Why Bitcoin could hit $60,000 before a rally to $72,000

- A crucial resistance at $68,000 could trigger a BTC pullback.

- While the coin might recover to $72,000 later, the price might trend higher.

AMBCrypto’s market analysis revealed that Bitcoin’s [BTC] jump to $67,740 does not mean that the price would no longer nosedive. In fact, there is a chance that BTC could drop to $60,000.

To arrive at this conclusion, the liquidation heatmap came into play. The liquidation heatmap helps traders to prevent further losses. High liquidation areas could be support or resistance areas.

North is not the only way

According to data from Coinglass, there was a big cluster of liquidity from $67,626 to $68,000, indicating that Bitcoin could approach the levels one more time.

On the downside, there was a major level at $60,160. As such, resistance between $67,000 and $68,000 could force BTC to drop to $60,000 which could later act as support.

However, the most concentrated area of liquidity was $72,000, meaning that the next uptrend could push Bitcoin to this point. Establishing this bias was the Realized Price.

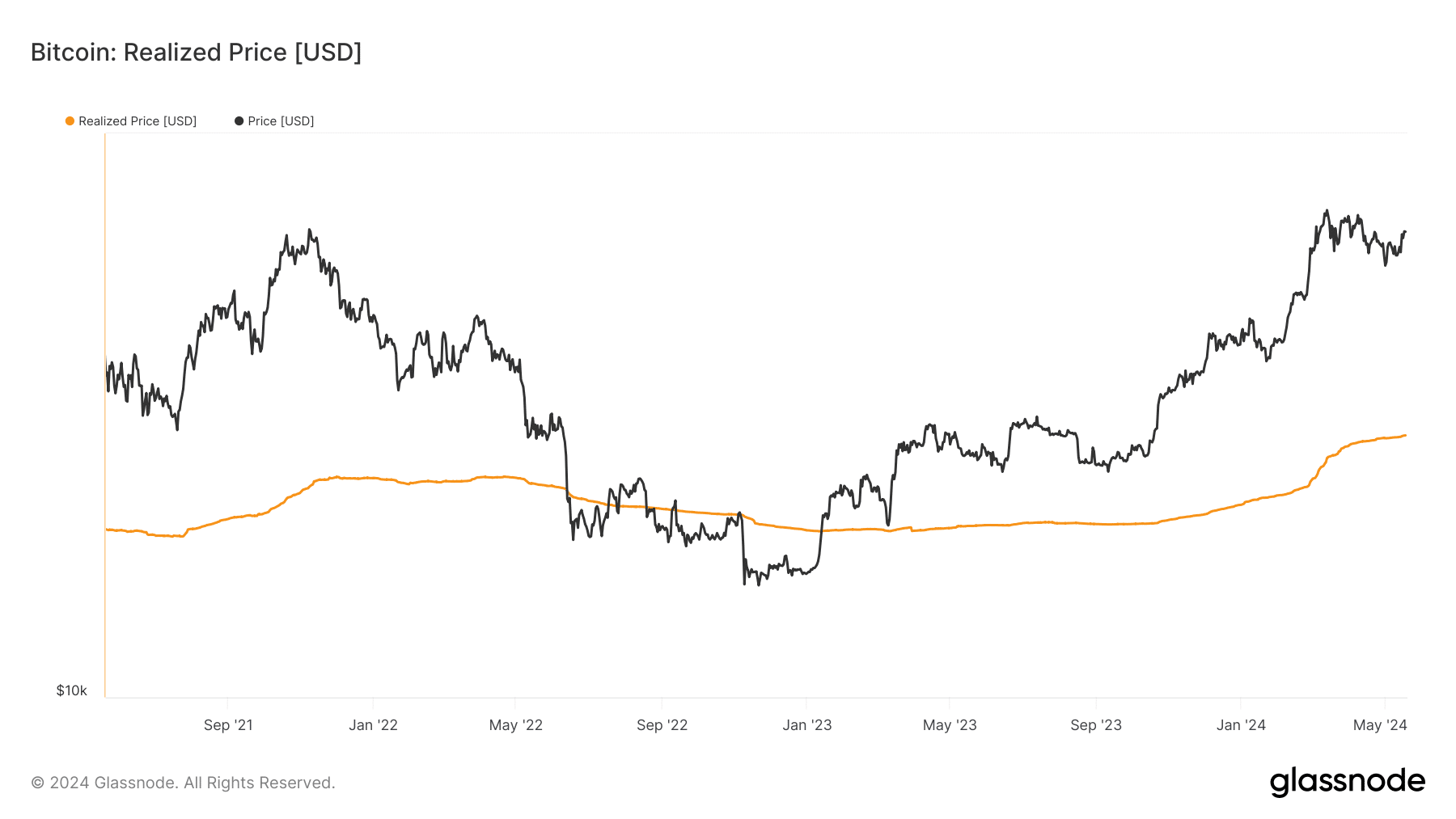

Realized Price measures the average price divided by Bitcoin’s supply. This helps to understand the economic state of the coin. Like the liquidation heatmap, this metric can act as on-chain support or resistance.

Bitcoin is not back to the bear market

If the Realized Price hits or crosses Bitcoin’s value, it means that the coin has fallen into a bear phase. For example, the metric flipped BTC in November 2022, confirming a crash in the price.

As of this writing, the Realized Price was $29,142— two times less than the press time value. With this position, one can infer that BTC has not hit the top of this cycle.

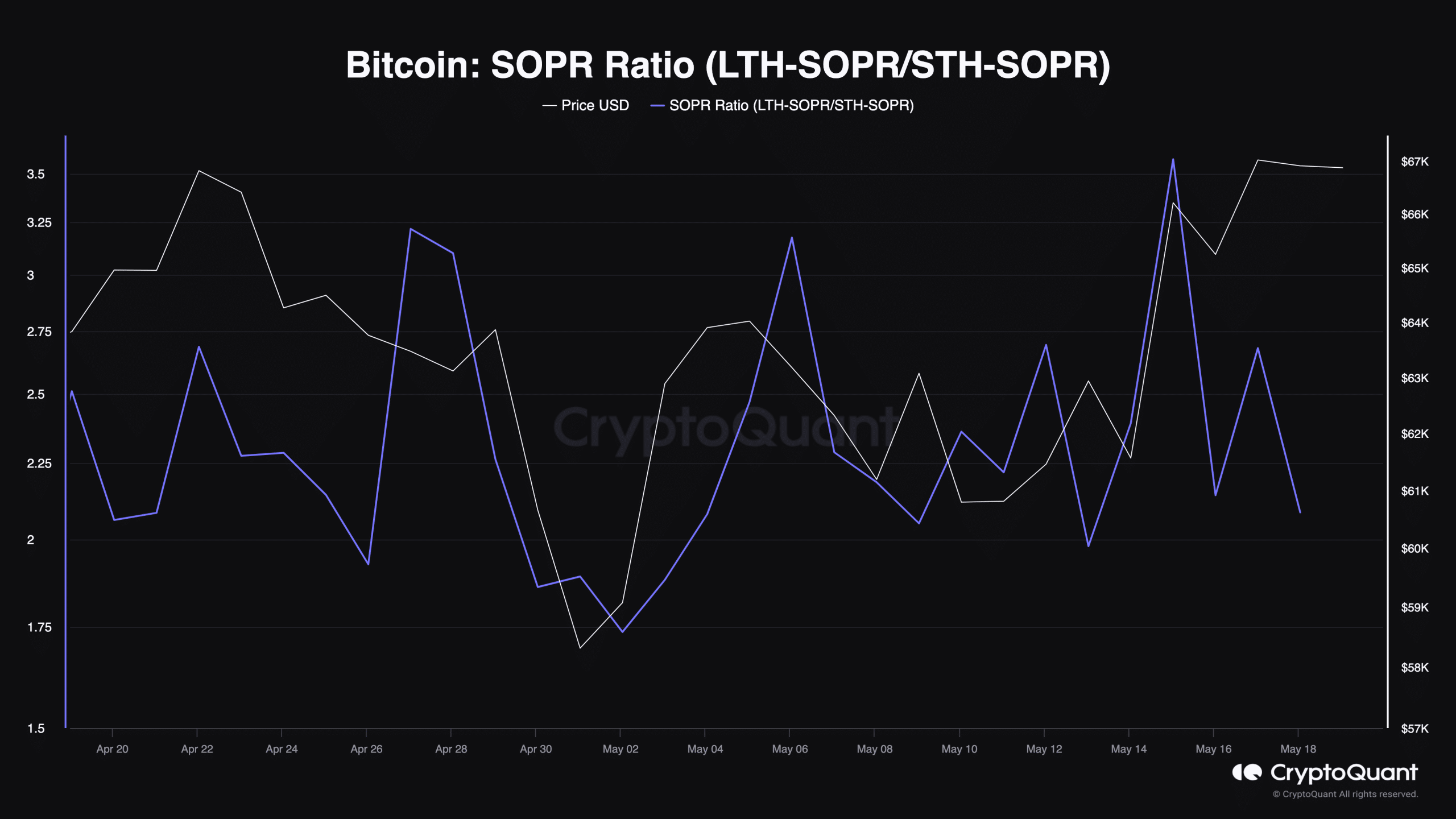

In addition, we assessed the SOPR Ratio. SOPR stands for Spent Output Profit Ratio. By definition, SOPR measures the profit ratio of the entire market.

The value of this metric is calculated as the division of the long-term holder’s SOPR by that of the short-term holder. A high SOPR ratio means higher profits for long-term holders than short-term holders.

If this is the case, it means that the market is close to the top. Conversely, a low SOPR ratio indicates that short-term holders have made more gains than their long-term counterparts.

At press time, the ratio was 2.08. Falling to this level suggests that Bitcoin’s price can move higher. For example, the ratio hit the same reading before Bitcoin’s all-time high in March.

Furthermore, the current state of the metric implied that BTC could rally again. This time, a move to $72,000 could be validated.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

But as mentioned earlier, the first step to hitting the region could be a correction to $60,000.

In the meantime, BTC could undergo a consolidation phase first. After that, more liquidity could flow out of the coin which could propel the downturn before the upswing.