Why AVAX’s prospects look bleak despite a surge in addresses

- Avalanche C-chain transactions declined by more than 30% last week.

- Market indicators were bearish, which could cause a further price decline.

Avalanche [AVAX] has reached a new milestone that reflects its increased adoption and usage. As per Token Terminal, AVAX’s monthly active users reached a new all-time high. Not only that, but as per Artemis, daily active addresses were also on the rise.

?@avax monthly active users at all-time highs pic.twitter.com/gJ1MRy5Ssn

— Token Terminal (@tokenterminal) May 30, 2023

However, despite the growth, AVAX C-chain’s weekly transactions declined by nearly 30%. The decline in the number of transactions also affected the network’s total gas use, which also registered a slight decline last week.

?#Avalanche C-chain weekly on-chain status?

?Network Status

Transactions: 9566534 -29.96%

Max TPS Observed: 188 -60.64%

Gas Used: 6.45T -1.21%?Staking:

Staking ratio: 59.17%

Staking rewards: 8.06%

Total validators: 1,272

Total delegations: 85,723#AVAX $AVAX pic.twitter.com/WrGCGRtWrk— AVAX Daily ? (@AVAXDaily) May 30, 2023

NFT space performed well, but network value went down

Interestingly, AVAX’s NFT ecosystem witnessed growth over the past week. According to Santiment’s chart, AVAX’s total NFT trade count and trade volume in USD spiked, which looked encouraging.

AVAX Daily also posted a tweet mentioning the top TVL gainers in the last week. As per the tweet, Kalmy App, SushiSwap, and WOOFi Swap sat in the top three spots.

Apart from these, Trader Joe Lend and Kyber Swap also made it to the top five on the same list. But Artemis’ data revealed that AVAX’s TVL gained downward momentum in the last 30 days.

Top TVL Gainers on Avalanche Ecosystem last 7D$KALM @kalmar_io$SUSHI @SushiSwap$WOO @_WOOFi$JOE @traderjoe_xyz$KNC @KyberNetwork$PORTX @chain_port$DF @dForcenet$RELAY @relay_chain$FLOKI @FlokiFi$DPX @dopex_io#Avalanche #AVAX $AVAX pic.twitter.com/o2mjOQJ0UW

— AVAX Daily ? (@AVAXDaily) May 30, 2023

Avalanche’s price not favoring the investors

Avalanche investors were having a hard time on 31 May 2023 as the token’s price declined sharply. CoinMarketCap’s data suggested that AVAX’s price dropped by more than 3% in the last 24 hours.

At the time of writing, it was trading at $14.11 with a market capitalization of over $4.8 billion.

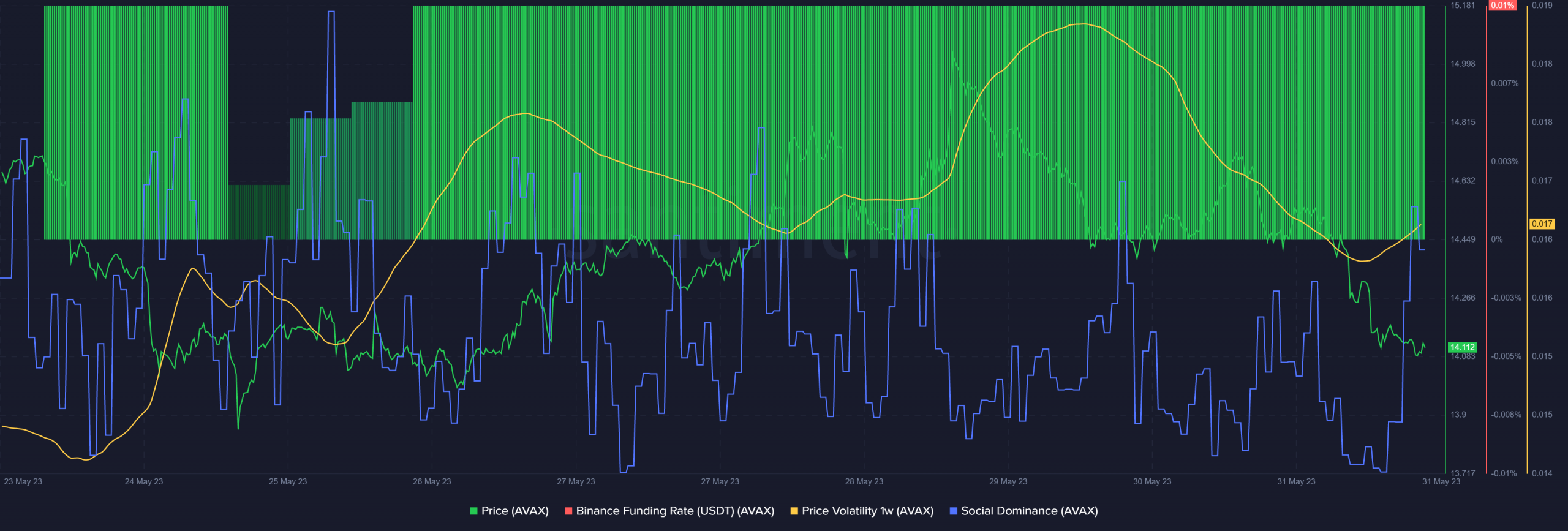

AVAX’s 1-week price volatility also registered an uptick lately, which indicated the possibility of a further price decline.

AVAX’s popularity also took a blow as its social dominance fell. Nonetheless, the token’s demand in the derivatives market was high, reflecting its demand in the derivatives market.

How much are 1,10,100 TRXs worth today

Investors should be prepared

Avalanche’s market indicators were also bearish. For instance, the 20-day Exponential Moving Average (EMA) was below the 55-day EMA, which is a typical bearish signal.

Its Relative Strength Index (RSI) was also resting way below the neutral zone. AVAX’s Money Flow Index (MFI) also followed the same declining trend, further increasing the chances of a continued price dip in the days to follow.