Why AVAX could surge past $28 soon

- Avalanche on the weekly and daily timeframe shows strength.

- On-chain data of AVAX was looking good.

Avalanche [AVAX] continues its expansion into traditional finance, with ParaFi Capital set to tokenize a portion of its $1.2 billion on the blockchain. The development aligns with AVAX’s growing momentum, as the price action shows potential for higher gains.

AVAX is currently consolidating within a falling wedge pattern on the daily chart, which started after the previous bull cycle ended in April.

Analysts are watching the AVAX/USDT pair closely, with expectations that a breakout above the $28 level could trigger a push toward the $50 mark. This could result in over 104% return on investment.

However, failure to break $28 might lead to a retest of support levels at $24.9 or $17.25.

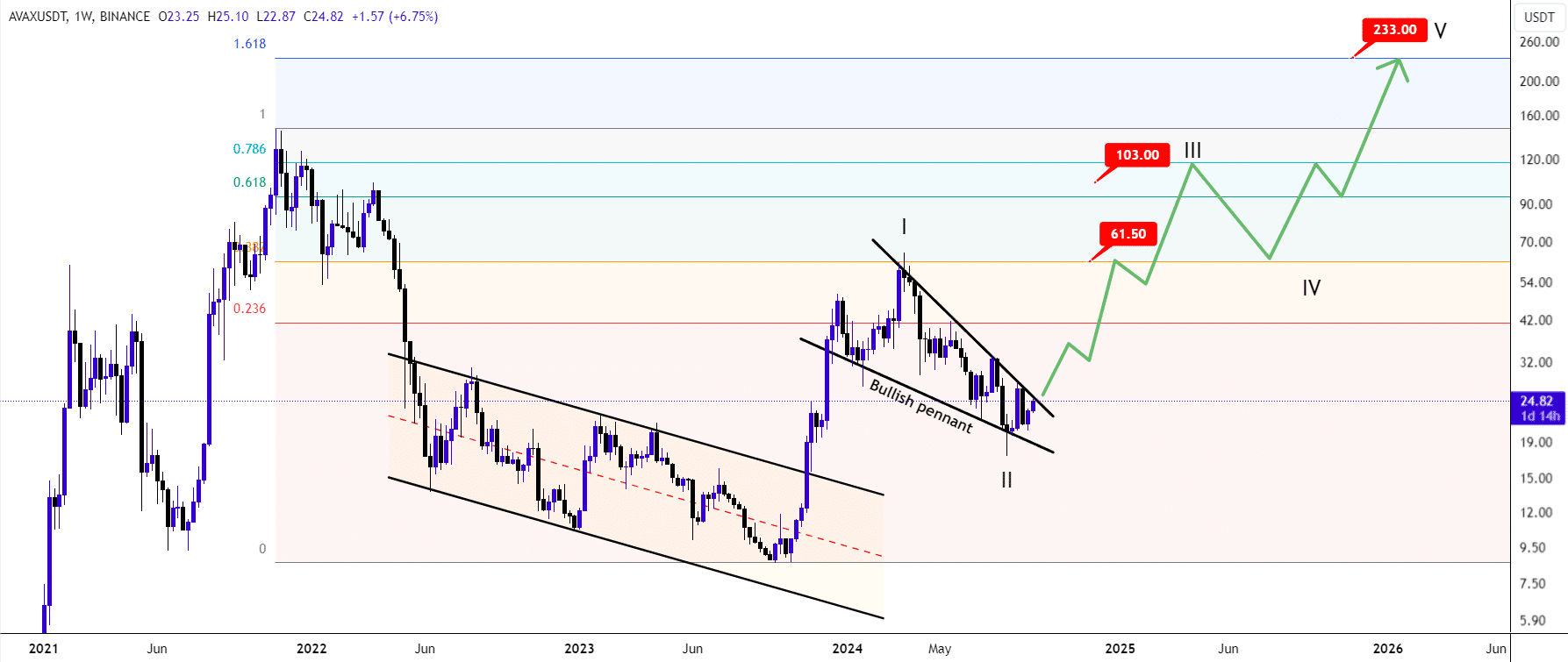

On the weekly timeframe, AVAX/USDT has completed its second correction wave, and the bullish pennant pattern is also finished.

The next move is expected to be the third bullish wave, potentially reaching the 0.618 to 0.786 Fibonacci zones before another correction and then further upside.

Short-term targets are set at $61.50, mid-term targets at $103, and long-term targets at $233. This higher timeframe outlook suggests a bullish trend for AVAX, with significant potential for long-term gains.

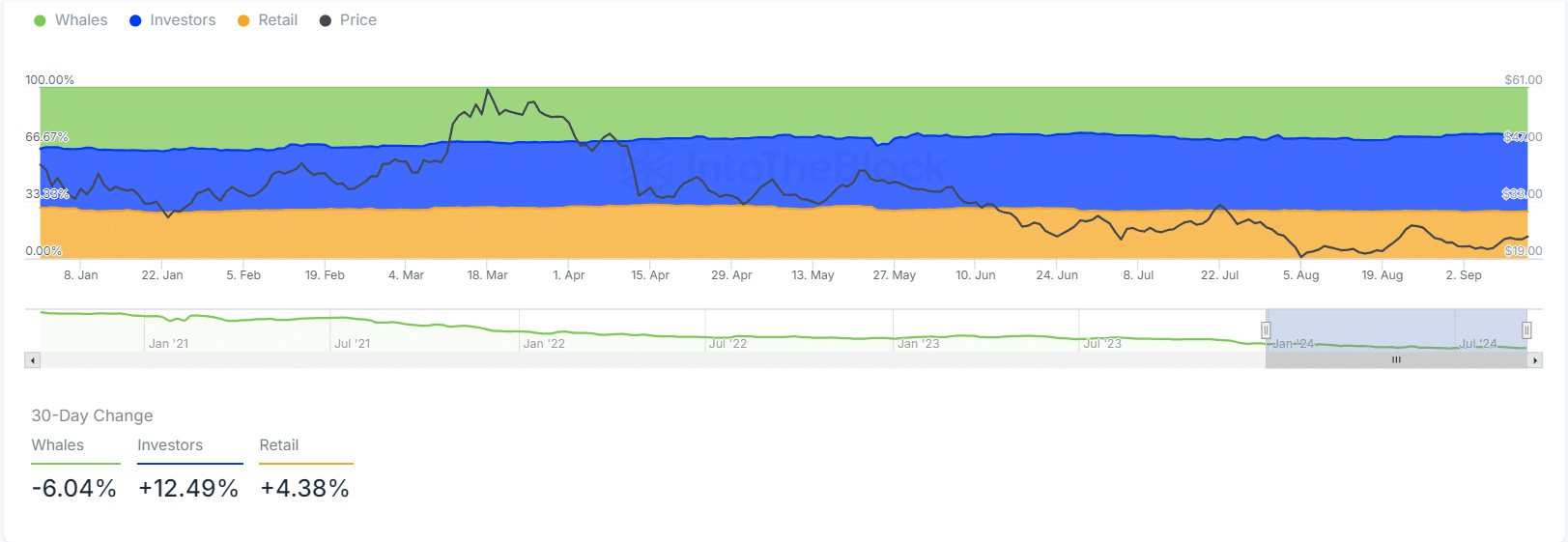

Historical ownership concentration

On-chain metrics are also supporting a bullish outlook for Avalanche. Staked AVAX has increased by 6%, DeFi total value locked (TVL) has risen by 11%, and stablecoins on the Avalanche blockchain have surged by 13%.

These factors reflect growing confidence in the network.

Additionally, historical ownership concentration shows minimal changes, with a notable rise in retail ownership by 4.38% and investor ownership increasing by 12%.

Whale ownership saw a slight decline of 6%, but the overall trend remains bullish, backed by the strong price action.

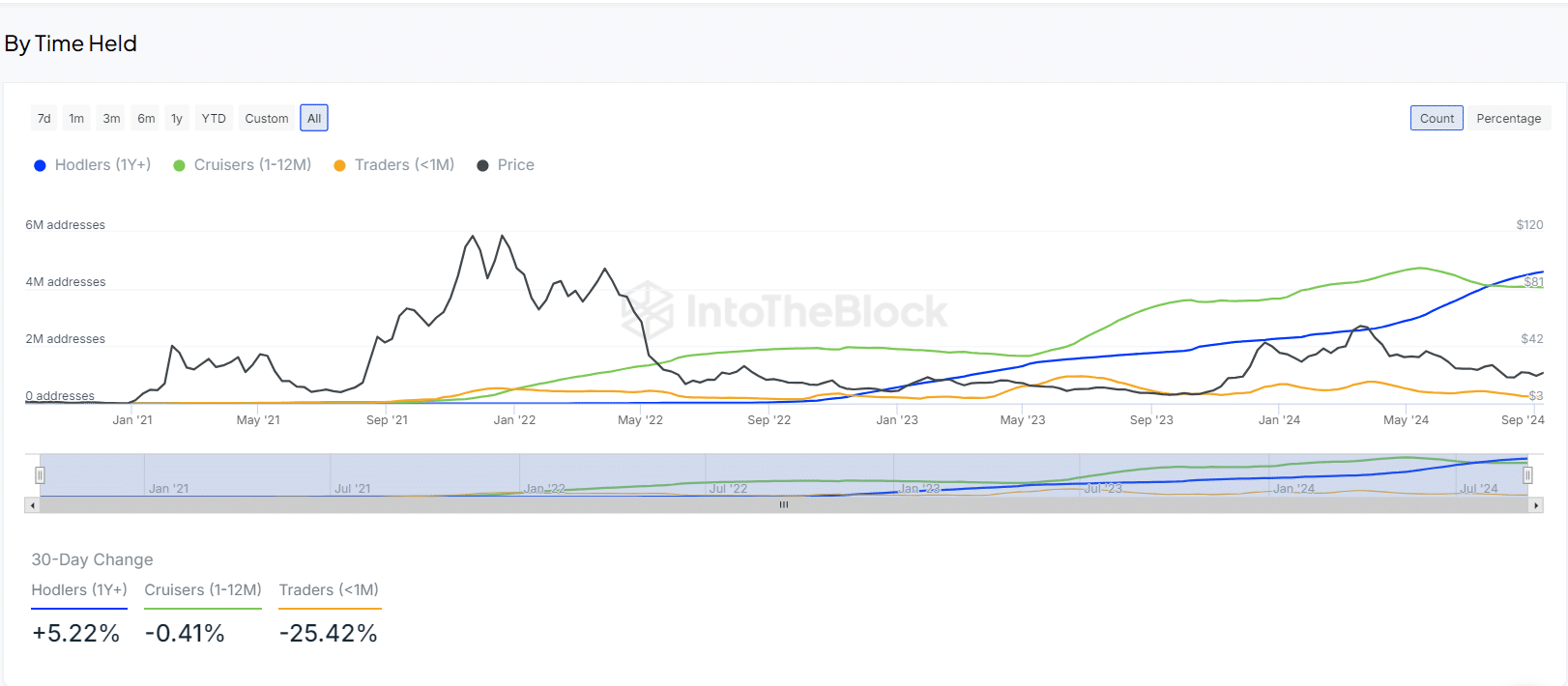

Avalanche addresses by time held

Furthermore, analysis of Avalanche tokens by time held reveals an increase in long-term holders.

Investors who have held AVAX for over a year saw a 5% rise, while those holding between one and 12 months experienced a small decline of 0.4%.

Day traders, although more active, hold AVAX for shorter periods and contribute to higher on-chain activity.

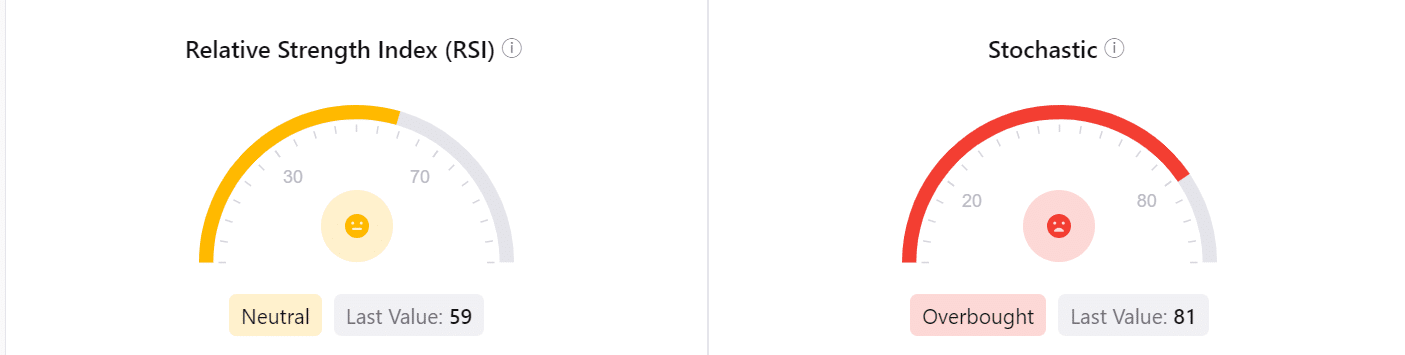

RSI is neutral

The relative strength index (RSI) is reading a neutral value of 59, while the stochastic RSI stands at 81, indicating an overbought condition.

Despite the overbought signal, this is not always a precursor to a reversal. In fact, it often suggests bullish momentum for AVAX, especially when other indicators are not signaling a downturn.

Is your portfolio green? Check the Avalanche Profit Calculator

Traders view this as an optimistic sign for the price of AVAX moving higher.

With these bullish signals across technical, on-chain, and ownership metrics, AVAX appears poised for further price increases in the near and long term.