What’s causing UNI’s declining price action despite increased whale interest?

- UNI remained one of the top choices of the whales.

- A few of the metrics and market indicators suggested a further downtrend in the coming days.

On 31 January, Uniswap [UNI] released details related to its new Permit2 smart contract, which is a token approval contract that can share and manage token approvals of different smart contracts. According to the latest tweet, Permit2 smart contract allows for seamless token approvals across web3 dApps, making things easier.

1/ Our new Permit2 smart contract allows for seamless token approvals across web3 dApps, making things easier & safer ?♀️

But that doesn’t mean every dApp that integrates Permit2 automatically has access to your tokens.

Let us explain ?

— Uniswap Labs ? (@Uniswap) January 30, 2023

Read Uniswap’s [UNI] Price Prediction 2023-24

With Permit2, users no longer have to execute multiple transactions when they connect to a new app. Moreover, Permit2 also allows setting expiries on approvals, meaning new protocols will only have permission for a customizable duration of time.

Incidentally, UNI once again became popular among the whales. According to WhaleStats, a popular Twitter account that posts updates related to whale activity, UNI was one of the top 10 purchased tokens among the 100 biggest Ethereum [ETH] whales, which reflected whales’ trust in the token despite UNI’s recent price action.

JUST IN: $UNI @Uniswap now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#UNI #whalestats #babywhale #BBW pic.twitter.com/rYxp0QpA0T

— WhaleStats (tracking crypto whales) (@WhaleStats) January 30, 2023

CoinMarketCap’s data revealed that UNI registered a nearly 2% decline in the last 24 hours, and at the time of writing, it was trading at $6.48 with a market capitalization of more than $4.9 billion.

Is the market to blame, or something else?

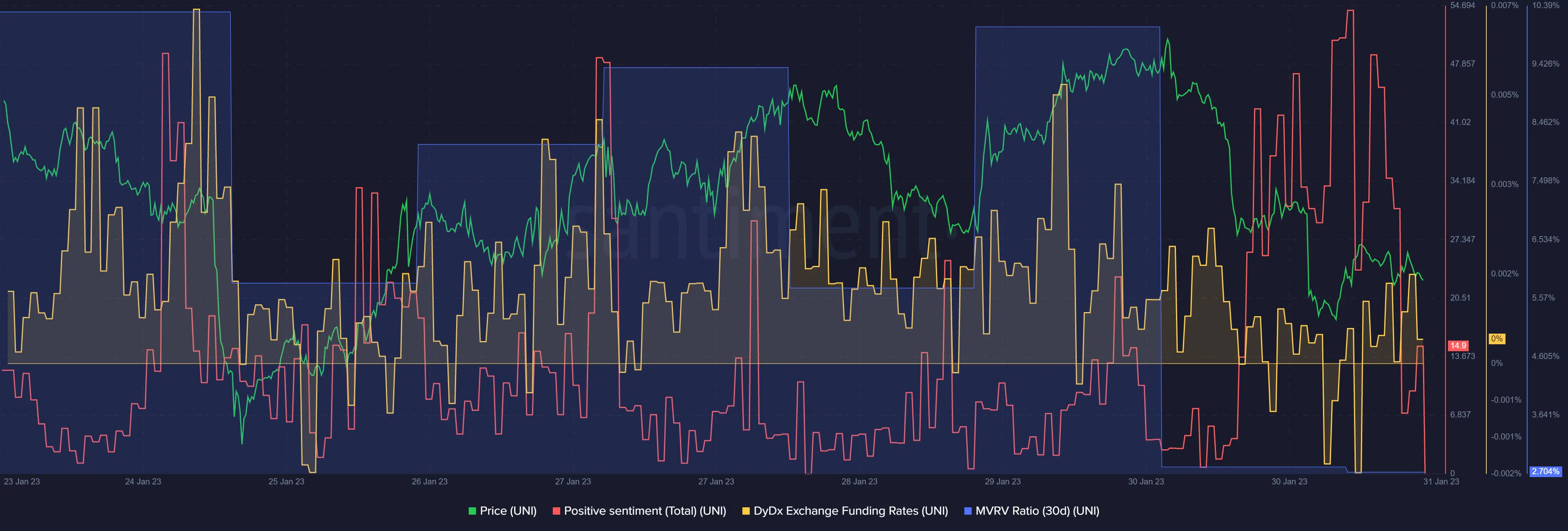

A closer look at UNI’s on-chain metrics revealed whether this negative price action was due to the current bearish market or if something else was at work. UNI’s MVRV Ratio declined sharply on 30 January, which looked bearish. Furthermore, demand from the derivatives market also decreased as UNI’s DyDx funding rate registered a decline.

Though UNI failed to increase its price, positive sentiments around the token surged. Not only that, but CryptoQuant’s data revealed that UNI’s exchange reserve was decreasing, reflecting less selling pressure. On the other hand, active addresses were rising, reflecting more users in the network, which also looked optimistic.

How much are 1,10,100 UNIs worth today?

UNI: Looking forward

Like the few on-chain metrics, UNI’s market indicators also supported the possibility of a further price decline. The MACD was bearish, as it displayed a crossover in the sellers’ favor. UNI’s On Balance Volume (OBV) registered a decline, which was again a negative signal. Additionally, the Money Flow Index (MFI) was resting at the neutral mark.

However, the Exponential Moving Average (EMA) Ribbon remained on the bulls’ side as the 20-day EMA was above the 55-day EMA.