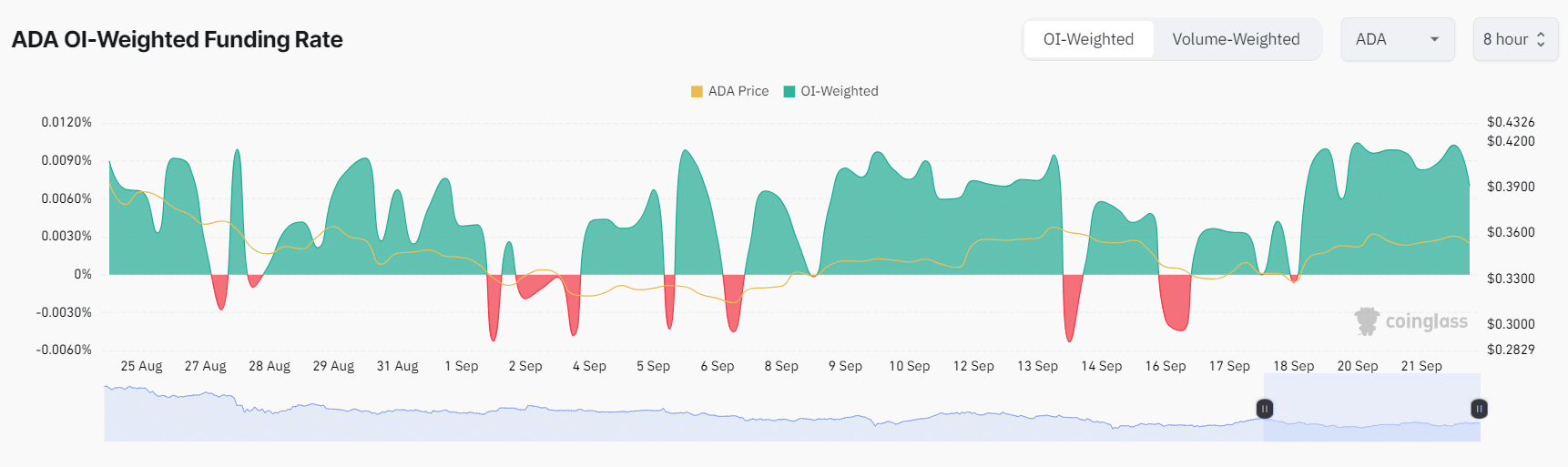

Additionally, its future open interest has declined by 3.8% in the last 24 hours and has been steadily falling. This suggests traders are either liquidating their positions or hesitating to build new ones.

On the other hand, ADA’s OI-weighted funding rate currently stands at +0.007, signals bullish momentum with long traders willing to pay to maintain their positions.

Read Cardano’s [ADA] Price Prediction 2024–2025

Meanwhile, data suggests that currently, 52% of top traders hold short positions, while 48% hold long positions.

At press time, ADA was trading near the $0.352 level and has experienced a modest price decline of 0.8% in the last 24 hours. During the same period, its trading volume has dropped by 18%, indicating lower participation from traders amid selling pressure.