Why Arbitrum could be poised for a 25% surge in September

- A bullish divergence appeared on Arbitrum’s price chart.

- Market indicators were supportive of a bullish breakout.

While several cryptos faced the wrath of bears the past week, Arbitrum [ARB] turned slightly bullish. However, there was more meat to the story as the token seems to be on the verge of breaking above a bullish pattern, which could result in a double-digit price increase in the coming days to weeks.

Arbitrum to turn bullish?

CoinMarketCap’s data revealed that ARB bulls stepped up in the last 24 hours by pushing the token’s price up marginally. At the time of writing, ARB was trading at $0.5019 with a market capitalization of over $1.75 billion.

The bad news was that 0% of ARB investors were in profit as per IntoTheBlock. However, the trend might change in the coming days.

AMBCrypto’s analysis revealed that long-term holders, investors holding a token for more than a year, increased slightly, reflecting their confidence in a price rise.

The better news was that the token’s price was moving inside a bullish pattern. World Of Charts, a popular crypto analyst posted a tweet revealing a bullish falling wedge pattern.

At the time of writing, it was on the verge of a breakout, which could result in a 25% price rise. In fact, a bullish divergence also appeared on one of its technical indicator’s charts, further indicating a bullish breakout.

Mapping ARB’s way ahead

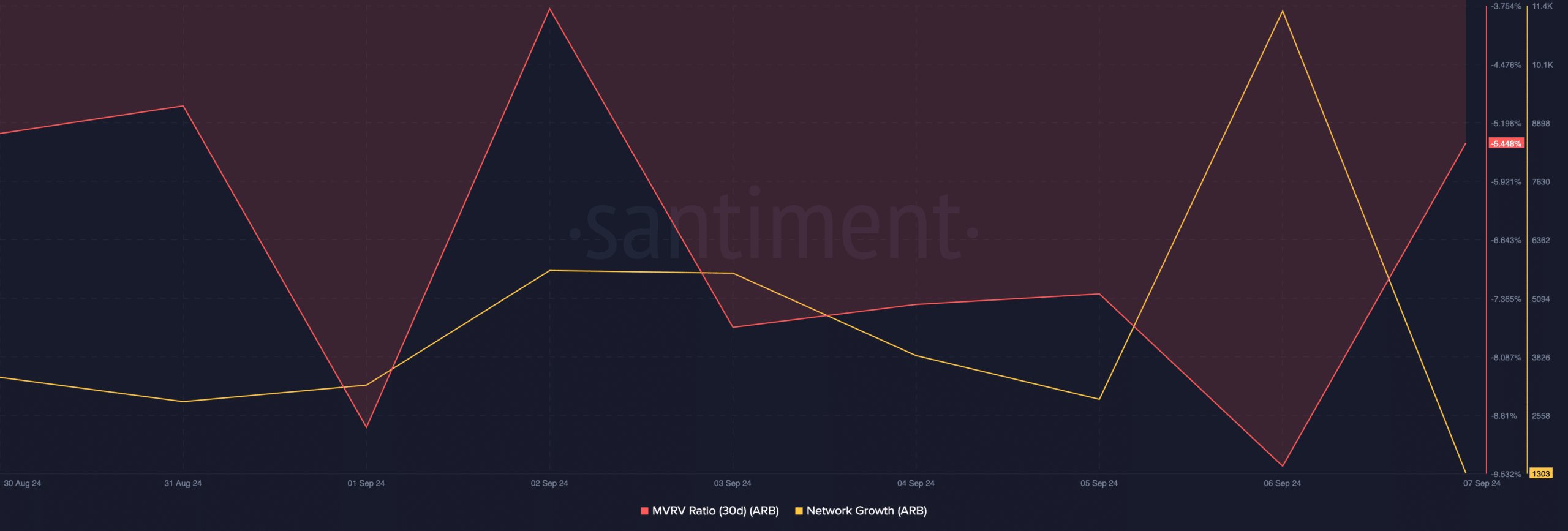

We then assessed the token’s on-chain data to see what metrics suggested regarding a bullish breakout. As per our analysis of Santiment’s data, Arbitrum’s MVRV ratio registered improvement.

Apart from that, the token’s network growth also spiked sharply on the 6th of September. A rise in the metric means that more new addresses were created.

However, Coinglass’ data revealed a bearish signal. As per the data, Arbitrum’s long/short ratio registered a decline. This meant that there were more short positions in the market than long positions, which can be inferred as a bearish signal.

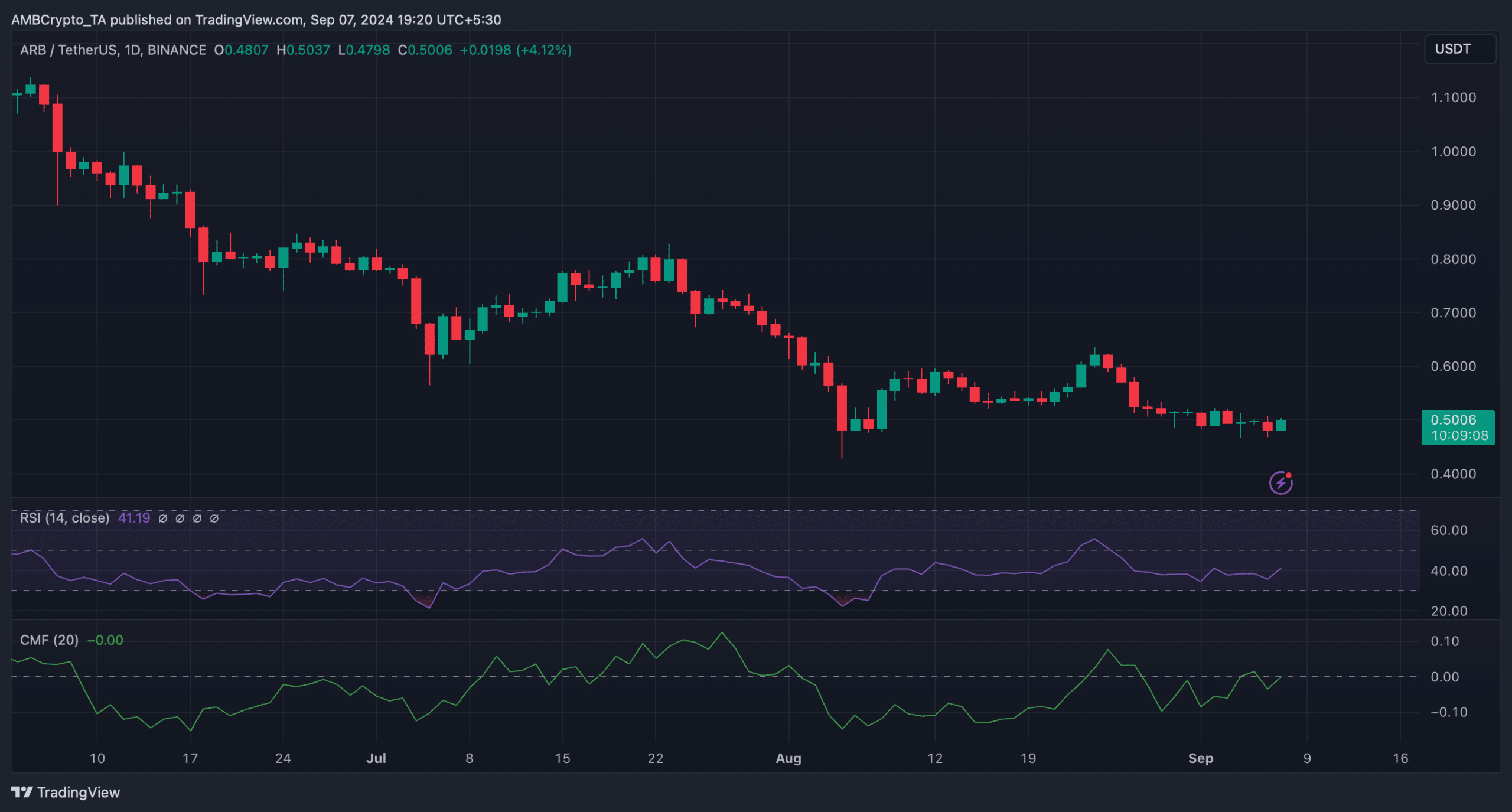

Therefore, we checked the token’s daily chart to better understand whether a bullish breakout is possible.

Realistic or not, here’s ARB’s market cap in BTC’s terms

We found that most of the market indicators were bullish on the token. For example, Arbitrum’s Chaikin Money Flow (CMF) registered an uptick.

The Relative Strength Index (RSI) also followed a similar trend. These meant that the chances of a price increase, which could result in a bullish breakout, were high.