Why Bitcoin dollar-cost-averaging could be your best bet in current market

- Bitcoin has continuously dropped over the last couple of weeks, largely due to the FTX crash

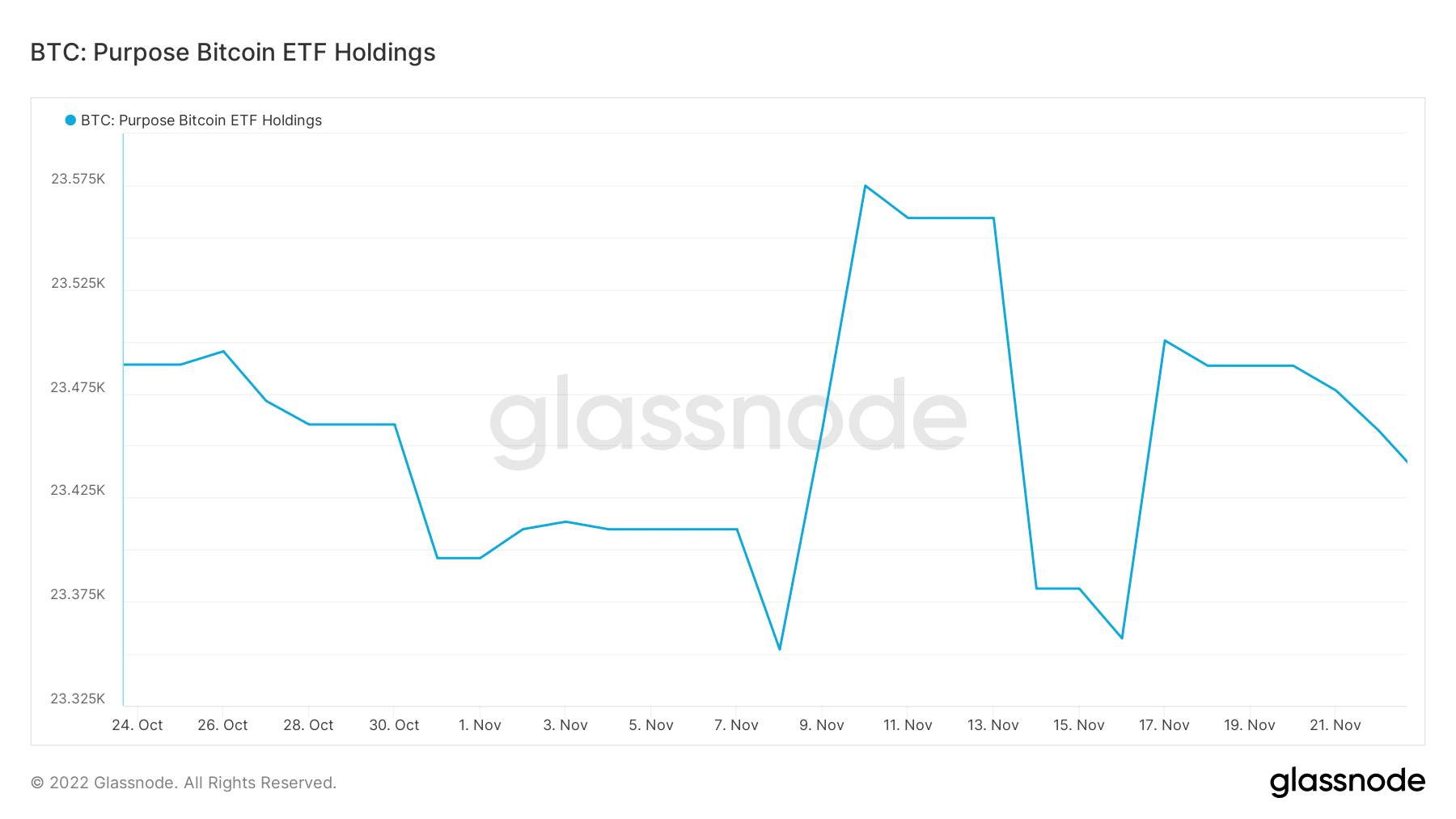

- Institutional investors like the Purpose Bitcoin ETF Holdings have not yet bought back despite the discount.

The latest Bitcoin (BTC) crash has done more harm than good to investors’ sentiment. Those that have been closely watching the market may have observed that investors are rather shy about buying back.

If you find yourself in the same boat, here are some considerations that may help you have a better understanding of the current situation.

Read Bitcoin’s (BTC) Price Prediction 2023-24

The price of Bitcoin has continuously dropped over the last couple of weeks, largely due to the FTX crash. Reports of an FTX hacker shortly followed suit. BTC has barely had enough time for a sizable recovery, and its latest performance is a ghost of its former, highly volatile self. The price is not the only thing that has been affected.

Investors’ sentiment also took a massive hit and dampened Bitcoin’s ability to recover. Investors are afraid to buy back only for the price to drop lower. In addition, most buyers are still standing on the sidelines due to fear of post-FTX risks. Institutional demand is one segment that has taken a big hit.

Institutional investors like the Purpose Bitcoin ETF Holdings have not yet bought back despite the discount. This is a confirmation that investors are waiting to see whether the market will recover.

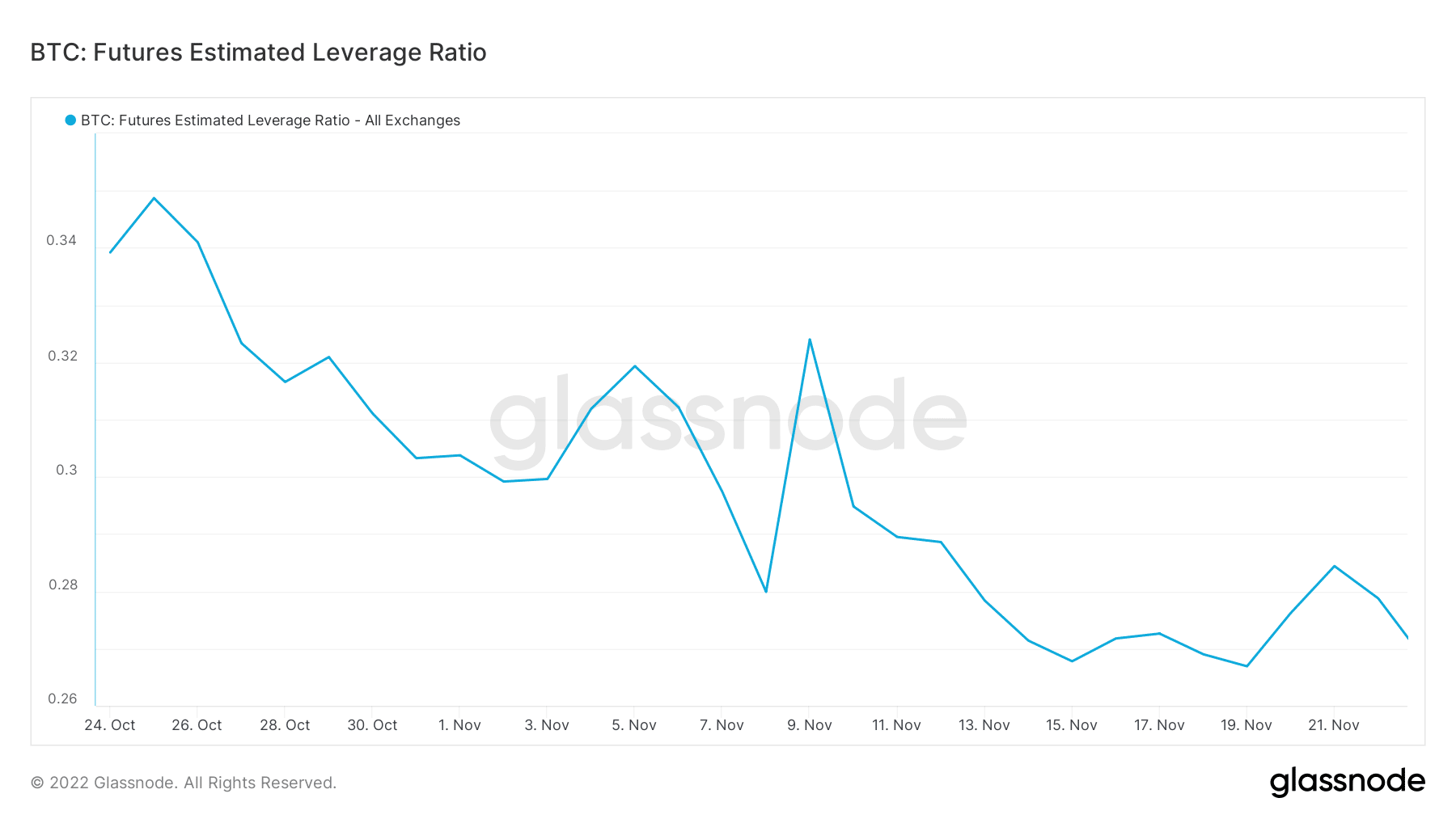

The lack of significant demand is evident in the low execution of leveraged positions after the latest crash. This is observed in Bitcoin’s futures estimated leverage ratio, which dropped significantly this week.

Why dollar-cost-averaging makes the most sense for Bitcoin

Many investors are still afraid to buy into BTC, especially now. This has affected its ability to bounce back. However, it does not mean that the current market situation is a bad time to buy.

The market might gradually recover, and those waiting for an opportunity to buy the bottom will have lost an opportunity. On the other hand, it could still go down further.

Timing the market is quite difficult, especially under the current market conditions. The best strategy would thus be to dollar-cost-average after every dip.

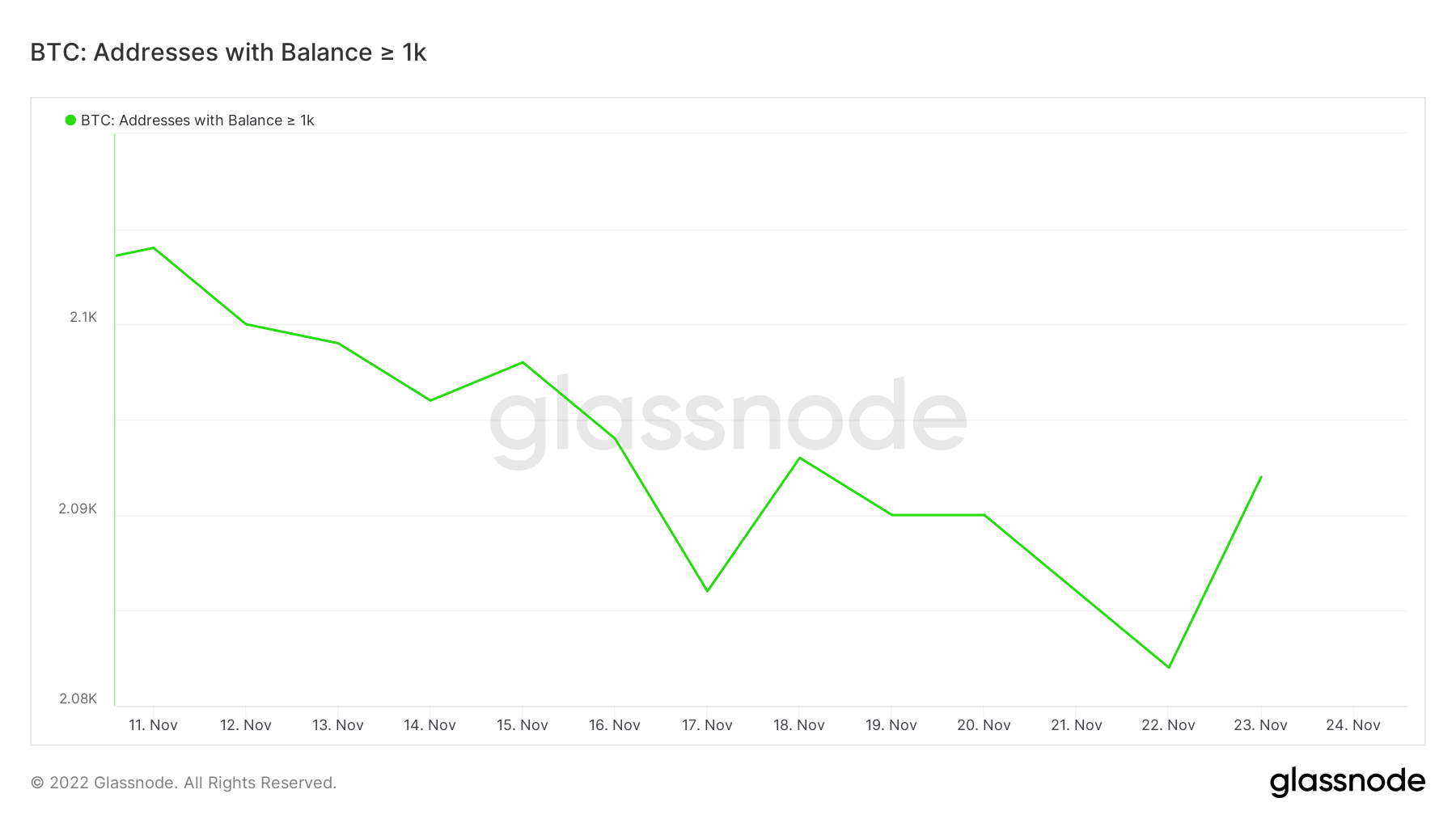

Following the footsteps of whales might also be a useful strategy. For example, BTC has experienced some relief from the bears in the last two days. It is no coincidence that whales have been accumulating during the same time, thus contributing to the latest uptick.

Well, Bitcoin is heavily discounted from its current high, which means the current price level is ideal for market entry. However, there is still a risk of more downside, but then, BTC has a history of unexpected rallies. A dollar-cost-average strategy during every dip is the best bet for long-term investors.