What’s in store for Bitcoin’s price this weekend?

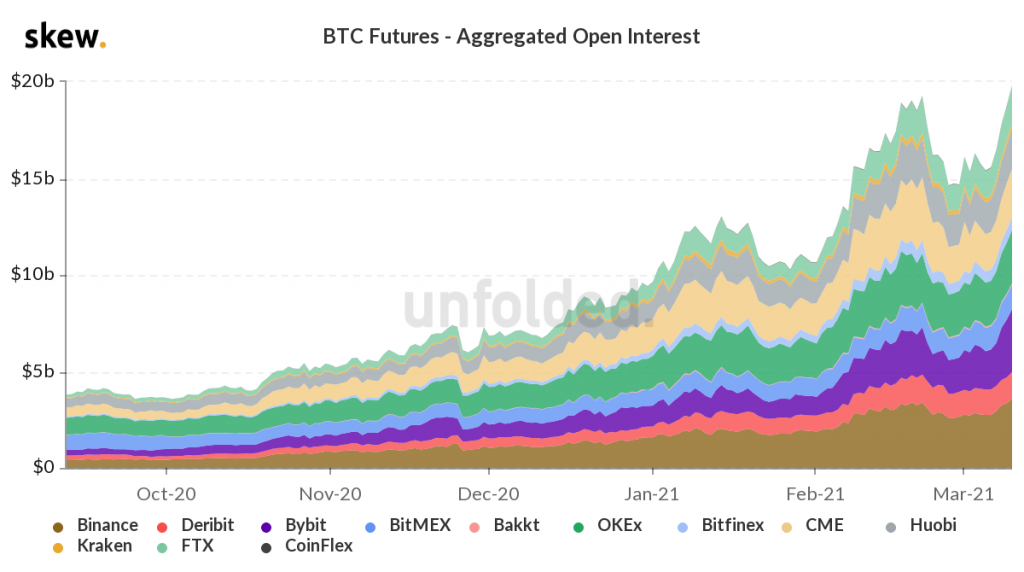

Bitcoin’s price is moving towards its ATH level of $58330 and as the price rises, the leverage on derivatives exchanges continues to build-up. For the first time ever, Bitcoin futures open interest had crossed $20 billion. The increase in open interest means two things, more retail, and institutional buying and reduced selling pressure and more demand on derivatives exchanges.

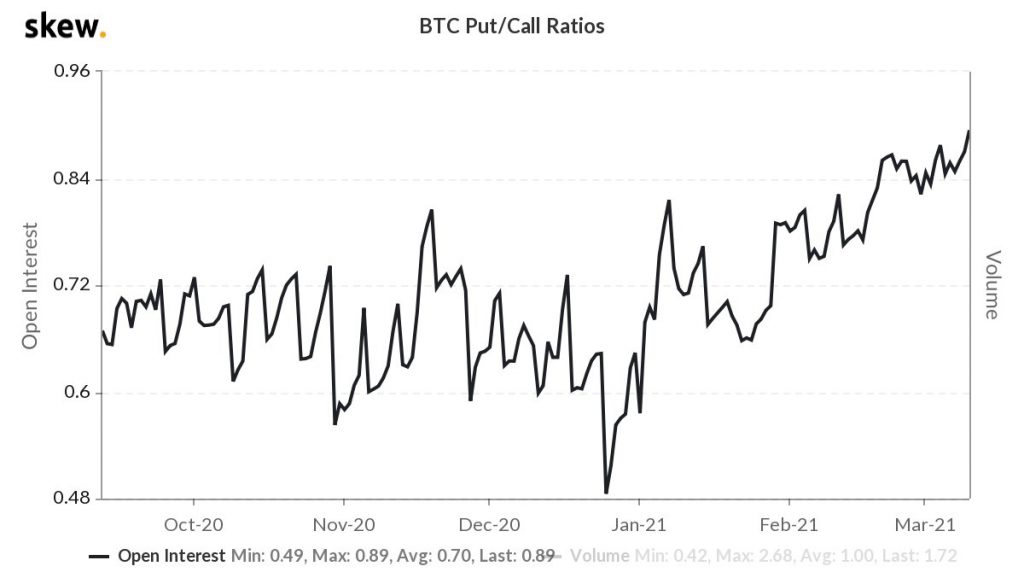

Both these point towards an increase in price in the short term. Currently trading around %57k, Bitcoin’s price is set to increase and continue an extended price rally through the weekend. However, a metric that signals that it may remain rangebound is the Put/Call ratio by Skew.

Source: Twitter

The Put/call ratio is signaling that there are around an equal number of traders on puts and calls. However, a social metric that puts the increasing open interest and its bullish impact on the asset’s price in perspective is the daily new exchange followers by Skew.

According to the chart, in the last two days, there has been a relatively high increase in the number of exchange followers on Twitter, and this signals an increase in investment flow, retail interest, and overall increase demand. The demand on exchanges may be enough to absorb the selling pressure and allow the price to cross the critical $57000 level soon enough.

Source: Twitter

Before the end of the weekend, it is expected that bullish divergence may be noted in Bitcoin’s extended rally unless, there is a large amount of Bitcoin hits exchanges, from miners or HODLers. Another situation in which there may be a trend reversal in the price rally is a sudden drop in Coinbase Pro outflow drops.

There are further short-term sell-off risks in Bitcoin. If the Bitcoin inflow means for exchanges crosses 30, the selling pressure may increase. If Bitcoin address count inflow for spot exchanges crosses 1250 and Bitcoin transactions count inflow for all exchanges exceeds 560, there may be a sell-off. The price rally may be interrupted by a correction and Bitcoin may change hands, with HODLers buying the dip and a transition in the HODLing pattern before the price recovers from the drop.