What’s the one certain thing about Bitcoin?

For a majority of the last 48 hours, Bitcoin, the world’s largest cryptocurrency has traded just below the $60,000 price level, with the aforementioned level not too far from the crypto’s ATH. Ordinarily, such steady consolidation would be good news, right? Well, yes. But, everything needs to be put in context and expressed in relative terms.

Take a look down at the cryptos below BTC and you’ll find that the likes of ETH and XRP are surging. Contrary to the prevailing perception that the altcoin market follows Bitcoin, here you have two of the market’s most-prominent alts defying the general market trend to register hikes of their own.

What does this entail? Is the alt season finally here? Perhaps. Perhaps not. What is evident, however, is that both these cryptos have surged on the back of developments that are ecosystem-centric. The purpose of this article is to answer the following question – should anyone be concerned about Bitcoin’s ‘stagnant’ price movement of late?

Yes, stagnant, At least, that’s what a lot of people are calling a consolidatory move on the charts these days. On a certain level, these concerns are justified. After all, Bitcoin is the flagbearer of the crypto-market and its performance is critical to that of the general market. However, it would seem that despite BTC’s unwillingness to sustain a breach of the psychological $60k barrier, there isn’t much to be concerned about.

Consider this – according to Santiment, Bitcoin isn’t in the “super overvalued territory” yet, with its 30d and 365d MVRVs well away from their local tops. In fact, these metrics suggest that there is still a lot of room for growth, with a lot of potential upside in price projected to come in. Historically, local tops in the same have been succeeded by price drops.

Since we are still away from these tops, BTC can be expected to climb some more despite recent consolidation, before correcting again.

Source: Santiment

Whether the said hike would be enough to breach its ATH, however, that will be difficult to ascertain.

Santiment’s report also looked at the cryptocurrency’s 3-year and 5-year Dormant Circulation, with the same observing that recently, a fair amount of very old coins were moved between addresses. According to the report, “This is a good sign, distribution keeps taking place.”

Source: Santiment

What’s more, other metrics such as Mean Coin Age seemed to suggest the network-wide accumulation trend is still going smoothly, despite the fact that there had been some degree of distribution back in the month of March.

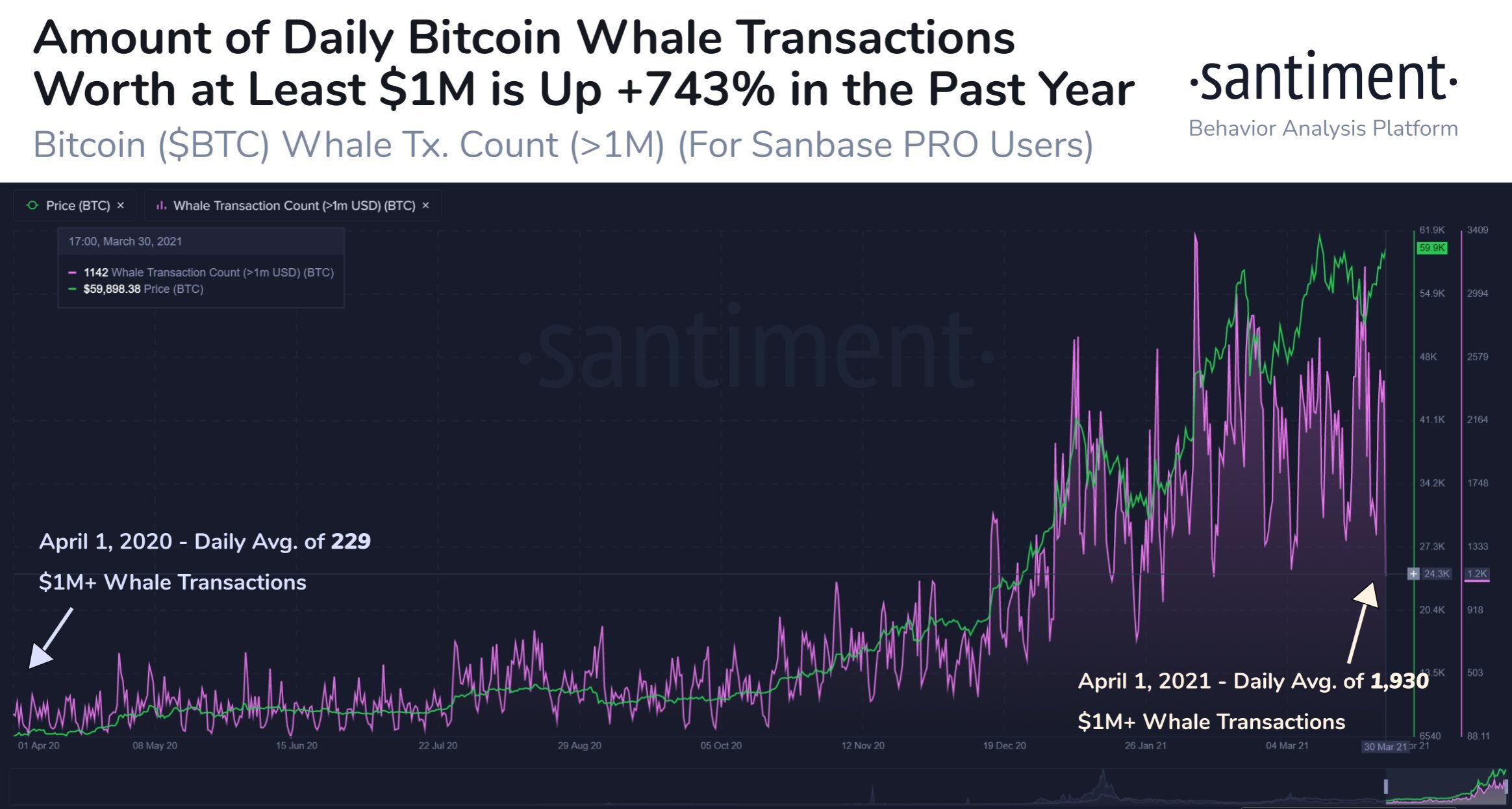

Finally, the nature of whale behavior is also crucial to understand what to expect going forward. This is true especially since not only have there been cases where whales have dictated price movements, but whale sentiment is a good barometer of where BTC might end up in the near term.

Over the past year, the amount of daily whale transactions worth at least $1M has risen by over 740%, with the daily average climbing from 229 on 1 April 2020 to 1,930 on 1 April 2021.

Source: Santiment

In fact, despite brief hiccups and the fact that BTC hasn’t reciprocated or shared the bullish sentiment of alts such as ETH and XRP, its whale holders are refusing to panic, with the brief drop-off in supply looking to steady itself at the time of writing.

That being said, it wouldn’t be an ordinary crypto-market without a few red flags rearing their heads. While the aforementioned metrics did suggest good times ahead for BTC, a few others seem to be erring on the side of caution.

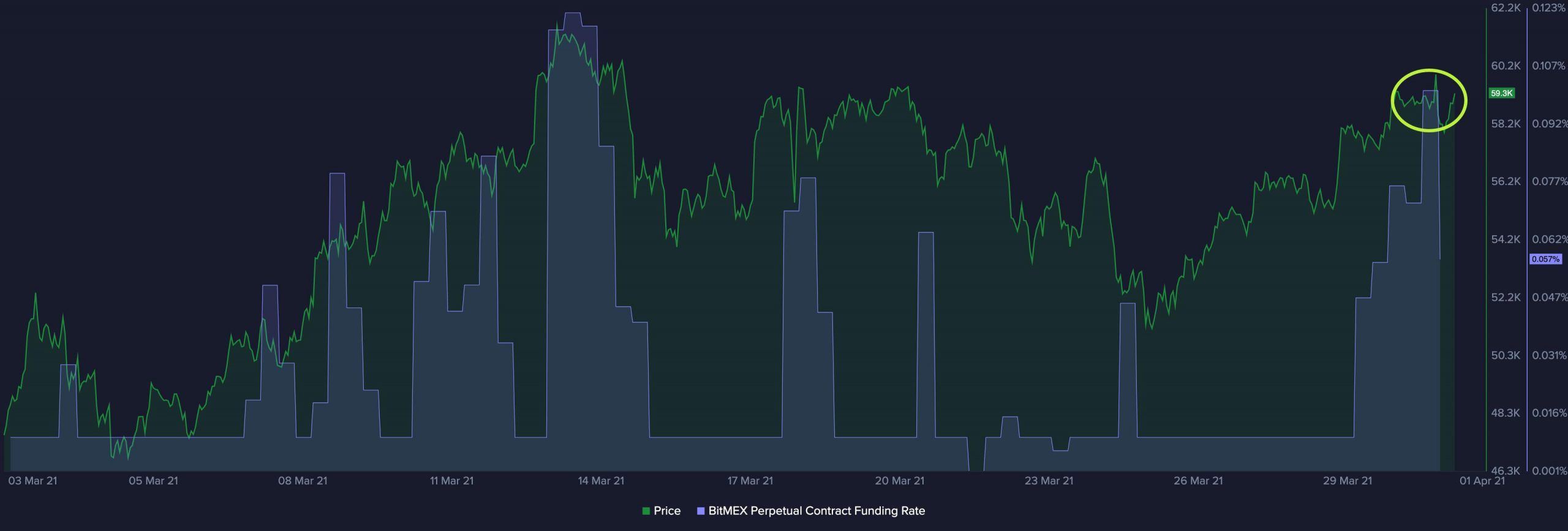

Consider Bitcoin’s funding rate, for instance. A few days ago, the same was recorded to be at +0.10%, very close to the 0.12% levels that were seen a few weeks ago. The latter coincided with the cryptocurrency recording its local top in March, with the same followed by a significant price drop.

Source: Santiment

This means that there isn’t a lot of room to move for the Funding Rate, with higher levels only playing into the probability of a short-term top being formed and a correction soon after.

There’s also the matter of sentiment. Whale sentiment is one thing, but what about retail sentiment? Well, Bitcoin’s weighted social sentiment at the moment is close to its one-year low. Here, it’s worth noting, however, that historically, there have been cases where similar findings have fueled the movement of Bitcoin in the opposite direction.

? #Bitcoin is on the cusp of crossing a $60,000 market value once again. And whether it does so or not in the next few days, #cryptotwitter is showing some major skepticism at this range. Historically, this level of doubt only propel $BTC further upward. https://t.co/J04Y8Et3n1 pic.twitter.com/sr4J9lj5FI

— Santiment (@santimentfeed) April 2, 2021

Ergo, uncertainty is the best projection one can give about Bitcoin’s short-term fortunes. While a longer case of consolidation is likely to be the case, price action in either direction on the charts cannot be ruled out.