What’s next for Cardano as Q3 decline prevails?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ADA has been on a steady depreciation since July.

- Open Interest rates didn’t improve much despite the recent recovery.

If you’re a Cardano [ADA] trader, you might have noticed the multi-month trendline resistance, especially on the higher timeframe. When captured using the parallel channel, the price action has steadily declined since mid-July.

Is your portfolio green? Check out the ADA Profit Calculator

At press time, the price action had bounced near the mid-range of $0.238, but sellers were betting against further upside beyond the range-high, as shown by the red candlestick.

Will sellers drive Cardano lower?

Since mid-July, ADA’s price action has faced price rejection at the range-high. If the trend persists, the press time price action could face the same fate.

Besides, the range-high of $0.2495 had a confluence with the 50-EMA (Exponential Moving Average) on the daily chart at press time. So, sellers could camp at the roadblock and force another decline to the H4 bullish order block of $0.2367 – $0.2433 (cyan), the mid-range or the range-low (near $0.21).

Conversely, a daily candlestick session close above the range-high and 50-EMA will reinforce a bullish intent. However, the daily market structure will only flip bullish if ADA exceeds $0.26. If so, the next target will be $0.28.

Meanwhile, the RSI has labored in the low range since August, demonstrating elevated sell pressure in Q3. On the contrary, the CMF reclaimed the zero mark in September and hasn’t dropped below the threshold, underscoring improved capital inflows over the same period.

Demand dipped in the derivatives market

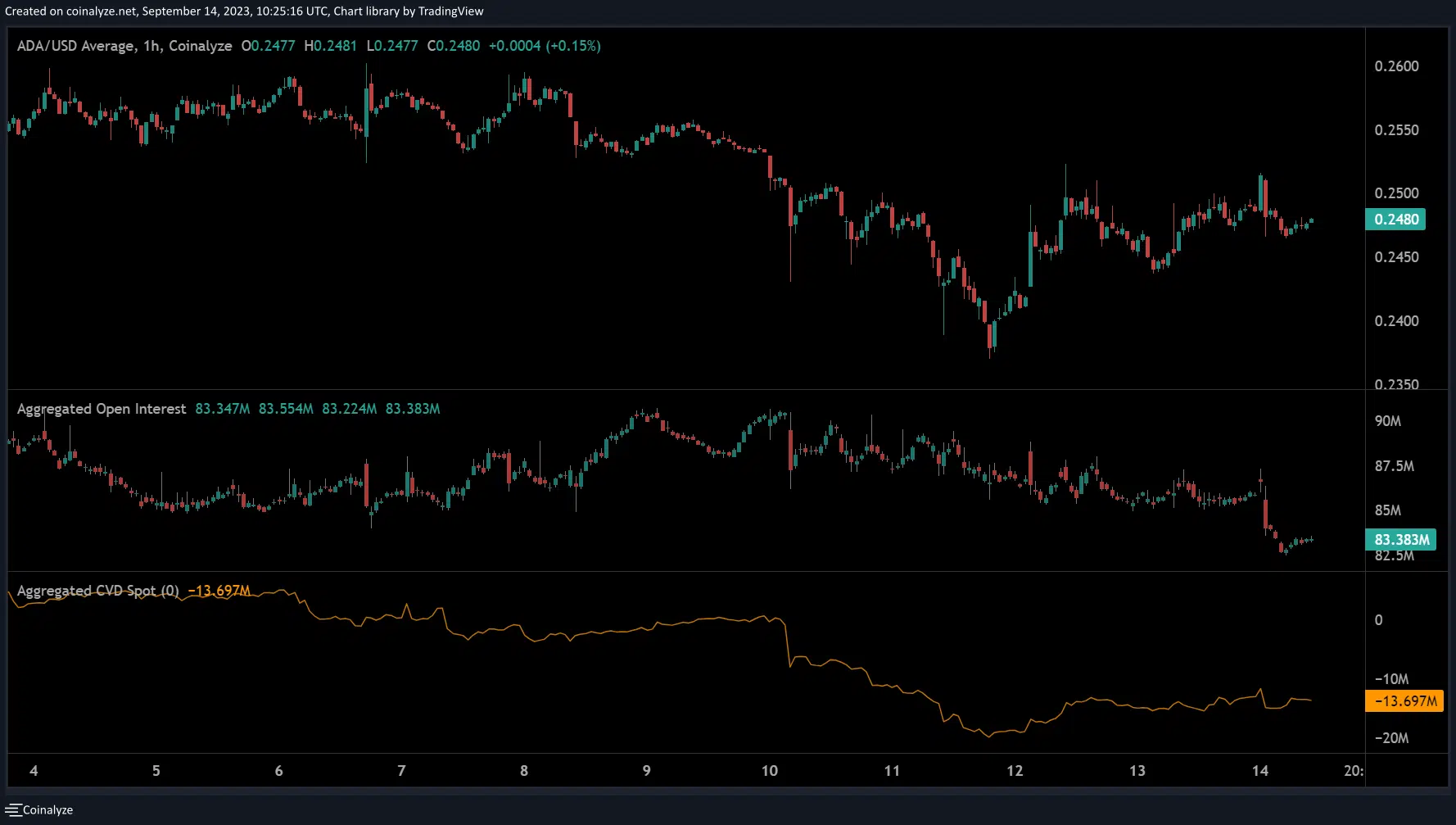

According to Coinalyze, the Open Interest rates declined further from 10 September, easing from $90 million to below $85 million as of press time. It shows demand for ADA in the derivatives market dipped over the same period.

How much are 1,10,100 ADAs worth today?

However, the CVD (Cumulative Volume Delta) improved over the same period. It indicates buyers in the spot market gain a little edge.

Nevertheless, live order book data from CryptoMeter showed more short positions on the higher timeframe, 24H, on Binance Exchange at press time. While this could cement a bearish inclination, tracking Bitcoin [BTC] is crucial for risk mitigation.