Why Bitcoin Cash is the biggest winner in Grayscale’s victory

- BCH’s price increased by 15.17%, outperforming Bitcoin and other altcoins.

- The market remained skeptical about its price action despite increasing Open Interest.

One undeniable fact is that Grayscale’s victory over the U.S. SEC was instrumental to the crypto market cap’s 4.91% increase in the last 24 hours. While the subject of the court case was Bitcoin’s [BTC] spot ETF, the biggest beneficiary of the development was not the king coin.

Read Bitcoin Cash’s [BCH] Price Prediction 2023-2024

BCH leads, others follow

Instead, its 2017 hard fork Bitcoin Cash [BCH] gained the most. According to CoinMarketCap, BCH’s value increased by 15.17% in the last 24 hours, much higher than Bitcoin itself and any other altcoin in the top 50.

Although Bitcoin Cash was not Bitcoin’s first hard fork, it’s the only one that has remained incredibly relevant to date. But besides that, BTC and BCH have a three-month correlation coefficient of 0.8.

Typically, values of the correlation coefficient range from -1 to +1 while measuring associated returns and direction. Therefore, the 0.8 coefficient means that BCH and BTC have a very strong similarity when it comes to price movements.

However, there is something interesting about the movement of both coins in recent times. For example, Bitcoin Cash has a 90-day 93.47% increase, while Bitcoin could only boast of a 2.34% hike.

This disparity could be traced back to the season the BlackRock futures ETFs made headway, which coincided with the period BCH also got listed on the EDX markets. So, it’s possible that anytime Bitcoin has a positive development, Bitcoin Cash may move in the upward direction.

Be watchful of the growing interest

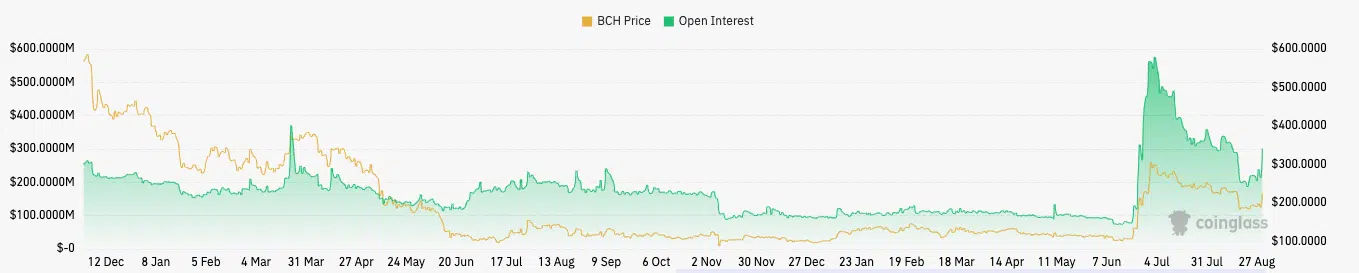

Interestingly, the Open Interest in BCH increased following the Grayscale win. Open Interest tracks the total number of open positions in a particular contract. Therefore, the hike in Open Interest indicates that more money had flowed into BCH contracts.

As an indicator to determine the strength behind prices, the Open interest showed that there was trader confidence that Bitcoin Cash could continue to move in the upward direction.

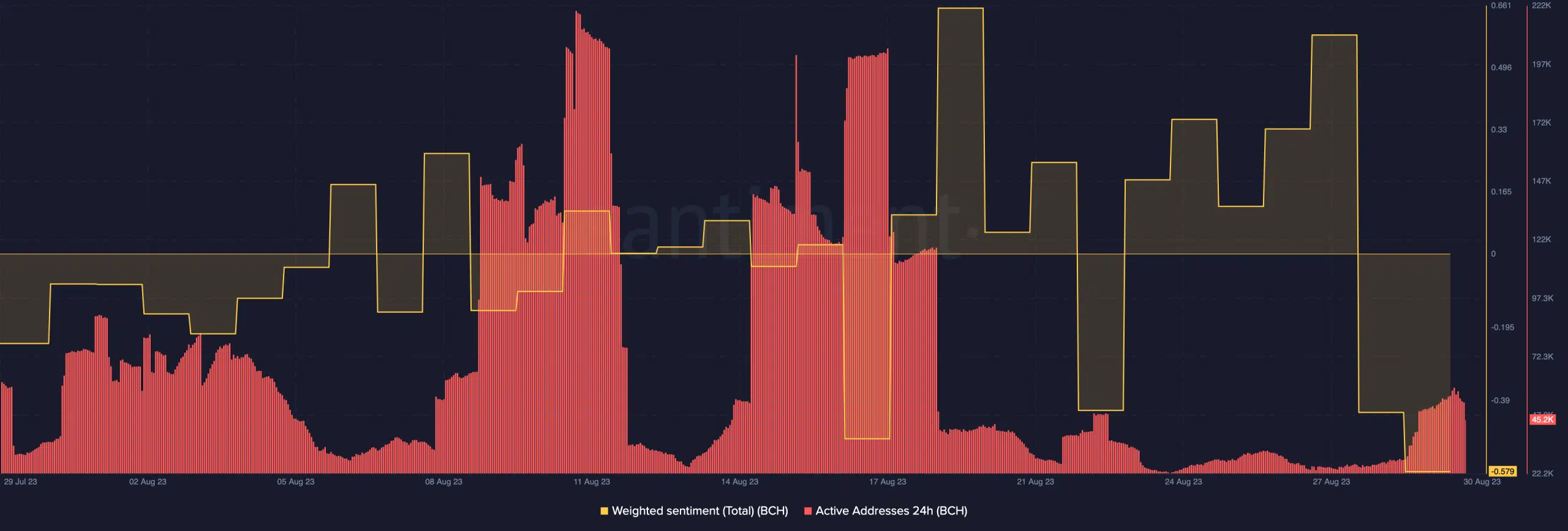

Furthermore, on-chain data showed that the weighted sentiment around Bitcoin Cash decreased. Weighted sentiment considers the unique social volume around an asset, and it’s used as an average measure of perception.

When the metric increases, it implies that positive commentary outpaced negative bias. Also, a decrease in the weighted sentiment suggests that negative commentary is outpacing the optimism around an asset. So, the latter was the case with Bitcoin Cash.

Is your portfolio green? Check out the BCH Profit Calculator

However, the 24-hour active addresses were able to fill in for the fall in weighted sentiment. At press time, BCH’s active addresses had increased to 45,200.

The surge implies that there has been an increase in speculation and interaction around the token, making BCH a coin on many traders watch.